February 13th, 2015 - Issue #774

In This Issue

1. Presidents Day Holiday Futures Trading Schedule

2. Why I Like to Use Tick and Volume Charts for Scalping

3. Economic Calendar

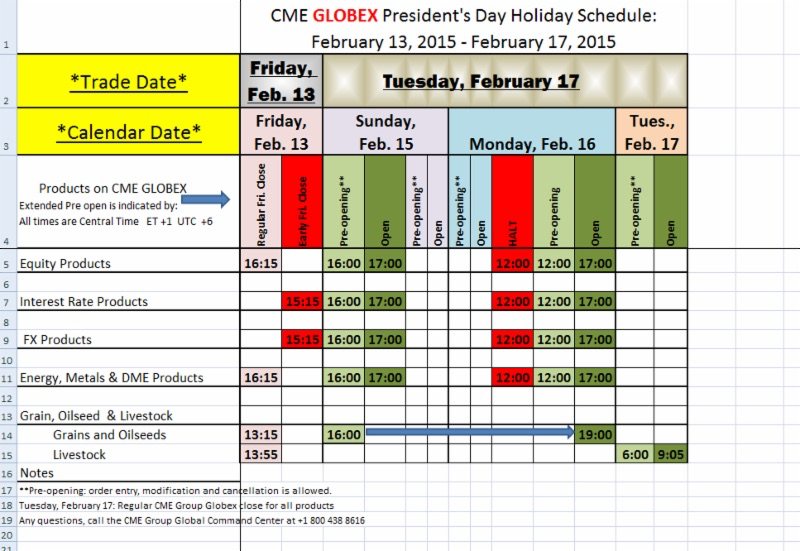

1. Presidents Day Holiday Futures Trading Schedule

Please have a Safe and Happy Holiday!!

From the CME Globex Control Center, here is the summary of changes, per CME market segment -

Friday – early close only for Int. Rates and FX

Sunday – normal open for all, EXCEPT grains & Livestock = stay closed

Monday – all open markets go into

HALT at 12:00 noon CENTRAL TIME

Monday night – NORMAL OPEN for all markets.

To read more, follow this link!

President's Day Holiday Schedule 2015

2. Why I Like to Use Tick and Volume Charts for Scalping

by Ilan Levy-Mayer, Cannon Trading VP featured on Equities.com

February 13th, 2015

Today, I decided to touch more on an educational feature rather than provide a certain market outlook.

Many of my clients and blog readers know that when it comes to short-term trading I am a fan of using volume charts, tick charts, range bar charts and Renko charts rather than the traditional time charts like the 1 minutes, 5 minutes etc.

My rule of thumb is that if you as a trader who makes decisions based on charts that are less than 15 minutes time frame, it may be worth your time to research, back test and do some homework as to potentially using other type of charts like volume charts, Range charts etc.

Volume charts will draw a new bar once a user defined number of contracts traded. An example is the mini SP 10,000 volume chart which will draw a new bar once 10,000 contracts are traded.

To Read the rest of this article, please fill out the form below.

To read the remaining article "Why I Like to Use Tick and Volume Charts for Scalping", fill out this form.

Cannon Trading respects your privacy and will never give this information to a 3rd party.If you like this Newsletter, Please share!

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates | 02/16 Mon |

PRESIDENTS DAY |

LT: Feb Eurodollar(CME) |

| 02/17 Tues |

7:30 AM CST - Empire Manufacturing(Feb) 9:00 AM CST - NAHB Housing Market Index(Feb) 5:00 PM CST - Net Long-Term TIC Flows(Dec) |

LT: Mar Crude Lt Options(NYM) Mar Sugar-11 Options(ICE) |

| 02/18 Wed |

6:00 AM CST - MBA Mortgage Purchase Index 7:30 AM CST - Building Permits & Housing Starts(Jan) 7:30 AM CST - Core PPI & PPI(Jan) 8:15 AM CST - Capacity Util & Industrial Prod(Jan) 1:00 PM CST - FOMC Minutes |

LT: Mar Platinum Options(NYM) Mar Palladium Options(NYM) |

| 02/19 Thurs |

7:30 AM CST - Initial Claims-Weekly 9:00 AM CST - Leading Indicators(Jan) 9:00 AM CST - Philadelphia Fed(Feb) 9:30 AM CST - EIA Gas Storage 10:00 AM CST - API & DOE Energy Stats 2:00 PM CST - Dairy Products Sales 3:30 PM CST - Money Supply |

FN: Mar Coffee(ICE) |

| 02/20 Fri |

7:30 AM CST - USDA Weekly Export Sales 2:00 PM CST - Cattle On Feed 2:00 PM CST - Cold Storage & Annual 2:00 PM CST - Milk Production |

LT: Mar Crude Lt(NYM) Feb Nikkei Options(CME) Feb DJIA Options(CME) Feb S&P 500 Options(CME) Feb NASDAQ Options(CME) Feb E-Mini S&P 500 Options(CME) Feb E-Mini NASDAQ Options(CME) Feb Russell Options(CME) Mar 2,5,10 Year Notes Options(CBT) Mar Bonds Options(CBT) Mar Corn Options(CBT) Mar Wheat Options(CBT) Mar Rough Rice Options(CBT) Mar Oats Options(CBT) Mar Soybeans,Soymeal,Soyoil Options(CBT) Mar Orange Juice Options(ICE) |

| 02/23 Mon |

9:00 AM CST - Existing Home Sales(Jan) | FN: Mar Cotton(ICE) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!