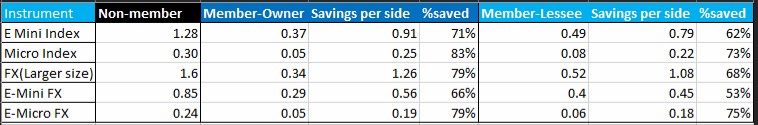

Save between $0.50 and $1.01 per side

High volume E-Mini and currency traders may save significantly on exchange fees by enrolling in the CME Electronic Membership program.

If you are an institution, corporation, or LLC, you may be eligible to become a CME Electronic Corporate Member.

CME Electronic Membership Rates

CME Electronic Membership Requirements

- You trade a minimum average of 50 contracts per day each quarter

- You are an institution, corporation or LLC

- Application fee of approximately $2000

For more detailed information, fill out the CME Membership request below.

Cannon Trading respects your privacy, all transactions are safe and secure with High-grade Encryption (AES-256, 256-bit keys). We do not sell your information to third parties.

Unlocking the Benefits of a CME Membership with Cannon Trading Company

Learn more about trading with a CME Membership through Cannon Trading Company here.

Cannon Trading Company has earned a stellar reputation in the world of futures trading. With a remarkable 4.9 out of 5-star rating, it stands as a testament to their unwavering commitment to providing top-notch client service. For traders who deal in currencies and E-Mini financial instruments, Cannon Trading Company offers the unique advantage of a CME Membership, which opens up a world of opportunities and advantages for currency trading. In this comprehensive guide, we will delve into the benefits that a CME Membership affords to traders, as well as explore Cannon Trading Company's legacy of exceptional service.

Understanding Cannon Trading Company's Legacy of Excellence and Trust

Cannon Trading Company: A Brief Overview

Cannon Trading Company, founded in 1988, is a well-established and highly regarded commodities broker in the futures trading industry. With decades of experience, they have built a reputation for providing excellent service and support to traders. Their 4.9 out of 5-star rating is a testament to their commitment to client satisfaction.

Legacy Commitment to Top Client Service

One of the key aspects that have contributed to Cannon Trading Company's success is their unwavering commitment to top client service. They understand that the world of futures trading can be complex and challenging, and they are dedicated to assisting traders every step of the way. Whether you are an experienced futures trader or just starting, Cannon Trading Company provides the guidance and support you need to succeed.

The World of CME Membership

What Is CME Membership?

The Chicago Mercantile Exchange (CME) is a global marketplace where futures and options on futures are traded. Becoming a member of the CME is an exclusive opportunity that allows traders to access various benefits and privileges. CME Membership grants traders unique advantages in futures & currency trading, which include the ability to trade a wide range of futures contracts, such as commodities, financial instruments, and more.

Why CME Membership Matters

CME Membership is highly sought after because it grants traders direct access to the exchange, providing benefits such as lower trading fees, priority order execution, and the ability to become a clearing member. These advantages can significantly impact a trader's profitability and efficiency in the futures market.

The Benefits of CME Membership for Traders

Lower Trading Fees

One of the most significant advantages of holding a CME Membership is the reduction in trading fees. These fee reductions can translate into substantial cost savings for traders, especially those who execute a high volume of trades. Lower trading costs contribute to increased profitability and can make a significant difference in a trader's bottom line.

Priority Order Execution

CME Membership provides traders with priority order execution. This means that their orders are given preference in the order queue, ensuring that they have a better chance of executing their trades at the desired price. In fast-paced and highly liquid markets, priority order execution can be the difference between a successful trade and a missed opportunity.

Access to a Wide Range of Futures Contracts

CME Membership opens the door to an extensive array of futures contracts. This includes commodities such as gold, crude oil, and agricultural products, as well as financial instruments like stock index futures and interest rate derivatives. Traders can diversify their portfolios and explore new trading opportunities with ease.

Becoming a Clearing Member

Another notable benefit of CME Membership is the potential to become a clearing member. Clearing members play a crucial role in the futures market by facilitating the clearing and settlement of trades. By becoming a clearing member, traders can gain even more control and flexibility in managing their futures trading activities.

Reduced Transaction Costs

One of the significant advantages of being a CME Member is the potential for reduced transaction costs. Members benefit from lower exchange fees and clearing fees, which can lead to substantial cost savings over time. By optimizing transaction costs, traders enhance their overall profitability and competitiveness in the market.

CME Members often receive preferential pricing and fee structures, further reducing the cost of currency trading. This is particularly beneficial for high-frequency traders and those who execute a large volume of trades.

Risk Management Tools

CME offers a wide array of risk management tools to protect traders' capital and safeguard their positions. These tools are essential for traders dealing with currencies, E-Mini contracts, and grains, where market volatility can be substantial. Some of the key risk management tools provided by CME include:

- Options Contracts: CME offers a variety of options contracts, which traders can use to hedge positions, protect against adverse price movements, and manage risk. Currency options, E-Mini options, and grain options all offer valuable hedging capabilities.

