September 18th, 2015 - Issue #801

In This Issue

1. How Should We As Traders Confront Risk?

2. Dr. Copper - Wrong or Right?

3. Economic Calendar

1. How Should We As Traders Confront Risk?

Risk, it is a four letter word. As traders it is something that we thrive on and dread. We chase and fear. We look for and look to avoid. It is RISK. Without it, there is no opportunity for profit. Without it trading lacks potential. With it, failure and heartache are the consequences when it is abused.

Risk itself is not a bad thing. When it is misused by traders, it becomes a problem. Controlled risk presents traders with exciting and profitable opportunities. Uncontrolled, it brings the end to the dreams and careers of many traders.

How should we as traders confront risk?....

The first step is to respect it. Realize the damage it can do to our account equities when it is abused. The two most important tools that we have to control risk are stops and position size. Oh, I know, you hate stops. We all do. We have all been stopped out at the high or low only to see the market immediately move in the direction that we thought it would. But without using stops on every trade that we enter, disaster will eventually prevail. I have a love/hate relationship with my stop orders. I hate to place them, but love how they save me from large, unacceptable account crushing losses. It is the same for all successful traders. Those foolish enough to trade without stop protection are risking disaster on every trade. Unless you as a trader have developed perfect discipline to exit a losing trade quickly, and according to your pre-entry criteria, stops are mandatory. And admit it, at least to yourself.....do you have perfect discipline? I think not.

To Read the remaining article on "How Should We As Traders Confront Risk?", please fill out this form.

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Dr. Copper - Wrong or Right?

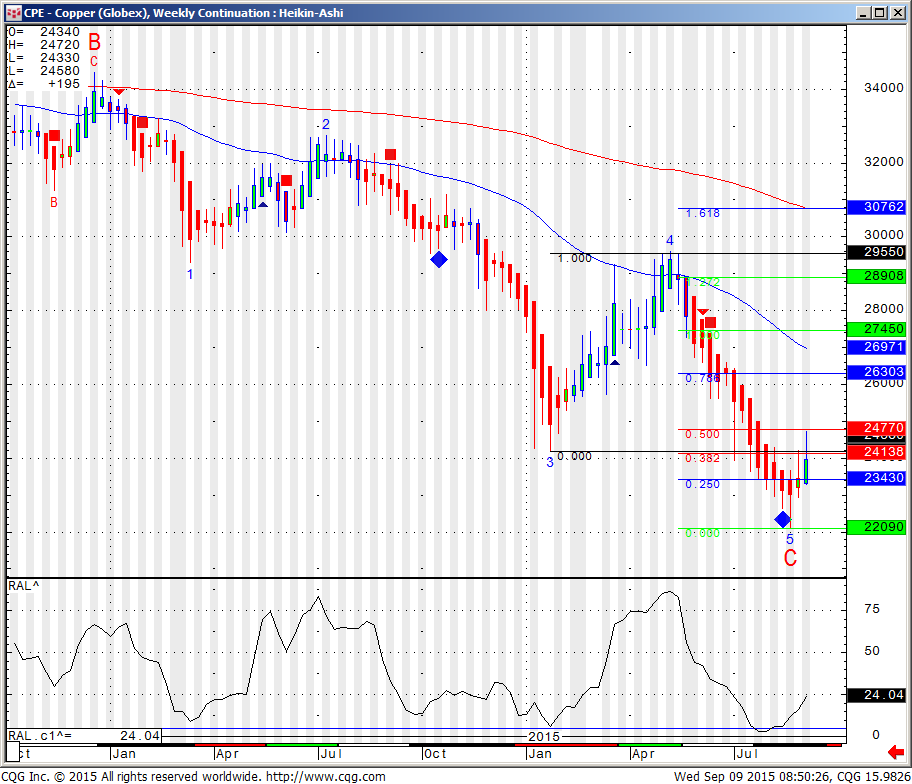

Despite recent moves, copper still has to prove something...that something would be a close above 247.70.

Written by our VP, Ilan Levy-Mayer Featured on FinanceMagnates.com

Many in the trading world refer to the Copper commodity as Dr. Copper for its above average correlation in predicting global economic turning points. This past week I saw a nice bounce and some volatile action in copper prices which lead me to write this quick review. If you have read some of my other reviews you will know by now that the first thing I do is turn to the charts. In May of this year, copper saw a nice decline about 2 months ahead of our equity markets.

This week we are noticing a start of a rebound pattern in copper prices following a diamond signal we got last week. These diamond signals suggest a possible oversold/overbought pattern with a possibility of turn around. This early reversal pattern coincides with our stock market strong bounce following Labor Day weekend, as well as the interventions made by the Bank of China (PBOC).

Many in the trading world refer to the Copper commodity as Dr. Copper for its above average correlation in predicting global economic turning points. This past week I saw a nice bounce and some volatile action in copper prices which lead me to write this quick review. If you have read some of my other reviews you will know by now that the first thing I do is turn to the charts. In May of this year, copper saw a nice decline about 2 months ahead of our equity markets.

This week we are noticing a start of a rebound pattern in copper prices following a diamond signal we got last week. These diamond signals suggest a possible oversold/overbought pattern with a possibility of turn around. This early reversal pattern coincides with our stock market strong bounce following Labor Day weekend, as well as the interventions made by the Bank of China (PBOC).

Read the Full Article on FinanceMagnates.com

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 09/21 Mon |

9:00 AM CDT - Existing Home Sales(Aug) |

LT: Sep 10 Year Notes(CBT) Sep Bonds(CBT) |

| 09/22 Tues |

8:00 AM CDT - FHFA Housing Price Index(Jul) 2:00 PM CDT - Cold Storage |

LT: Oct Crude Lt(NYM) |

| 09/23 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 9:30 AM CDT - API & DOE Energy Stats 2:00 PM CDT - Dairy Products Sales |

|

| 09/24 Thurs |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Durable Goods-Ex Transportation(Aug) 7:30 AM CDT - Durable Orders(Aug) 9:00 AM CDT - New Home Sales(Aug) 9:30 AM CDT - EIA Gas Storage 3:30 PM CDT - Money Supply |

|

| 09/25 Fri |

7:30 AM CDT - GDP-Third Estimate(Q2) 7:30 AM CDT - GDP Deflator-Third Estimate(Q2) 9:00 AM CDT - Michigan Sentiment-Final(Sep) 2:00 PM CDT - Quarterly Hogs & Pigs |

LT: Oct 2,5,10 Year Notes Options(CBT) Oct Bonds Options(CBT) Oct Canola Options(CBT) Oct Corn Options(CBT) Oct Oats Options(CBT) Oct Rough Rice Options(CBT) Oct Wheat Options(CBT) Oct Soybeans,Soymeal,Soyoil Options(CBT) Oct Natural Gas Options(NYM) Oct RBOB & ULSD Options(NYM) |

| 09/28 Mon |

7:30 AM CDT - PCE Prices-Core(Aug) 7:30 AM CDT - Personal Income & Spending(Aug) 9:00 AM CDT - Pending Home Sales(Aug) |

LT: Sep Copper(CMX) Sep Gold(CMX) Sep Silver(CMX) Sep Platinum(NYM) Sep Palladium(NYM) Oct Natural Gas(NYM) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!