September 12th, 2014 - Issue #753

In This Issue

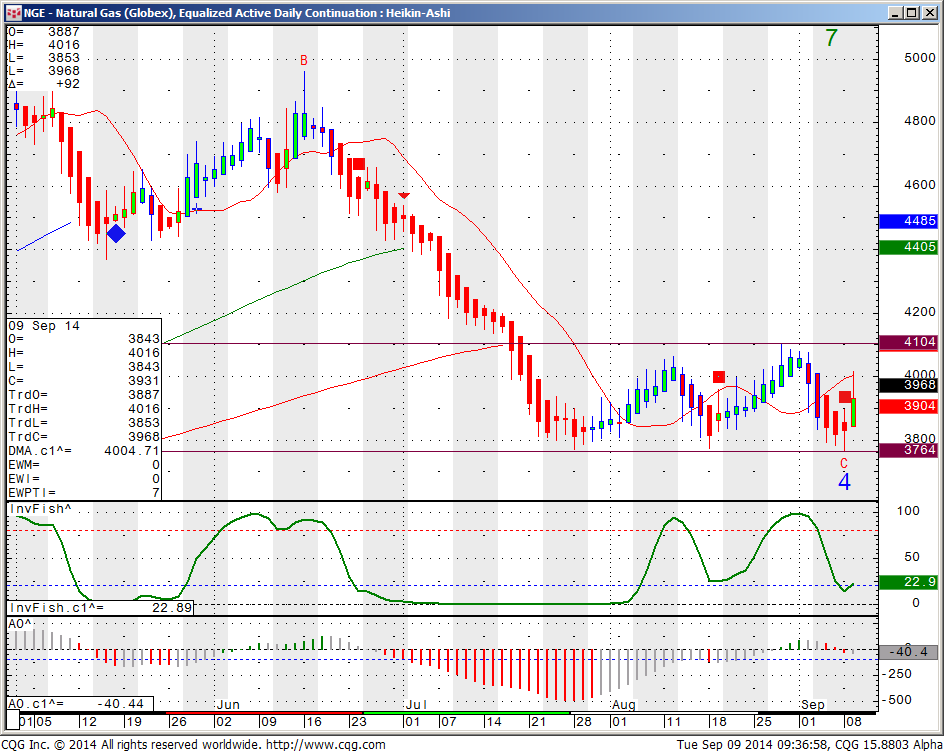

1. Natural Gas Review: Locked in a range

2. Make Trendlines your Friends!

3. Economic Calendar

1. Natural Gas Review: Locked in a range

By Cannon Trading VP Ilan Levy-Mayer on Forexmagnates.com

Natural Gas has been trading in a relatively tight range since July of this year. After experiencing a massive rally, followed by massive sell off…. the market is trying to find fair value ahead of the fall season where many states do use natural gas for heating as well.

Natural Gas has been trading in a relatively tight range since July of this year. After experiencing a massive rally, followed by massive sell off…. the market is trying to find fair value ahead of the fall season where many states do use natural gas for heating as well.

Natural Gas futures CAN be a very explosive market, both ways. The contract is sizeable ( $100 per point either way, 3.970 to 3.980 = $100 per contract) and I have seen some very powerful, fast moves over the years.

Read the rest at:

http://experts.forexmagnates.com/natural-gas-locked-tight-range/

2. Make trend Lines your Friends!

Here's Why Trendlines Are Your New Best Friend, Part 1

See how trendlines show you lasting price levels of risk-defining support in this real-world example from this free eBook

By Elliott Wave International

For the past 15 years, Elliott Wave International's chief commodity analyst Jeffrey Kennedy has been using trendlines to identify high-probability trade set-ups in close to 20 markets he regularly follows. Want to learn how to draw your own trendlines -- and gain an advantage you've never had before? Read more.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 09/15 Mon |

7:30 AM CDT - Empire Manufacturing(Sep) 8:15 AM CDT - Capacity Util & Industrial Prod(Aug) 11:00 AM CDT - NOPA Crush |

|

| 09/16 Tues |

7:30 AM CDT - Core PPI & PPI(Aug) 8:00 AM CDT - Net Long-Term TIC Flows(Jul) |

FN: Sep Lumber(CME) Sep US Dollar Index(ICE) LT: Sep Canadian Dollar(CME) |

| 09/17 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 7:30 AM CDT - Core CPI & CPI(Aug) 7:30 AM CDT - Current Account Balance(Q2) 9:00 AM CDT - NAHB Housing Market Index(Sep) 9:30 AM CDT - API & DOE Energy Stats 1:00 PM CDT - FOMC Rate Decision(Sep) 3:00 PM CDT - Dairy Products Sales |

LT: Oct Crude Lt Options(NYM) Oct Platinum Options(NYM) Oct Palladium Options(NYM) |

| 09/18 Thurs |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Building Permits & Housing Starts(Aug) 7:30 AM CDT - Initial Claims-Weekly 9:00 AM CDT - Philadelphia Fed(Sep) 9:30 AM CDT - EIA Gas Storage 3:30 PM CDT - Money Supply |

LT: Sep Coffee(ICE) Sep NASDAQ(CME) Sep S&P 500(CME) Sep NASDAQ Options(CME) Sep S&P 500 Options(CME) |

| 09/19 Fri |

9:00 AM CDT - Leading Indicators(Aug) 2:00 PM CDT - Cattle On Feed |

LT: Sep 10 Year Notes(CBT) Sep Bonds(CBT) Sep DJIA(CME) Sep E-Mini S&P 500(CME) Sep E-Mini NASDAQ(CME) Sep Russell(CME) Sep DJIA Options(CME) Sep E-mini S&P 500 Options(CME) Sep E-Mini NASDAQ Options(CME) Sep Russell Options(CME) Oct Orange Juice Options(ICE) |

| 09/22 Mon |

9:00 AM CDT - Existing Home Sales(Aug) 2:00 PM CDT - Cold Storage |

LT: Oct Crude Lt(NYM) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!