Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

By Mark O’Brien

Heads up:

Keep an eye out for the second of this week’s inflation reports: the Bureau of Labor Statistics’ Producer Price Index. The report will be released tomorrow, 7:30 A.M., Central Time.

Energy:

This morning, the Energy Information Agency released its weekly crude oil stocks report and the data was a bullish curveball showing a surprise withdrawal in U.S. crude inventories and a bigger-than-expected drop in U.S. gasoline stocks. April RBOB gasoline futures rose over seven cents as of this typing – a ±$3,000 per contract move – up to ±$2.66 per gallon, close to 6-month highs. Spurring the price increase, Ukrainian drone attacks struck several oil refining facilities in Russia for the second day, damaging its refining capacity

Metals:

In concert with the month-long slump in the U.S. dollar and a lingering expectation the Fed will reduce borrowing costs this June, today gold is chipping away at its ±$20 sell-off Monday and poised to around its prior all-time high close (basis April): $2,188.60/oz. As of this typing, April gold is ±$2,177.00.

Indexes:

All three major stock indexes have sustained trading near their all-time highs this week – after the Personal Consumption & Expenditures Price Index on April 1st (the Fed’s preferred U.S. inflation gauge), February’s non-farm payrolls last Friday and Tuesday’s higher-than-expected CPI reading yesterday. As of this typing, prices are mixed ahead of tomorrow’s release of the Bureau of Labor Statistics’ Producer Price Index.

Softs:

So far, the king of all-time highs this week is not Bitcoin (see below). It’s Cocoa. The May cocoa contract broke above $7,000/ton, nearly $2,000/ton higher over the last month – a ±$20,000 per contract move, including today’s 361-point ($3,6010) move today – with “no top in sight,” stated by The Hightower Report.

Crypto:

March Bitcoin futures are set to close at a new all-time high above 73,000 today. With the Bitcoin ETF now trading, remember that the world’s largest futures and options exchange – the CME Group – offers Bitcoin and Micro Bitcoin futures and options with efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform. Make it your choice for managing cryptocurrency risk.

Plan your trade and trade your plan

Watch video below on how to rollover from March to June contracts if you are a stock index trader on our E-Futures Platform!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

NFP Tomorrow.

Non Farm payrolls – market moving report.

I personally like to be out few minutes before the report and look to get back in after the “smoke clears”.

I know some traders who try to play the extremes by placing buy orders on the lower bands and/or sell orders on the upper bands and attach automated brackets to these orders, trying to take advantage of the fast market moves.

Refer back to your journal and keep notes.

With Bitcoin reaching unprecedented levels, investors are seeking dependable ways to participate. Apart from ETFs and complex offshore entities, the CME Group offers straightforward access to Futures on Bitcoin, Micro Bitcoin, Ether, and Micro Ether futures. Utilize a licensed broker to trade these futures on the esteemed CME Group exchange. Opportunities for engagement range from 1. self-directed trading 2. demo trials 3. opening an account seeking advice from a seasoned broker.

Plan your trade and trade your plan

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Heads up:

Keep an eye out for Friday (7:30 A.M., Central Time) for the release of the monthly Non-farm Payrolls report by the Labor Department. It’s widely considered to be one of the most important and influential measures of the U.S. economy.

To review, the Labor Dept.’s Bureau of Labor Statistics surveys about 141,000 businesses and government agencies, representing approximately 486,000 individual work sites. The report excludes farm workers, private household employees, domestic household workers and non-profit organization employees. The report also includes other detailed industry data including the overall unemployment rate as a percentage of the total labor force that is unemployed but actively seeking work, wages, wage growth and average workday hours.

General:

It was truly an historical day yesterday. Both the decades-old 100-oz gold futures contract and the seven-year-old Bitcoin futures contracts traded up to all-time highs. Apart from any of the stock index futures contracts, rarely do we see simultaneous all-time highs for futures contracts. April gold touched $2,150.50 per ounce (and is trading at new all-time highs again today), while the March Bitcoin futures hit 70,195 – before a significant ±10,000-point sell-off in a span of four hours around mid-session.

