NO FOMC TODAY + Levels + Limit numbers for March 18th

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Yesterday I sent out the blog talking about FOMC today….however with all the craziness out there I forgot that they had the emergency meeting this Sunday instead of today….

Highlights

March 16, 2020

Taking questions from reporters shortly following Sunday’s emergency statement, Jerome Powell said the Federal Reserve’s principal job right now is to “stabilize” the financial markets during the crisis. This he stressed is the Fed’s central concern. A “secondary” concern, Powell said, is the immediate economic fallout which looks to hit the second quarter, after which he said a rebound is likely.

The FOMC voted 9-to-1 to cut the funds target to 0.125 percent with the lower bound of the 25-basis-point range now sitting at zero. Powell said he does not see rates moving negative, and he stressed that fiscal stimulus in conjunction with the Fed’s moves is “critical” right now.

These moves also include a new round of quantitative easing that will see the Fed increase the size of its balance sheet after having brought it down over the past several years, from $4.5 trillion in 2014 and 2015, to a low of $3.5 trillion late last year and back at $4.3 trillion before today’s announcement. The new buying plans, at $500 billion in Treasuries and $200 billion for mortgage-backed securities, do not include buying wider assets, a possibility downplayed by Powell who said is not seeking such authority from Congress.

Yet the Fed Chair didn’t rlue out further direct buying, stressing that the Fed has plenty of power left in its kit of tools — the full range of which, as demonstrated today, the Fed he said is prepared to use. One of these tools is a rehabilitated discount rate, cut a lopsized 150 basis points to 0.25 discount and no longer well above the funds target. Powell said the Fed is encouraging banks to turn to the discount window which in the past has been a last resort for distressed borrows.

Sunday’s surprise announcement replaces what had been a scheduled meeting on Tuesday and Wednesday. The next scheduled meeting is April 28 and 29.

Going into the impact of the coronavirus, Powell said he economy was on a “sound” footing”. He said the virus will hurt US exports and also hold down inflation. This repeats the assessments of the emergency statements: March 3 and today Sunday March 15.

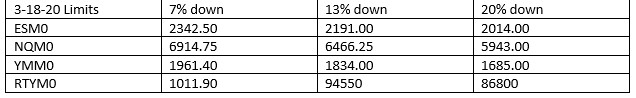

Overnight limit, can’t trade below but can trade above.

-5%

Intra day

-7% Trading Halt 15 mins

-13% Trading Halt 15 mins

-20% Closed for rest of day

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

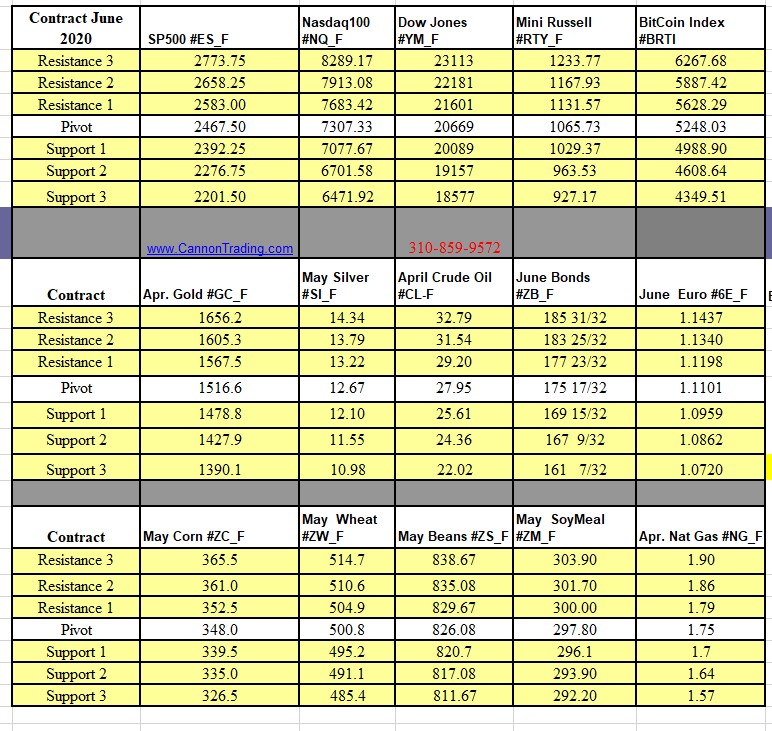

Futures Trading Levels

03-18-2020

Did you know?

Order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News