August 24th, 2012 - Issue #649

In This Issue

1. Trader's Resource Corner - Options 101 WEBINAR

2. Chart of the Week: What's Next for Grains? by CQG.com

3. Economic Calendar

Featured Articles This Week

a. "The Commodity Markets Take No Prisoners" Do you have what it takes to succeed despite losing trades? Peter Brandt does -- and shares some of his insights in this FREE report.

Elliott Wave International

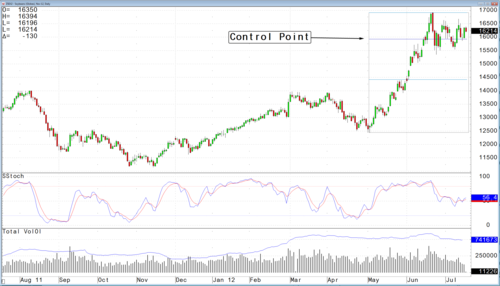

B. Sentiment Measure Shows No Fear of Major U.S. Stock Decline If investors are climbing a "wall of worry," where's the evidence?

1. Traders Resource Corner - OPTIONS WEBINAR

Adding Options as a weapon in your trading arsenal - Options 101 WEBINAR

Join us for a Webinar on August 28 at 3:00 PM Central. Space is limited. Reserve your Webinar seat now

Options on futures can be used in many different ways and as a trader you need to be aware of all the tools you can use! Join John Thorpe, Senior Broker with Cannon Trading Co, Inc. as he walks you through Options 101 and explains the basics of options and different ways traders can utilize options in their trading along with current options trading recommendations.

SEATS ARE LIMITED, SO DON'T MISS THIS SPECIAL FREE WEBINAR!

2. Chart of the Week: What's Next for Grains?

By Shaun Downey of CQG

This summer has seen an unprecedented drought in the Midwest, which has come on the back of a poor South American harvest. The heat has been so intense that the crop cycle is a few weeks ahead of where it normally would be. This means that it is prudent to reassess the technical outlook as we have switched from a weather-driven market to a demand and supply driven one. If you are new to grains, there are a few basic calendar reference points that need to be remembered. READ THE REST OF THE ARTICLE

This summer has seen an unprecedented drought in the Midwest, which has come on the back of a poor South American harvest. The heat has been so intense that the crop cycle is a few weeks ahead of where it normally would be. This means that it is prudent to reassess the technical outlook as we have switched from a weather-driven market to a demand and supply driven one. If you are new to grains, there are a few basic calendar reference points that need to be remembered. READ THE REST OF THE ARTICLE

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 08/27 Mon |

||

| 08/28 Tues |

8:00 AM CST - Case-Shiller 20-City Index(Jun)

9:00 AM CST - Consumer Confidence(Aug) |

LT: Sep Copper Options (CMX)

Sep Gold Options(CBT) Sep Silver Options(CBT) Sep Heating Oil Options(NYM) Sep RBOB Gasoline Options(NYM) Sep Natural Gas Options(NYM) |

| 08/29 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index

7:30 AM CDT - Dairy Products Prices 7:30 AM CDT - GDP-Second Estimate(Q2) 7:30 AM CDT - GDP Deflator-Second Estimate(Q2) 9:00 AM CDT - Pending Home Sales(Jul) 9:30 AM CDT - API & DOE Energy Stats 1:00 PM CDT - Fed's Beige Book(Aug) |

LT: Aug Copper(CMX)

Aug Gold(CMX) Aug Silver(CMX) Aug Platinum(NYM) Aug Palladium(NYM) Sep Natural Gas(NYM) |

| 08/30 Thurs |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Personal Income & Spending 9:30 AM CDT - EIA Gas Storage 3:30 PM CDT - Money Supply |

FN: Sep Natural Gas(NYM)

LT: Aug Butter(CME) Aug Feeder Cattle(CME) Aug Milk(CME) Aug Butter Options(CME) Aug Feeder Cattle Options(CME) Aug Milk Options(CME) |

| 08/31 Fri |

8:45 AM CDT - Chicago PMI(Aug)

8:55 AM CDT - Michigan Sentiment-Final(Aug) 9:00 AM CDT - Factory Orders(Jul) |

FN: Sep Bonds(CBT)

Sep 2,3,5,10 Year Notes(CBT) Sep Copper,Silver,Gold(CMX) Sep Platinum,Palladium(NYM) Sep Corn(CBT) Sep Oats(CBT) Sep Wheat(CBT) Sep Rough Rice(CBT) Sep Soybeans,Soymeal,Soyoil(CBT) LT: Aug Fed Funds(CME) Aug Live Cattle(CME) Sep Heating Oil(NYM) Sep RBOB Gasoline(NYM) Aug Fed Funds Options(CME) Sep Lumber Options(CME) |

| 09/03 Mon |

LABOR DAY |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!