- Margining System: CME's margin system ensures that traders meet their financial obligations promptly. It plays a critical role in maintaining market integrity by reducing the risk of default.

- Clearinghouse Guarantees: The CME clearinghouse acts as a guarantor for all trades, mitigating counterparty risk and enhancing the overall security of the trading process.

Educational Support and Mentorship

Futures trading can be complex and challenging, especially for newcomers. As part of their commitment to regulatory compliance, CME Members have access to educational support and mentorship programs to navigate the intricacies of trading successfully.

CME provides a wealth of educational resources, including webinars, seminars, and training materials. These resources help traders, whether seasoned or novice, gain the knowledge and skills needed to succeed in their respective markets. Complementing CME's educational support, many Members offer mentoring programs, where experienced traders provide guidance and insights to help newcomers make informed trading decisions.

Regulatory Compliance and Oversight

CME Members operate within a well-defined regulatory framework that ensures the integrity of the marketplace. Regulatory compliance and oversight are paramount in maintaining the trust and confidence of market participants. By adhering to NFA regulations and CME rules, traders can trade with confidence, knowing that their interests are protected, and market fairness is upheld.

The NFA plays a crucial role in this compliance process, acting as the regulatory authority for the futures industry. It sets and enforces rules and standards for professional conduct, financial responsibility, and business operations within the industry. Complying with NFA regulations is a commitment to ethical and transparent trading practices.

Competitive Advantage

In the highly competitive world of futures trading, a CME Membership provides traders with a competitive edge. It signals to counterparties and clients that a trader is dedicated to their craft and meets stringent compliance standards. This reputation can open doors to new opportunities and partnerships in the industry.

A CME Membership also acts as a mark of professionalism and credibility, offering traders an advantage over non-members. This is particularly significant for traders looking to expand their business and gain access to new markets and clientele.

Networking Opportunities

Becoming a CME Member opens the door to valuable networking opportunities within the currency trading community. Networking is an integral part of the trading business, providing traders with insights, sharing strategies, and building meaningful relationships. CME Members have the opportunity to connect with like-minded individuals, including fellow Members, traders, and industry professionals.

Networking can lead to collaborations, partnerships, and the sharing of vital market intelligence. It allows traders to stay informed about emerging trends and opportunities, enhancing their overall trading performance.

Tailored Services

CME Members often have access to tailored services provided by their clearing firms and brokers. These services are designed to meet the specific needs of traders and enhance their trading experience. Whether it's personalized consultation, risk management expertise, or educational support, these services help traders succeed in their trading endeavors.

Clearing firms and brokers work closely with CME Members to ensure they are well-prepared to navigate the complexities of futures trading. These services are essential for traders looking to make informed decisions, protect their capital, and maximize their profitability.

Enhanced Liquidity

One of the primary advantages of CME Membership is access to enhanced liquidity. The CME is renowned for its deep and liquid markets, providing traders with the opportunity to enter and exit positions without causing significant price fluctuations. This enhanced liquidity results in tighter spreads, reduced currency trading costs, and improved profitability.

Liquidity is especially crucial for currency traders, where the ability to execute large trades without market impact is essential. E-Mini traders benefit from enhanced liquidity, which contributes to efficient order execution and minimizes trading costs. Likewise, grain traders can navigate the agricultural futures market with ease, thanks to the robust liquidity provided by the CME.

Diverse Asset Classes

CME Members can explore a wide range of asset classes beyond currencies, E-Mini contracts, and grains. This diversity allows traders to diversify their portfolios and access a broader spectrum of trading opportunities. Some of the additional asset classes available to CME Members include:

- a. Energy Products: Access energy markets by trading crude oil, natural gas, and other energy-related futures contracts, providing opportunities to capitalize on global energy trends.

- b. Interest Rate Products: Trade interest rate futures, including contracts based on short-term and long-term interest rates, offering exposure to interest rate movements that impact the financial industry.

- c. Metals: Access precious and base metals markets through CME contracts, such as gold, silver, and copper, providing opportunities for diversification and safe-haven trading.

Regulatory Oversight and Support

Regulatory oversight and support are fundamental to the trading process. The NFA and CME provide a robust framework for market regulation and dispute resolution. In the event of disputes or issues, CME Members can rely on the exchange for resolution, ensuring that their trading activities are conducted in a transparent and accountable manner.

Continuous Innovation

The CME is committed to innovation, continually introducing new products and features to meet the evolving needs of traders. As a CME Member, traders can stay at the forefront of these innovations and explore new trading opportunities. Staying informed about the latest developments is essential for traders looking to adapt to changing market conditions and seize emerging opportunities.

