Weekly mini SP500 options been around for the last few years and provide traders with the ability of speculating with options rather than day trade as well as hedging their day trades if they choose to do so. Learn more about the mechanics and the uses of weekly mini SP500 options.

There are 100's of indicators available to traders to assist with decision making that can be applied to technical analysis, which is precisely the reason to utilize a sound and inexpensive weekly ES strategy to compliment a day trading strategy.

Briefly, the definition of an option contract from the National Futures Association is: An investment vehicle which gives the option buyer the right—but not the obligation—to buy or sell a particular futures contract at a stated price at the specified expiration date. There are two separate and distinct types of options: calls and puts. These weekly options are European Style, Exercisable to the nearest futures contract at 3pm Central time on Friday. If in the money by any amount, the exercise is automatic.

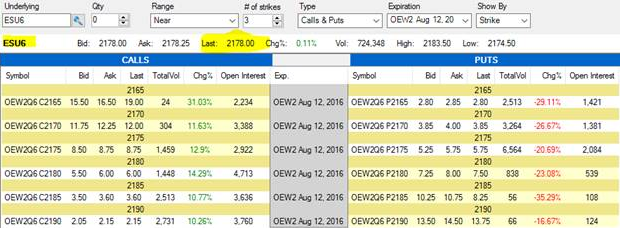

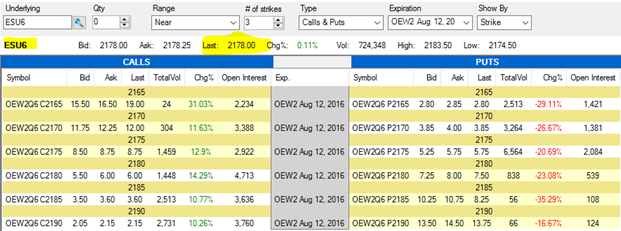

Weekly ES options have weekly, sequential clearing symbols of EW1,EW2,EW3,EW4 Here are the nearest to the money strikes with bids and offers relative to the last futures price for the ESU6. The multiplier, like the E-Mini S&P is $50.00 X the Premium, ( Screen shot from Aug. 9th 2016 ESU6 traded around 2175 at that time)

Please look at the 2175 p, OEW2Q6 P2175 the bid is 5.25 and the ask is 5.75 the cost to buy 1 of these puts at the market is 5.75 X $50.00 or $287.50 not incl. commission and fees. The screen shot above is taken using our FREE trading software, E-futures International, try a demo now!

Let’s say you are long the ESU6 at 2178.00, you can buy at 2175.00 put for $287.50 or 5.75 pts.

If the market goes down to 2160.00 you have an unrealized loss on your futures of 18 points or $900.00

But also have a put option worth approximately the amount the option is in the money (15 points intrinsic value,, plus extrinsic value or time value if you just bought this option today this value should be at least worth 5.75 points) for a total of 20.75 in value. If you were to offset this strategy with the market at 2160.00 you would lose 900 on the futures and gain 15 points or $750.00 on the option for a net loss of $150.00 or 3 points. Not including commissions & fees. BTW the margin is greatly reduced to reflect your actual risk of only the distance between the strike on the put and your futures entry price, in this case 2178.00- 2175.00 or 3 points $150.00. The reduced margin should also allow you to hold this strategy overnight.

Remember this is just a hedge, if the market rallies to 2195.00 you make 18 points on your future, but will lose some on your put option; approximately 3 to 4 points on your out of the money put option with a strike of 2175.00 Because there is still time left in this option, even though it’s out of the money (extrinsic value) and it has not expired, it will still have some value and not be entirely worthless.

This strategy allows you the somewhat peace of mind of not only having to determine where to put a stop, but also potentially allowing you to hold on to a much larger move, have fun with the math and see for yourself! (Ask your broker about writing premium above this strategy to maximize the cost effectiveness of this strategy)

Buying weekly mini SP500 puts or calls can be a relatively inexpensive way to speculate on market direction that can be for minutes, for hours or for a few days.

We’ll use the same screenshot for a straight put or call example. ( Screen shot from Aug. 9th 2016 ESU6 traded around 2175 at that time)

If your trading bias is for the market to go lower soon, but you are not certain when, it could be a matter of hours, or days and you want a lower risk way to participate, Buy a PUT. Let's say you believe the market can test the 2150 level before Friday at 3PM Central, and you don't want to spend more than a few hundred dollars, you see the 2170 put on your trading platform is bid at 3.85* and offered at 4.00.

You can buy 1 2170 put at 4 points or $200.00 before commissions & fees (remember each full point is worth $50.00 just like the futures. Also of note here *0.05= $2.50 for premium ≤ 5.00). No margin required, what is required is the cash in your account to buy the option.

Or, if you believe the market will rally to 2200.00 within the week, take a look at the out of the money call options, say the 2180. Its bid at 5.50 or $275.00 and offered at 6.00 or $300.00, you can buy it at $300 immediately. If the market closes at 2200.00 on Friday and the option is exercisable, you can sell the futures at 2200.00, and when the option is exercised ( it's in the money and is automatic at expiration) you will receive an offsetting futures contract at your strike price of 2175.00 (long the futures at 2175.00 and an offsetting sale at 2200.00 and will have made 25.00 points x $50.00 or $1250.00 minus what you paid for the option, let's do the math, 1250.00 – 300.00 = $950.00 less any exchange, clearing, NFA fees and commissions. You can get creative with your offsetting futures trade if you are in the money by placing a GTC sell limit quite a distance above your strike price in the event the market rally's, let's say at 2210.00 or if you want, when you are in deep in the money with a day or two before expiration you can place a sell stop under GTC, or even a trailing stop in the futures, you know what they say, "cut your losses short and let your profits run!".. Once you are filled, you have locked in your gain and simply wait for the exchange to convert your in the money call on Friday afternoon.

But what happens if after you bought your 2175.00 weekly call option and had the opportunity to sell the future at a much higher price like at the 2200.00 level only to see the futures price collapse to 2160.00 by Friday?

You lose the premium you paid on your option, all 300.00. BUT! You are now short the futures from 2200.00 and can buy the futures back at 2160.00 for a 40 point gain!, less the cost of the option of course and fees and commissions.

Using weekly options is another smart tool to use to benefit from price action in the short run.

If you are not familiar with the risks associated with futures trading and/or options on futures, I recommend you visit our broker assist services and get help creating a trading plan.

Disclaimer - Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.