June 12th, 2015 - Issue #790

In This Issue

1. Day Trading indicators and Algorithm free trial

2. Hot Market Review - Corn Bulls Making Some Noise; Key Timeframe Lies Ahead

3. Economic Calendar

1. Day Trading Indicators and Algorithm Free Trial

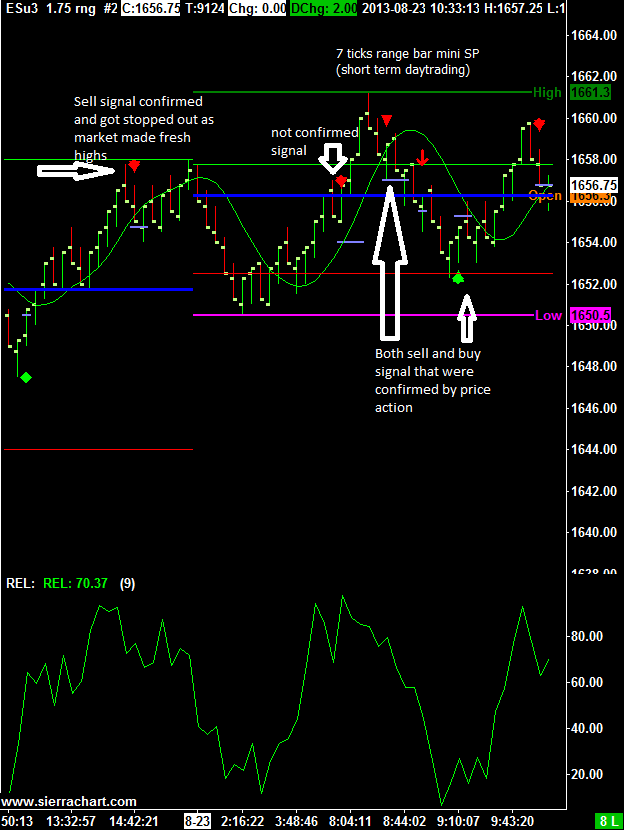

Below is a screen shot of the Mini Sp 500 and mini Russell 2000 charts from August 23rd 2013

The charts are sierra charts and the signals that appear are based on proprietary indicators developed by Ilan Levy-Mayer of LEVEX Capital Mgmt Inc. and VP of Cannon Trading Co, Inc.

The concept is a simple concept that looks for exhaustion in either buying/ selling and reversal. The signals that appear on the charts are alerting you for potential buy or sell IF/ONCE price confirmation occurred (crossing of the hull moving average). Full explanation along with chart samples included in the 23 page PDF booklets that comes with the free trial.

Would you like to have access to the DIAMOND and TOPAZ and 5T ALGOs as shown above and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where the ALGO is enabled along with few studies for your own sierra/ ATcharts. The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details.

TRADING COMMODITY FUTURES AND OPTIONS INVOLVE SUBSTANTIAL RISK OF LOSS. THE RECOMMENDATIONS CONTAINED IN THE LETTER IS OF OPINION AND DOES NOT GUARANTEE ANY PROFITS. THERE IS NOT AN ACTUAL ACCOUNT TRADING THESE RECOMMENDATIONS. THESE ARE RISKY MARKETS AND ONLY RISK CAPITAL SHOULD BE USED. PAST PERFORMANCES ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

If you like this Newsletter, Please share!To start your trial please provide a VALID email and phone number:

Day Trading Indicators and Algorithm Free Trial

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. Hot Market Review - Corn Bulls Making Some Noise; Key Timeframe Lies Ahead

From our friend Jim Wyckoff

Jim has an excellent daily newsletter where he reviews different markets, alerts you for potential trades and much more. Included is his great bi-weekly newsletter with charts and a little longer term outlook. We recommend checking out his website, educational CDROM, and services at www.jimwyckoff.com click on image below to enlarge

The corn market has rebounded from the June low and on Tuesday hit a two-week high. The bulls have gained a bit of upside momentum, but have more heavy lifting to do in the near term to suggest that a price uptrend can be sustained. Grain traders are looking forward to the early-July timeframe. That's the period when, historically, grain futures markets prices can see price trends reversed or accelerated. Given that the grains have already been beaten down this spring, odds would favor any trend action change being a trend reversal and not an existing price trend (down) acceleration.

The corn market has rebounded from the June low and on Tuesday hit a two-week high. The bulls have gained a bit of upside momentum, but have more heavy lifting to do in the near term to suggest that a price uptrend can be sustained. Grain traders are looking forward to the early-July timeframe. That's the period when, historically, grain futures markets prices can see price trends reversed or accelerated. Given that the grains have already been beaten down this spring, odds would favor any trend action change being a trend reversal and not an existing price trend (down) acceleration.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 06/15 Mon |

7:30 AM CDT - Core PPI & PPI(May) 9:00 AM CDT - Mich Sentiment(Jun) |

LT: Jun Lean Hogs(CME) Jun Lean Hogs Options(CME) Jul Cotton Options(ICE) Jul Coffee Options(ICE) |

| 06/16 Tues |

7:30 AM CDT - Building Permits & Housing Starts(May)

|

FN: Jun US Dollar Index(ICE) LT: Jun Canadian Dollar(CME) |

| 06/17 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 9:30 AM CDT - API & DOE Energy Stats 1:00 PM CDT - FOMC Rate Decision(Jun) 2:00 PM CDT - Dairy Products Sales |

FN: Jul Cocoa(ICE) LT: Jul Crude Lt Options(NYM) Jul Platinum Options(NYM) Jul Palladium Options(NYM) |

| 06/18 Thurs |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Core CPI & CPI(May) 7:30 AM CDT - Current Account Balance(Q1) 9:00 AM CDT - Leading Indicators(May) 9:00 AM CDT - Philadelphia Fed(Jun) 9:30 AM CDT - EIA Gas Storage 2:00 PM CDT - Milk Production 3:30 PM CDT - Money Supply |

LT: Jun NASDAQ(CME) Jun S&P 500(CME) Jun NASDAQ Options(CME) Jun S&P 500 Options(CME) |

| 06/19 Fri |

2:00 PM CDT - Cattle On Feed |

LT: Jun 10 Year Notes(CBT) Jun Bonds(CBT) Jun DJIA(CME) Jun E-Mini S&P 500(CME) Jun E-Mini NASDAQ(CME) Jun Russell(CME) Jun DJIA Options(CME) Jun E-Mini S&P 500 Options(CME) Jun E-Mini NASDAQ Options(CME) Jun Russell Options(CME) Jul Orange Juice Options(ICE) |

| 06/22 Mon |

9:00 AM CDT - Existing Home Sales(May) 2:00 PM CDT - Cold Storage |

FN: Jul Coffee(ICE) LT: Jul Crude Lt(NYM) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!