But wait, there’s more! May cocoa traded up to its own all-time high yesterday as well, hitting $6,660/metric ton intra-day. This is a ±$26,000 move for cocoa in a little more than two months, having closed at $4,048 on Jan. 8.

Three consecutive all-time highs in futures: gold, Bitcoin and cocoa. Oh my!

Energy:

Managing Director and Global Head of Commodity Strategy at Royal Bank of Canada’s Capital Markets Division. That’s quite a title and it’s how Helima Croft’s business card reads. She’s well regarded as a specialist in geopolitics and energy and along with her team of commodity strategists who cover energy and metals are seeing signs of the higher supply/lower demand imbalance in crude oil tipping in the other direction. This is a macro prediction and not forecasting any sort of breakneck move to $100/barrel and it rests in part on the view that the U.S. will be unable to replicate its “blockbuster” output of 2023. It also anticipates OPEC+ will look to press on with its aggressive production cuts having already committed to extending its 2.2 million barrel-a-day production cut through June. The projection also sees the conflict in the Middle East as instilling a risk premium in energy prices that isn’t going away soon and may increase if the region sees a spread of hostilities.

Plan your trade and trade your plan

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

Heads up:

Keep an eye out tomorrow (7:30 A.M., Central Time) for the release of the Fed’s preferred U.S. inflation gauge: the PCE Personal Consumption & Expenditures Price Index. The consensus is that the January core PCE deflator will ease to 2.8% year-over-year from the 2.9% reading December.

General:

By and large, the outlook for the global economy is improving. In China, the business storm clouds are at least not bucketing down on the county’s overall fiscal house. Report after economic report released in the U.S. continue to validate forecasts of a future “soft landing,” or better – plain ol’ get up and go. To that end, A.I. euphoria dominates the conversation about what’s driving things. Even the disappointment surrounding the Fed’s patience in deciding when interest rates should be lowered hasn’t disturbed the current frame of mind. Keep an eye out for commodities sitting on major lows, such as corn and soybeans. Even with forecasts for a large South American harvest and a stage set for a strong crop year in the U.S., global growth begets global demand and “bargain price” commodities may be ready to mount rallies.

Crypto:

Bitcoin’s value has been on an impressive rise over the past month, and CME Bitcoin futures (“Full-size”-5-Bitcoin contract, 1/50-Micro Bitcoin contract) have lead the way, with the March Micro Bitcoin contract hitting $65,000 during morning trading today, well above the $57,000 range highs posted in Nov. 2021. Open interest for the full-size contract came in at a nominal value of $7.77 billion, which is nearly a third of the market share for all Bitcoin market derivatives – more than Binance ($6.1 billion); more than Bybit ($4.1 billion). These values surpassed past records set in both 2021 and 2017.

At present, the open interest figures for bitcoin futures have reached an all-time high of $24.44 billion as of Feb. 27, 2024.

Energy:

Did you know the U.S. is currently producing around 13.3M barrels of crude per day, which is way more than any country on the globe, including Saudi Arabia at ±8.9M barrels per day (as of Dec. ’23). The output growth has helped tame gas prices and, perhaps more importantly, undermined the influence of OPEC and Russia following the invasion of Ukraine in 2022.

Producers also know that while times are good, demand can come down or eventually plateau, especially with the U.S. currently exporting more oil than nearly every member of OPEC. Remember the 2014-16 downturn, which hammered the industry and was largely driven by a supply glut.

Plan your trade and trade your plan

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

By Mark O’Brien

Bitcoin futures open interest on the Chicago Mercantile Exchange hit a fresh all-time high this week. Its nominal value reached $5.4 billion as the Jan. futures contract traded within 200 points of $48,000 on Tuesday. The previous all-time high of $4.5 billion was recorded in November 2021 when the front month contract traded to its all-time high above $68,000.

News in the cryptosphere hit a milestone today with the announcement that Bitcoin ETF’s began trading on U.S. exchanges, but should you?

