December 9, 2011 - Issue #613

In This Issue

1. Special: Rollover Notice

2. Cannon Trading has a new Video!

3. Jim Wyckoff's Hot Market

4. Economic Calendar

1. Special: Rollover Notice

Please note that Equity Indices products; TF, ES, NQ, EMD and YM roll on Thursday the 8th at 8:30 am Chicago time from the December 2011 contract to the March 2012 contract. The month code for March is ‘H’.

It is recommended that all new positions be placed in the March contract as of Thursday’s trade date. Please close any open December Currencies positions by the close on Friday, December 16th. Should you have any further questions please contact one of our futures brokers here.

2. Cannon Futures Trading's New Youtube Video!

On a different topic

The first video of a series of trading videos Cannon Trading is planning to produce is on the air!

This specific video shares a set up of overbought/oversold Algorithm and how you can set up one of our trading platforms to have automatic exits. Worth taking a few minutes of your time to watch.

If after you watch the video, you would like a trial of the custom studies/charts or trading platform shown, please visit our website to learn more about our webinars

Each trading day, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, holds a live educational day trading webinar during the first 2 hours of trading.

3. Jim Wyckoff's Hot Market

Gold Bulls Fade Thursday, amid Downbeat EU Developments

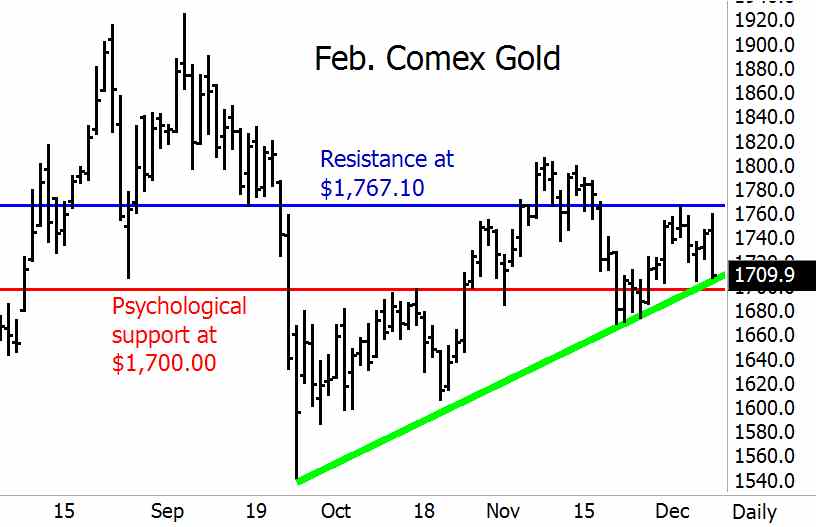

Comex February gold futures sold off on fresh, downbeat news out of the European Union was deemed bearish for the precious metals and many other markets. Once again, the market place is held hostage by developments coming out of the European Union. Technically, February gold futures prices closed nearer the session low Thursday and scored a bearish “outside day” down on the daily bar chart. Bulls faded Thursday. Bulls do still have the slight overall near-term technical advantage. A 10-week-old uptrend is still in place on the daily bar chart, but now just barely. Bulls' next upside technical breakout objective is to produce a close above solid technical resistance at last week’s high of $1,767.10. Bears' next near-term downside price objective is closing prices below psychological support at $1,700.00.

Jim has an excellent daily newsletter where he reviews different markets, alerts you for potential trades and much more. Included is his great bi-weekly newsletter with charts and a little longer term outlook. We recommend checking out his website, educational CDROM, and services at Jim Wyckoff

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

![]()

4. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 12/09 Fri |

7:30 AM CST - WASDE Report & Crop Production 7:30 AM CST - Dairy Products Prices 7:30 AM CST - Trade Balance(Oct) 8:55 AM CST - Mich Sentiment(Dec) | LT: Dec Canadian Dollar Options(CME) Dec Currencies Options(CME) Dec US Dollar Options(CME) Jan Coffee Options(ICE) |

| 12/12 Mon |

1:00 PM CST - Treasury Budget(Nov) | |

| 12/13 Tue |

7:30 AM CST - Retail Sales(Nov) 9:00 AM CST - Business Inventories(Oct) 1:15 PM CST - FOMC Rate Decision(Dec) | |

| 12/14 Wed |

6:00 AM CST - MBA Mortgage Purchase Index 7:30 AM CST - NOPA Crush 7:30 AM CST - Export & Import Prices(Nov) 9:30 AM CST - API & DOE Energy Stats | LT: Dec Wheat(CBT) Dec Corn(CBT) Dec Oats(CBT) Dec Soymeal,Soyoil,Soybeans(CBT) Dec Barley(ICE) Dec Cocoa(ICE) Dec Lean Hogs(CME) Dec Lean Hogs Options(CME) |

| 12/15 Thu |

7:30 AM CST - USDA Weekly Export Sales 7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Core PPI & PPI(Nov) 7:30 AM CST - Current Account Balance(Q3) 7:30 AM CST - Empire Manufacturing(Dec) 8:00 AM CST - Net Long-Term TIC Flows(Oct) 8:15 AM CST - Capacity Util & Industrial Prod(Nov) 9:00 AM CST - Philadelphia Fed(Dec) 9:30 AM CST - EIA Gas Storage 3:30 PM CST - Money Supply | LT: Dec NASDAQ(CME) Dec S&P 500(CME) Dec NASDAQ Options(CME) Dec S&P 500 Options(CME) Dec Value Line Options(CME) Jan Crude Lt Options(NYM) Jan Sugar-11 Options(CME) |

| 12/16 Fri |

7:30 AM CST - Dairy Products Prices 7:30 AM CST - Core CPI & CPI(Nov) 2:00 PM CST - Cattle On Feed | LT: Dec DJIA(CME) Dec E-Mini S&P 500(CME) Dec NASDAQ(CME) Dec Russell(CME) Dec Value Line(CME) Dec DJIA Options(CME) Dec E-Mini S&P Options(CME) Dec NASDAQ Options(CME) Dec Russell Options(CME) Jan Cotton Options(CME) Jan Orange Juice Options(ICE) |

| 12/19 Mon |

9:00 AM CST - NAHB Housing Market Index(Dec) 2:00 PM CST - Milk Production | LT: Dec Currencies(CME) Dec Eurodollar(CME) Dec Coffee(ICE) Dec US Dollar Index(ICE) Dec Eurodollar Options(CME) |

| 12/20 Tue |

7:30 AM CST - Building Permits & Housing Starts(Nov) | FN: Dec US Dollar Index(ICE) LT: Dec Butter(CME) Dec Canadian Dollar(CME) Jan Crude Lt(NYM) |

| 12/21 Wed |

6:00 AM CST - MBA Mortgage Purchase Index 9:00 AM CST - Existing Home Sales(Nov) 9:30 AM CST - API & DOE Energy Stats | LT: Dec 10 Year Notes(CBT) Dec Bonds(CBT) Jan Palladium Options(CMX) Jan Platinum Options(CMX) |

| 12/22 Thu |

7:00 AM CST - Cotton Consumption 7:00 AM CST - Census Crush 7:30 AM CST - USDA Weekly Export Sales 7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - GDP & GDP-Deflator Third Estimate(Q3) 8:55 AM CST - Michigan Sentiment-Final(Dec) 9:00 AM CST - FHFA Housing Price Index(Oct) 9:00 AM CST - Leading Indicators(Nov) 9:30 AM CST - EIA Gas Storage 2:00 PM CST - Cold Storage 3:30 PM CST - Money Supply | FN: Jan Crude Lt(NYM) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!