January 31, 2014 - Issue #722

In This Issue

1. The CBOE Volatility Index (VIX) Futures Now Available

2. Weekly Mini NASDAQ 100 futures analysis

3. Economic Calendar

1. The CBOE Volatility Index (VIX) Futures Now Available.

Effective February 3, 2014: The VIX futures contract has been added to E-Futures Int'l trading platform.

The contract symbol is VX and trading hours, margin requirement, and contract specification information is available at: https://www.cannontrading.com/tools/contract-specifications

According to CFE, trading volume in VIX futures totaled 39.9 million contracts for 2013, a fourth straight annual volume record, and surpassing the 23.8 million contracts traded in 2012 by 68 percent. Average daily volume in VIX futures was 158,508 contracts, also a fourth consecutive annual record, and up 67 percent from 2012.

Note: The CFE exchange does not allow trials. All products are available in the development and live trading environments but are not accessible for demo trading in the simulated environment

If you like this Newsletter, Please share!

2. Weekly Mini NASDAQ 100 futures analysis

by Ilan Levy-Mayer, VP at Cannon Trading Co, Inc.

FOMC yesterday confirmed what I believe is a shift in market personality.  After the 2008 crash the FED came with QE. Enough was written about QE but in hindsight what QE did is limit the downside potential of stock index. Another affect was reduced volatility for intraday traders. The last two FOMC meetings confirmed a trend of the unwinding of QE. How fast will that take place and how soon we will see the affects, I am not sure but from a traders perspective, i am embracing for different type of trading, different type of market, especially when it comes to stock index futures. From the short term perspective, i think we will see higher intraday volatility. Larger overnight swings and a more balanced shift between the short and the long side ( in contrast to the limited downside moves and larger upside moves we have witnessed over the past 3 years).

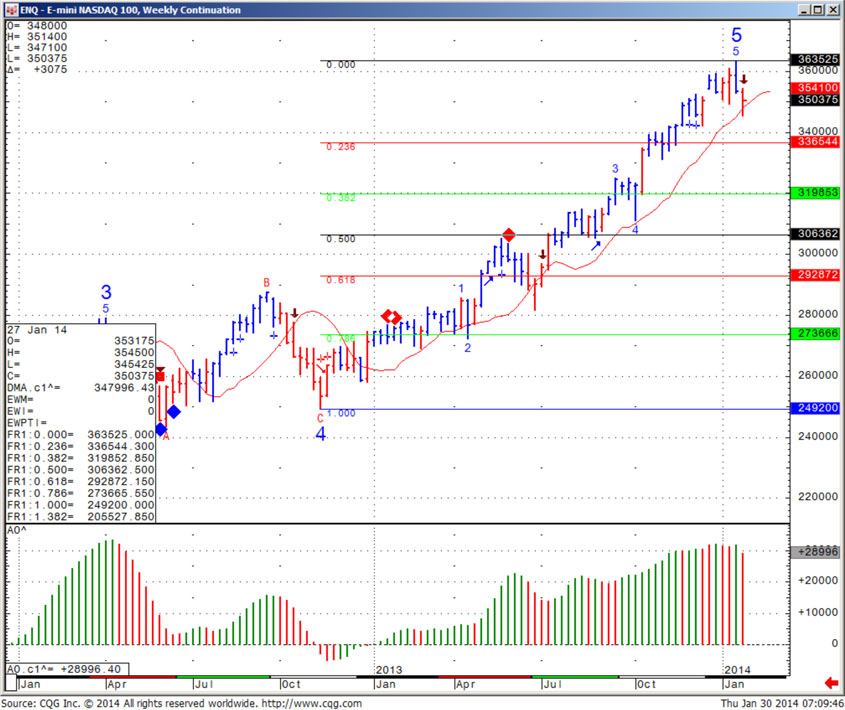

Looking at a weekly chart of the mini NASDAQ 100 futures below, I see a completed 5th wave based on the Elliott Wave theory and a possible correction back to 2492 over the long term ( months) and amore imminent pullback towards the 3198 ( 38% Fibonacci retracement level).

The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like this Newsletter, Please share!

To start your trial please provide a VALID email and phone number:

2. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 02/03 Mon |

9:00 AM CST - Construction Spending(Dec)  9:00 AM CST - ISM Index(Jan)  1:00 PM CST - Auto & Truck Sales(Jan)       |

|

| 02/04 Tues |

9:00 AM CST - Factory Orders(Dec)           |

FN: Feb RBOB Gasoline & ULSD(NYM)  LT: Jan Milk(CME)  Jan Butter(CME)  Jan Milk Options(CME)  Jan Butter Options(CME)  |

| 02/05 Wed |

6:00 AM CST - MBA Mortgage Purchase Index  7:15 AM CST - ADP Employment Change(Jan)  9:00 AM CST - ISM Services(Jan)  9:30 AM CST - API & DOE Energy Stats  3:00 PM CST - Dairy Products Sales |

|

| 02/06 Thurs |

6:30 AM CST - Challenger Job Cuts  7:30 AM CST - USDA Weekly Export Sales  7:30 AM CST - Initial Claims-Weekly  7:30 AM CST - Productivity-Prel(Q4)  7:30 AM CST - Trade Balance(Dec)  9:30 AM CST - EIA Gas Storage  3:30 PM CST - Money Supply |

|

| 02/07 Fri |

7:30 AM CST - Ave Workweek & Hourly Earnings(Jan)  7:30 AM CST - Nonfarm Payrolls(Jan)  7:30 AM CST - Unemployment Rate(Jan)  2:00 PM CST - Consumer Credit(Dec) |

LT: Feb Canadian Dollar Options(CME)  Feb Currencies Options(CME)  Feb Live Cattle Options(CME)  Feb US Dollar Index Options(ICE)  Mar Cotton Options(NYM)  Mar Cocoa Options(ICE)  |

| 02/10 Mon |

11:00 AM CST - WASDE Report & Crop Production | FN: Feb Live Cattle(CME)  LT: Mar Sugar-16(ICE)     |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!