May 23, 2014 - Issue #738

In This Issue

1. Memorial Day Holiday Schedule

2. Hot Market Report: Crude Oil Bulls taking charge

3. Economic Calendar

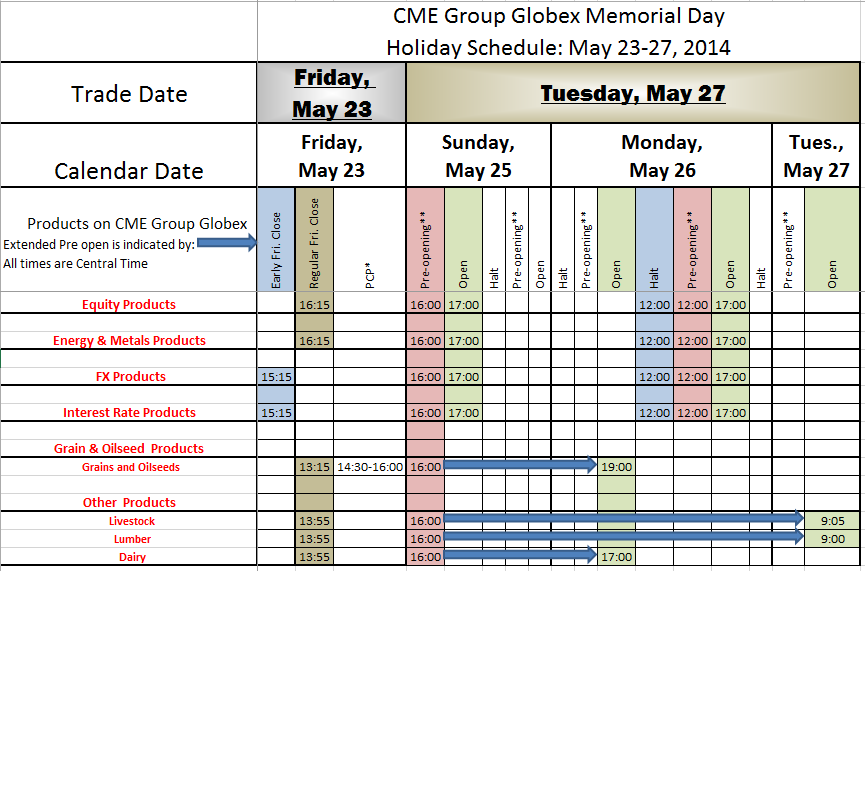

1. Memorial Day Holiday Schedule

If you want a more detailed schedule, please click here.

2. Hot Market Report: Crude Oil Bulls taking charge

Nymex Crude Oil Bulls in Technical Command

From our friend Jim Wyckoff

Jim has an excellent daily newsletter where he reviews different markets, alerts you for potential trades and much more. Included is his great bi-weekly newsletter with charts and a little longer term outlook. We recommend checking out his website, educational CDROM, and services at www.jimwyckoff.com click on image below to enlarge

The Nymex crude oil market is firmly controlled by the bulls, at present, as prices Wednesday scored a new contract high. The rallying crude oil market is a bullish underlying factor for the entire raw commodity sector.

The Nymex crude oil market is firmly controlled by the bulls, at present, as prices Wednesday scored a new contract high. The rallying crude oil market is a bullish underlying factor for the entire raw commodity sector.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 05/26 Mon |

MEMORIAL DAY |

|

| 05/27 Tues |

7:30 AM CDT - Durable Orders(Apr) 8:00 AM CDT - Case-Shiller 20-City Index(Mar) 8:00 AM CDT - FHFA Housing Price Index(Mar) 9:00 AM CDT - Consumer Confidence(May) |

LT: Jun Copper Options(CMX) Jun Gold Options(CMX) Jun Silver Options(CMX) Jun Natural Gas Options(NYM) Jun RBOB & ULSD Options(NYM) |

| 05/28 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index | LT: May Copper(CMX) May Silver(CMX) May Gold(CMX) May Platinum(NYM) May Palladium(NYM) Jun Natural Gas(NYM) |

| 05/29 Thurs |

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - GDP-Second Estimate(Q1) 7:30 AM CDT - GDP Deflator-Second Estimate(Q1) 9:00 AM CDT - Pending Home Sales(Apr) 9:30 AM CDT - EIA Gas Storage 10:00 AM CDT - API & DOE Energy Stats 3:00 PM CDT - Dairy Products Sales 3:30 PM CDT - Money Supply |

FN: Jun Natural Gas(NYM) |

| 05/30 Fri |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - PCE Prices-Core(Apr) 7:30 AM CDT - Personal Income & Spending(Apr) 8:45 AM CDT - Chicago PMI(May) 8:55 AM CDT - Michigan Sentiment-Final(May) |

FN: Jun 2,5,20 Year Notes(CBT) Jun Bonds(CBT) Jun Copper(CMX) Jun Gold & Silver(CMX) Jun Platinum & Palladium(NYM) LT: May Fed Funds(CME) Jun RBOB & USLD(NYM) May Fed Funds Options(CME) Jun Lumber Options(CME) |

| 06/02 Mon |

9:00 AM CDT - ISM Index(May) 9:00 AM CDT - Construction Spending(Apr) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!