April 25, 2014 - Issue #734

In This Issue

1. Trade from your smart phone!

2. Hotmarket: Crude Oil Bull Fading

3. Economic Calendar

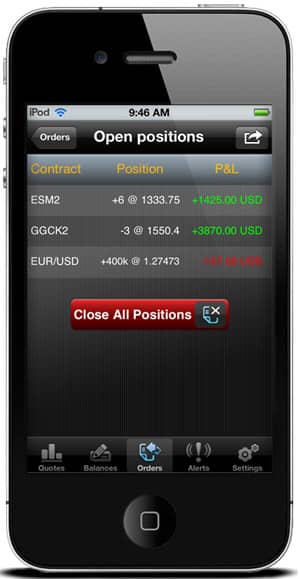

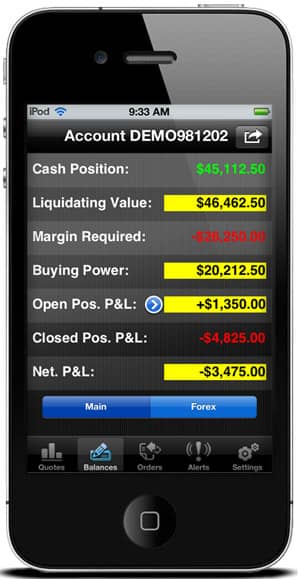

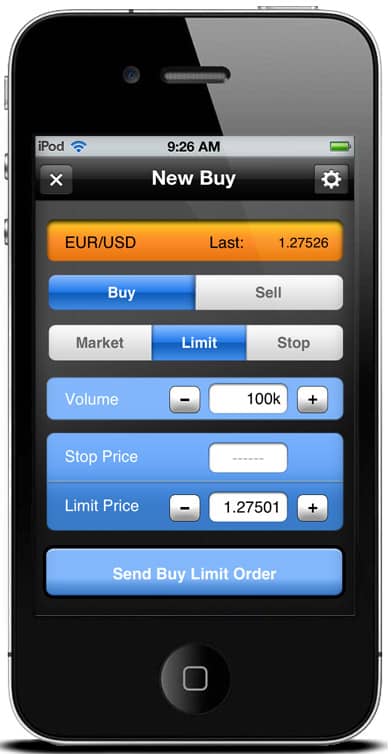

1. Trade from your smart phone or other mobile Devices!

You don't need to be confined to your desk when it comes to trading. On the Go, execute trades from any location with mobile trading platform. We offer a cutting-edge solution, iBroker. Our brokers are always here to assist you. Request for more information below by clicking on the "Try a Free Demo" or call us at (800) 454-9572 and let us introduce you to iBroker, the mobile trading platform. Simple to setup and very user friendly. Click here to learn more and get setup with iBroker mobile trading solution by Cannon Trading.

2. Hot Market: Crude Oil Bulls are Fading

Nymex Crude Oil Bulls Fading

From our friend Jim Wyckoff

Jim has an excellent daily newsletter where he reviews different markets, alerts you for potential trades and much more. Included is his great bi-weekly newsletter with charts and a little longer term outlook. We recommend checking out his website, educational CDROM, and services at www.jimwyckoff.com click on image below to enlarge

See on the daily bar chart for June Nymex crude oil futures that prices are still in an overall near-term uptrend, but price action the past two days has seen serious pressure to the downside. See, too, that the Moving Average Convergence Divergence (MACD) indicator has just produced a bearish line crossover signal, whereby the thick blue MACD line crossed below the thin red trigger line. The bulls need to show power yet this week; otherwise technical clues are building that a markte top is in place.

See on the daily bar chart for June Nymex crude oil futures that prices are still in an overall near-term uptrend, but price action the past two days has seen serious pressure to the downside. See, too, that the Moving Average Convergence Divergence (MACD) indicator has just produced a bearish line crossover signal, whereby the thick blue MACD line crossed below the thin red trigger line. The bulls need to show power yet this week; otherwise technical clues are building that a markte top is in place.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 04/28 Mon |

9:00 AM CDT - Pending Home Sales(Mar) |

LT: Apr Copper(CMX) Apr Gold(CMX) Apr Silver(CMX) Apr Platinum(NYM) Apr Palladium(NYM) May Natural Gas(NYM) |

| 04/29 Tues |

8:00 AM CDT - Case-Shiller 20-City Index(Feb) 9:00 AM CDT - Consumer Confidence(Apr) |

FN: May Natural Gas(NYM) LT: Apr Butter(CME) Apr Milk(CME) Apr Butter Options(CME) Apr Milk Options(CME) |

| 04/30 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 7:15 AM CDT - ADP Employment Change(Apr) 7:30 AM CDT - Chain Deflator-Adv(Q1) 7:30 AM CDT - Employment Cost Index(Q1) 7:30 AM CDT - GDP-Adv(Q1) 8:45 AM CDT - Chicago PMI(Apr) 9:30 AM CDT - API & DOE Energy Stats 1:00 PM CDT - FOMC Rate Decision(Apr) 3:00 PM CDT - Dairy Product Sales |

FN: May Copper(CMX) May Silver(CMX) May Gold(CMX) May Platinum,Palladium(NYM) May Wheat(CBT) May Corn(CBT) May Oats(CBT) May Rough Rice(CBT) May Soybeans,Soymeal,Soyoil(CBT) LT: Apr Fed Funds(CME) Apr Live Cattle(CME) May RBOB & ULSD(NYM) May Sugar-11(ICE) Apr Fed Funds Options(CME) May Lumber Options(CME) |

| 05/01 Thurs |

6:30 AM CDT - Challenger Job Cuts(Apr) 7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Personal Income & Spending(Mar) 7:30 AM CDT - PCE Prices-Core(Mar) 9:00 AM CDT - Construction Spending(Mar) 9:00 AM CDT - ISM Index(Apr) 9:30 AM CDT - EIA Gas Storage 1:00 PM CDT - Auto & Truck Sales(Apr) 3:30 PM CDT - Money Supply |

FN: May Orange Juice(ICE) May Sugar-11(ICE) |

| 05/02 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Apr) 7:30 AM CDT - Nonfarm Payrolls(Apr) 7:30 AM CDT - Unemployment Rate(Apr) 9:00 AM CDT - Factory Orders(Mar) |

FN: May RBOB & ULSD(NYM) LT: May Live Cattle Options(CME) Jun Cocoa Options(ICE) |

| 05/05 Mon |

9:00 AM CDT - ISM Services(Apr) |

|

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!