January 29, 2016 - Issue #815

In This Issue

1. FREE TRIAL: Trading Indicators and ALGOS

2. Hot Market report: Early Clues of Market Bottom in S&P 500 Index

3. Economic Calendar

1. Free Trial to Trading Signals and Indicators

Cannon Trading is pleased to present a 3 weeks FREE trial to LEVEX family of indicators and ALGO:

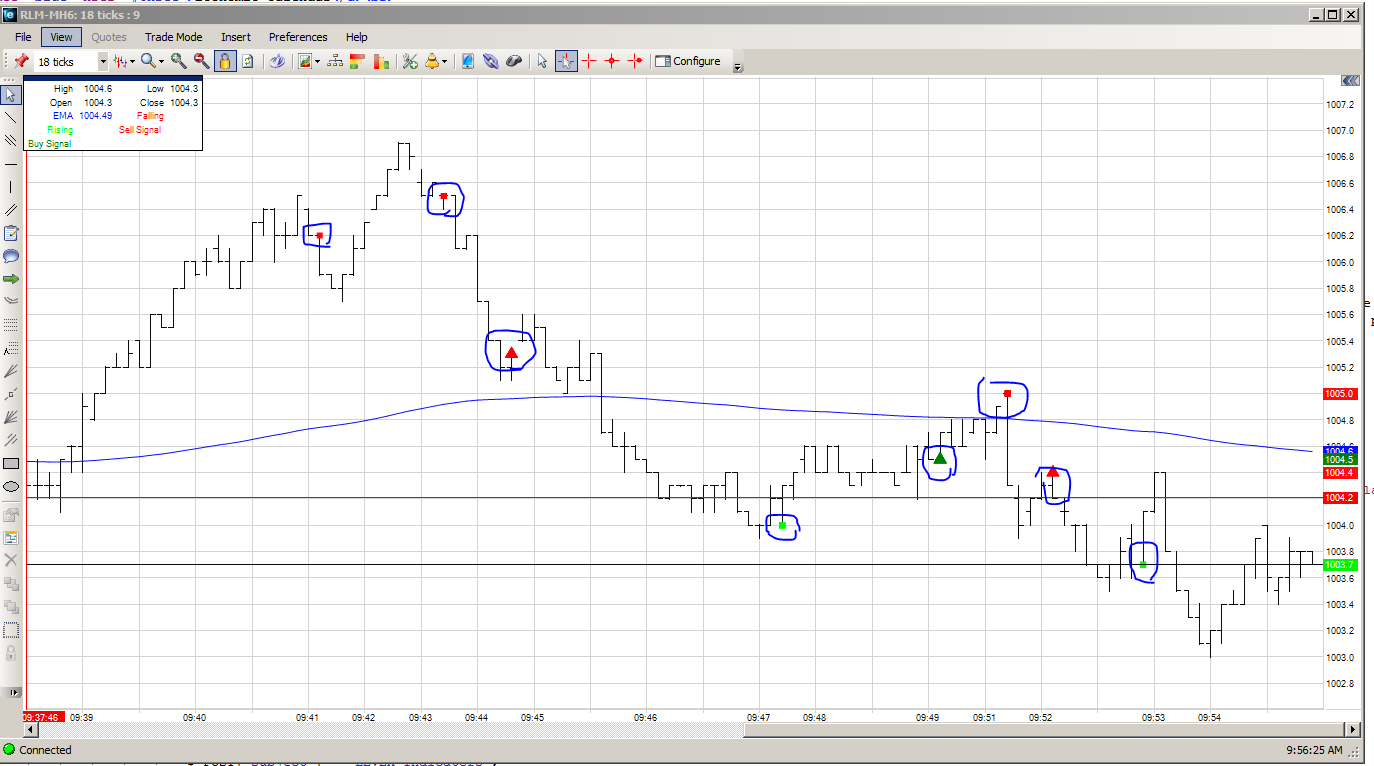

To start the trial is very easy and once you are set you will see indicators such in the screen shot below which produce possible buy and sell signals based on the two main ALGOS below:

Diamonds:

DIAMONDS is an algorithm that was created while designing different trading systems. It is a proprietary algorithm that tries to measure exhaustion in selling or buying and possible chance of short term reversal.

