March 1, 2013 - Issue #675

In This Issue

1. More downside potential for gold?

2. Free trial to a unique newsletter covering major markets for all time frames

3. Economic Calendar

1. More downside potential for gold?

From our friends http://www.bellcurvetrading.com

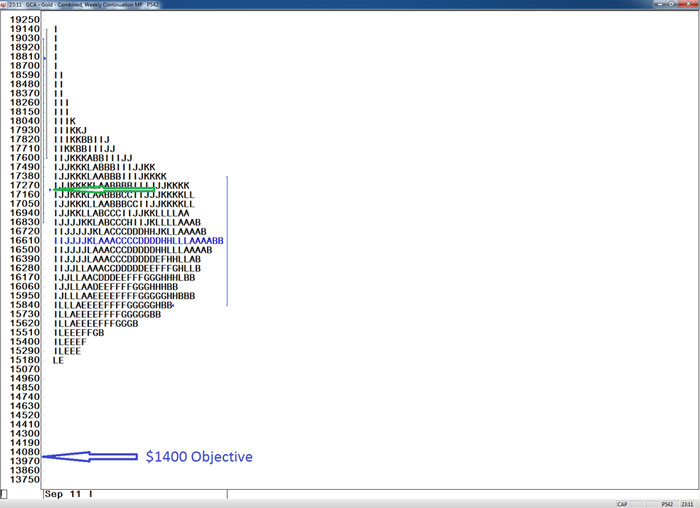

2/28 - We have been bearish GOLD since mid-September when the market was trading around $1800.00. Not coincidentally, this was right around the time QE3 was announced. What told us to get short when everyone else was forecasting major new highs? Take a look at the sell off from the all-time highs back in September of 2011 depicted using the BELL CURVE supply/demand methodology. This curve has kept us bearish when all the fundamentals pointed to higher prices. Do you think there is still more to go on the downside ???

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

2. Free trial to a unique newsletter covering major markets for all time frames.

The Gold chart and analysis above is provided by Bell Curve Trading. Here at Cannon Trading, we have been following Bell Curve for the past 3 months and are quite impressed with the information they been providing on variety of markets. Bell Curve has been using its proprietary supply/demand methodology in all time frames to assist traders and asset managers for over 25 years. They add value to their clients by identifying superior risk/reward trading opportunities, mapping out entry points, profit objectives, exit strategies, and risk management parameters. They cover over 40 global markets including domestic and foreign equity indices, primary sector ETF's, precious and base metals, major currency pairs, energy, US and foreign fixed income markets, and soft commodities.

If you have been trading for more than a few months, you should take a look at the information and products Bell Curve Trading provides. To start your free 30-day trial, please complete the short form below. Valid phone number and email are required to authorize the trial.

For a free trial for the Bell Curve Methodology, please fill out this form.

Cannon Trading respects your privacy and will never give this information to a 3rd party.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 03/04 Mon |

FN: Mar Heating Oil(NYM) Mar RBOB Gasoline(NYM) |

|

| 02/12 Tues |

1:00 PM CST - Treasury Budget(Jan) | |

| 03/05 Wed |

9:00 AM CST - ISM Services(Feb) | |

| 03/06 Thurs |

6:00 AM CST - MBA Mortgage Index 7:15 AM CST - ADP Employment Change(Feb) 9:00 AM CST - Factory Orders(Jan) 9:30 AM CST - API & DOE Energy Stats 1:00 PM CST - Fed's Beige Book(Mar) 3:00 PM CST - Dairy Products Sales |

LT: Mar Cotton(NYM) ) |

| 03/08 Fri |

7:30 AM CST - Nonfarm Payrolls(Feb) 7:30 AM CST - Unemployment Rate(Feb) 7:30 AM CST - Ave Workweek & Hourly Earnings(Feb) 9:00 AM CST - Wholesale Inventories(Jan) 11:00 AM CST - WASDE Report & Crop Production |

LT: Mar Orange Juice(ICE) Mar Canadian Dollar Options(CME) Mar Currencies Options(CME) Mar US Dollar Index Options(ICE) Apr Coffee Options(ICE) |

| 03/11 Mon |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.