Requirements for CME Membership

To become a CME Member, traders must meet specific eligibility criteria and requirements. These requirements are established by the CME and are designed to ensure that all Members adhere to the highest professional standards. While the specific requirements may vary, some common criteria for becoming a CME Member include:

- a. Financial Requirements: Traders must meet minimum financial criteria to demonstrate their ability to meet their trading obligations and cover potential losses.

- b. Professional Experience: A certain level of professional experience in trading or a related field is often required to become a CME Member.

- c. Regulatory Compliance: Traders must adhere to regulatory requirements and standards set by the NFA and CME, including ethical and professional conduct.

- d. Membership Fees: Becoming a CME Member involves the payment of membership fees, which can vary based on the specific membership type and exchange regulations.

- e. Application Process: The application process involves submitting necessary documentation, undergoing background checks, and meeting with regulatory authorities.

It is essential to consult with clearing firms, brokers, or CME Membership professionals to understand the precise requirements and steps involved in the membership application process, as these can evolve over time.

CME Membership and the Currencies Market

Trading Currencies on the CME

The CME offers a wide range of currency futures contracts that allow traders to speculate on the exchange rates of major currency pairs, including the Euro, Japanese Yen, British Pound, Swiss Franc, and many others. These contracts are a popular choice for forex traders who want to diversify their trading strategies and gain exposure to currency markets.

Hedging Currency Risk

CME Membership is particularly advantageous for traders who deal with currency markets because it provides an effective means of hedging currency risk. Currency fluctuations can have a significant impact on international businesses and investors. By using currency futures contracts available through the CME, traders can hedge against adverse exchange rate movements, thus protecting their investments and financial positions.

Diversification of Trading Strategies

For traders primarily focused on the forex market, CME Membership can offer a valuable opportunity to diversify their trading strategies. By incorporating currency futures into their portfolios, traders can take advantage of different market dynamics and potentially increase their overall profitability. Diversification is a fundamental principle in risk management, and CME Membership facilitates it seamlessly.

CME Membership and E-Mini Financial Instruments

The Popularity of E-Mini Contracts

Liquidity is a key consideration for any trader. The CME is known for its deep liquidity across multiple asset classes, providing traders with efficient and cost-effective order execution. This reduces the risk of slippage and ensures that traders can execute orders at the desired prices.

High liquidity in the currency futures market means that traders can enter and exit positions swiftly and efficiently, even during volatile market conditions. This is particularly advantageous for currency traders who need to capitalize on fleeting market opportunities.

E-Mini contracts, being among the most traded derivatives globally, offer significant liquidity, with tight spreads and ample market depth. CME Members can take full advantage of this liquidity, trading with confidence in their ability to execute orders seamlessly.

Grain markets also benefit from the CME's liquidity, allowing traders to manage positions efficiently and respond to market-moving news without undue concern about order execution.

Leveraging E-Mini Contracts

CME Membership can greatly benefit traders who focus on E-Mini financial instruments. The reduced trading fees and priority order execution advantages are especially advantageous in high-frequency trading environments, where every fraction of a second counts. Traders can execute their strategies with precision, maximizing their returns.

Diversified Portfolio Strategies

E-Mini contracts are versatile and can be used in various trading strategies, such as day trading, swing trading, and portfolio diversification. With CME Membership, traders have the flexibility to incorporate E-Mini contracts into their portfolios, allowing for diversified trading strategies that can help manage risk and seize opportunities in different market conditions.

Cannon Trading Company's Expertise in CME Membership

Cannon Trading Company's Guidance

Cannon Trading Company is renowned for its expertise in assisting traders with CME Membership. They provide comprehensive guidance to help traders navigate the membership application process, understand the associated costs, and make the most of the privileges that come with it.

Personalized Support

What sets Cannon Trading Company apart is their personalized approach to client support. They understand that each trader has unique needs and goals, and they tailor their assistance accordingly. Whether you are a seasoned professional or just starting, their team is dedicated to helping you achieve your objectives.

A CME Membership with Cannon Trading Company is a gateway to a world of benefits and advantages for traders dealing in currencies and E-Mini financial instruments. The combination of Cannon Trading Company's legacy commitment to top client service and the privileges offered by CME Membership makes for a formidable partnership in the world of futures trading.

Traders can enjoy lower trading fees, priority order execution, access to a wide range of futures contracts, and the potential to become clearing member. Additionally, CME Membership opens doors to hedging currency risk and diversifying trading strategies in the currencies and E-Mini markets.

If you are a trader looking to enhance your futures trading experience and take your strategies to the next level, consider the advantages of a CME Membership with Cannon Trading Company. Their exceptional service and expertise in this field make them a trusted partner for traders of all levels.

Ready to start trading futures? Call US 1(800)454-9572 - Int’l (310)859-9572 email info@cannontrading.com and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer - Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

**This article has been generated with the help of AI Technology. It has been modified from the original draft for accuracy and compliance reasons.

***@cannontrading on all socials.