Before you jump on the Bitcoin ETF bandwagon, remember that the world’s largest futures and options exchange – the CME Group – offers you a choice for managing cryptocurrency risk with Bitcoin and Micro Bitcoin futures and options. With efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform.

Take the worry out of your crypto trading!

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

01-12-2024

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

Ahead of CPI and the Rest of the Week:

By Mark O’Brien, Senior Broker

Crypto:

Bitcoin futures open interest on the Chicago Mercantile Exchange hit a fresh all-time high, its nominal value reaching $5.4 billion as the Jan. contract traded within 200 points of $48,000 yesterday. The previous all-time high of $4.5 billion was recorded in November 2021 when the front month contract traded to its all-time high above $68,000.

Energy:

Concerns of slowing demand growth in the energy sector received additional fodder this morning when the Energy Information Agency (EIA) reported a surprise jump in U.S. crude stockpiles and a larger-than-expected jump in storage of both gasoline and distillates. Crude oil (basis Feb.) remains mired in the low $70 per barrel range with a few forays below $70 per barrel over the last month. Despite fears the Israel-Hamas war – now into its third month – could be a catalyst to supply disruption in the Middle East, crude oil is more that $10 per barrel (a $10,000 per contract move) lower since the beginning of the conflict, suggesting traders are more focused on global economic growth (slowing) than geopolitical risk, which seems to be increasing as events related to the war have spread, including attacks on U.S. bases in Iraq, U.S. strikes on Iranian-backed organizations in Syria and Yemen, Israeli attacks in Lebanon on Hezbollah, Yemeni-based Houthi attacks on vessels moving through the Bab al-Mandab Strait at the entrance to the Red Sea from the Gulf of Aden – a route that sees 10-12% of the world’s seagoing freight travel through it.

General:

Tomorrow we’ll be apprised yet again of the inflation situation here in the U.S. with the release of the Bureau of Labor Statistics’ Consumer Price Index Report, which measures the prices paid by consumers for a basket of consumer goods and services (7:30 A.M., Central Time). The reading plays an important role in shaping the Federal Reserve’s outlook on much-anticipated interest rate cuts this year.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

01-11-2024

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

|

|

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

By Senior Broker, Mark O’Brien

General:

It will likely be challenging to predict the next stage of the Israel/Hamas war in terms of how broadly it draws in other participants. For now, diplomatic efforts – negotiating for the release of hostages, calls for a cease fire, bringing humanitarian aid to civilians in Gaza – have toned down the severity of the fighting. Concurrently, Israel is softening up the opposition by bombing of targets thought to be Hamas military strongholds and the markets are anticipating the launch of a ground war.

Even with the conflict entering its 20th day and seeing how commodities have already reacted in that time, the start of ground fighting and/or a broadening of participants would likely see sharper moves in particular futures contracts, i.e., gains in energies, flight-to-quality upward movement in gold and the Swiss franc and even food-related commodities like wheat. Conversely, equity index futures – U.S. and more broadly – will be vulnerable to draw-downs. Note that the E-mini Nasdaq already fell into correction territory on Wednesday following the latest tech earnings.

Financials:

One instrument at a potential cross-roads – it’s current 6-month / ±$11K per contract decline a dominant catalyst for dragging shares around the world to multi-month lows – is the 10-year T-note futures contract. Its correspondent benchmark yield is hovering at a 15-yr high of 5%. Already vulnerable to information on the pace of the U.S. economy, the conflict uncertainty poses a new agitator to the market.

Crypto:

After trading down to 3-year lows below 15,000 last October, on Tuesday, Bitcoin futures traded through 35,000, a 17-month high, a ±$10,000 move for a Micro Bitcoin futures contract (contract size: 1/50 Bitcoin), a ±$100,000 for the “adult” / Bitcoin futures contract (contract size: 5 Bitcoin).