The ALGO calculates recent highs/lows, consecutive highs/lows, RSI, volatility and then the formula outputs; a number that either meet certain criteria or not. RED diamonds suggest possible short term top. GREEN or BLUE diamonds suggest possible short term bottoms.

The term “suggested” is used because like any other indicator or trading strategy, the future for the next few minutes or sometimes seconds cannot be predicted.

ILM: ILM produces arrows on the charts that signal potential change in direction and momentum since ILM is based on moving average and a volatility system.

Simply review the information, fill out the form below to instantly download our trading platform, and start your FREE trial with the indicators on the charts.

After the FREE TRIAL the Cost - Non Cannon Trading Clients - $99/month, Cannon Trading Clients - $49/month

Don't wait... limited time free trial. Sign up NOW!

If you like this, Please share!

LEVEX - Trading Indicators

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. Early Clues of Market Bottom in S&P 500 Index

From our friend Jim Wyckoff at JimWyckoff.com

Click on image below to enlarge

The beginning of 2016 has been very unkind to world stock markets, including the S&P 500. However, see on the March e-mini S&Ps that prices have rebounded from the spike low scored in mid-January, to suggest that the bears became exhausted at that time. Also, see at the bottom of the chart that the Moving Average Convergence Divergence (MACD) indicator is just now producing a bullish line crossover signal, whereby the thick blue MACD line crosses above the thin red "trigger" line. There are early technical clues that the e-mini S&P stock index has put in at least a near-term bottom. However, the bulls have more work to do to suggest a near-term price uptrend can be sustained. Make 2016 a great year!!

The beginning of 2016 has been very unkind to world stock markets, including the S&P 500. However, see on the March e-mini S&Ps that prices have rebounded from the spike low scored in mid-January, to suggest that the bears became exhausted at that time. Also, see at the bottom of the chart that the Moving Average Convergence Divergence (MACD) indicator is just now producing a bullish line crossover signal, whereby the thick blue MACD line crosses above the thin red "trigger" line. There are early technical clues that the e-mini S&P stock index has put in at least a near-term bottom. However, the bulls have more work to do to suggest a near-term price uptrend can be sustained. Make 2016 a great year!!

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 02/01 Mon |

7:30 AM CST - PCE Prices(Dec) 7:30 AM CST - Personal Income & Spending(Dec) 9:00 AM CST - Construction Spending(Dec) 9:00 AM CST - ISM Index(Jan) 2:00 PM CST - Fats & Oils 2:00 PM CST - Grain Crushings |

|

| 02/02 Tues |

1:00 PM CST - Auto & Truck Sales(Jan) |

FN: Feb RBOB & ULSD(NYM) LT: Jan Butter(CME) Jan Milk(CME) Jan Butter Options(CME) Jan Milk Options(CME) |

| 02/03 Wed |

6:00 AM CST - MBA Mortgage Purchase Index 7:15 AM CST - ADP Employment Change(Jan) 9:00 AM CST - ISM Services(Jan) 9:30 AM CST - API & DOE Energy Stats 2:00 PM CST - Dairy Product Sales |

|

| 02/04 Thurs |

6:30 AM CST - Challenger Job Cuts(Jan) 7:30 AM CST - USDA Weekly Export Sales 7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Productivity-Prel(Q4) 9:00 AM CST - Factory Orders(Dec) 9:30 AM CST - EIA Gas Storage 3:30 PM CST - Money Supply |

|

| 02/05 Fri |

7:30 AM CST - Ave Workweek & Hourly Earnings(Jan) 7:30 AM CST - Nonfarm Payrolls(Jan) 7:30 AM CST - Trade Balance(Dec) 7:30 AM CST - Unemployment Rate(Jan) |

LT: Feb Canadian Dollar Options(CME) Feb Currencies Options(CME) Feb Live Cattle Options(CME) Feb US Dollar Index Options(ICE) Mar Cocoa Options(ICE) |

| 02/08 Mon |

FN: Feb Live Cattle(CME) LT: Mar Sugar-16(ICE) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!