Softs:

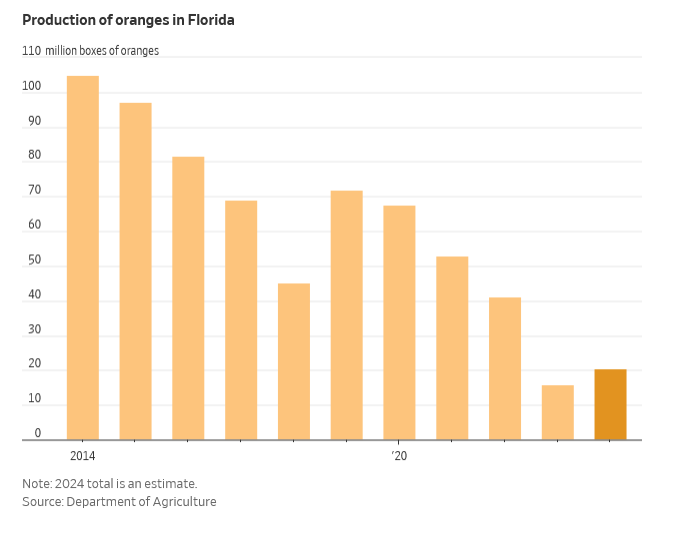

With new all-time highs being set all year – almost weekly – orange juice futures (basis Nov.) are poised to break through $4.00/lb. (contract size: 15,000 lbs, 1 cent = $150), more than double its ±$1.85 levels in January, a ±$32,000 per contract move. Florida orange growers harvested their smallest crop in nearly 90 years, the result of an ill-timed freeze, two hurricanes and the citrus psyllid, a tiny invasive winged insect that has spread citrus greening disease and is laying waste to Florida’s groves.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-27-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Last trading day of April tomorrow!

See reports section below:

PCE

Univ. of Michigan

and Chicago PMI tomorrow can inject additional volatility into the market.

Both ES and NQ are trading against intermediate resistance level.

The Coinbase Derivatives Exchange (CDE) Nano Bitcoin and Nano Ether Futures Contracts are now available on E-Futures Int’l trading platform. Cannon Trading, through our clearing partner, StoneX Offers Clients Access to Coinbase Derivatives Exchange Contracts Cleared by Nodal Clear | Business Wire

E-Futures Contract Symbols

Nano Bitcoin = BIT

Nano Ether = ET

Contract Specs

Coinbase_Derivatives_Nano_Bitcoin_Spec_V2.pdf (ctfassets.net)

Coinbase_Derivatives_Nano_Ether_Spec_V2.pdf (ctfassets.net)

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 04-28-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

The Coinbase Derivatives Exchange (CDE) Nano Bitcoin and Nano Ether Futures Contracts are now available on E-Futures Int’l trading platform. Cannon Trading, through our clearing partner, StoneX Offers Clients Access to Coinbase Derivatives Exchange Contracts Cleared by Nodal Clear | Business Wire

E-Futures Contract Symbols

Nano Bitcoin = BIT

Nano Ether = ET

Contract Specs

Coinbase_Derivatives_Nano_Bitcoin_Spec_V2.pdf (ctfassets.net)

Coinbase_Derivatives_Nano_Ether_Spec_V2.pdf (ctfassets.net)

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 04-26-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

General: The March Consumer Price Index came in cooler than expected, showing a rise of 0.1% in March. Economists polled by Dow Jones were expecting CPI to rise by 0.2% month over month.

Minutes from the Federal Reserve’s March policy meeting showed officials feared that the economy could tilt into a mild recession later this year in the wake of the U.S. banking crisis.

Yesterday, Bitcoin futures (BTC) pushed over the $30,000 level for the first time since June 2022. This on the heels of a ±10,000-point move from March 10 when the April contract traded to an intraday low of 19,620 and closed at 20,110.

Today, May orange juice futures closed at an all-time high of $2.8490 per pound a remarkable ±80-cent / $12,000 move from late January. This year, the U.S. orange crop is forecast to be the smallest since 1937. Output has generally been in decline since peaking 25 years ago, though this year’s losses in Florida – a global top producer still – are extremely sharp. Yesterday, the USDA pegged the 2022-2023 U.S. orange crop at 62.25 million boxes, an 86-year low and down 23% on the year. That is less than 20% of U.S. output compared to the record 1997-1998 season.

May sugar futures traded today to 6 1/2 -year highs and an intraday high of 24.85 cents/pound continuing its months-long charge from the 17-18-cent range (one cent = $1,120). News of lower-than-expected production in some key regions and tightening supplies have persisted into the year.

For the seventh consecutive session, June gold has closed above $2,000/ounce. Referencing the Fed minutes mentioned above, economists have cited rising interest rates and now a potentially more acute slowdown in lending after the collapse of several U.S. banks as a possible trigger of a recession this year. The prospect of a U.S. recession boosts safe-haven demand for gold, which has been on a tear since early-March – with a ±$200 per ounce / $20,000 move.

Plan your trade and trade your plan.

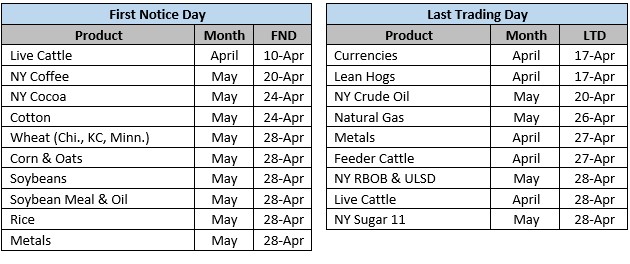

First Notice and Last trading Days for the month of May below

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 04-13-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

Trading Updates:

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

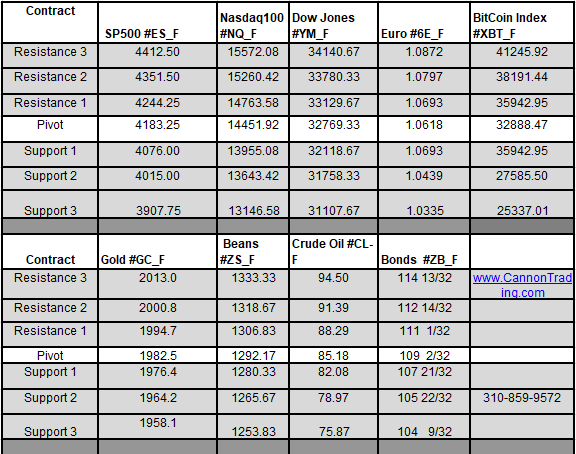

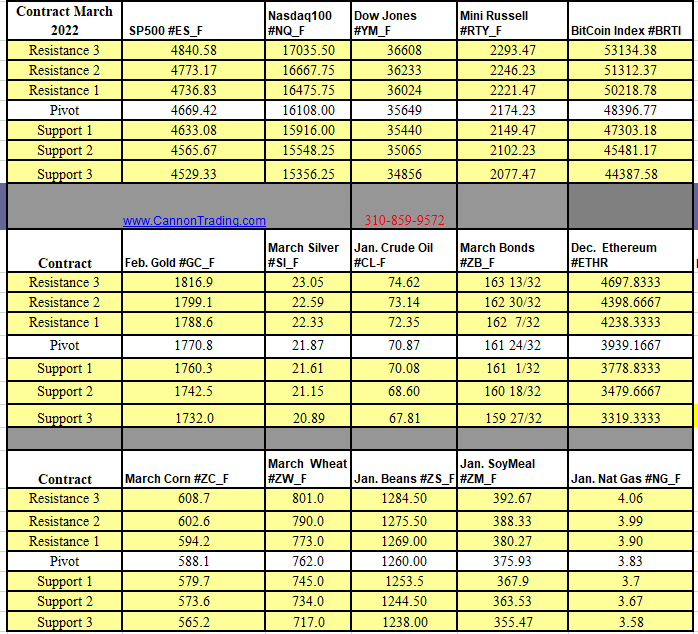

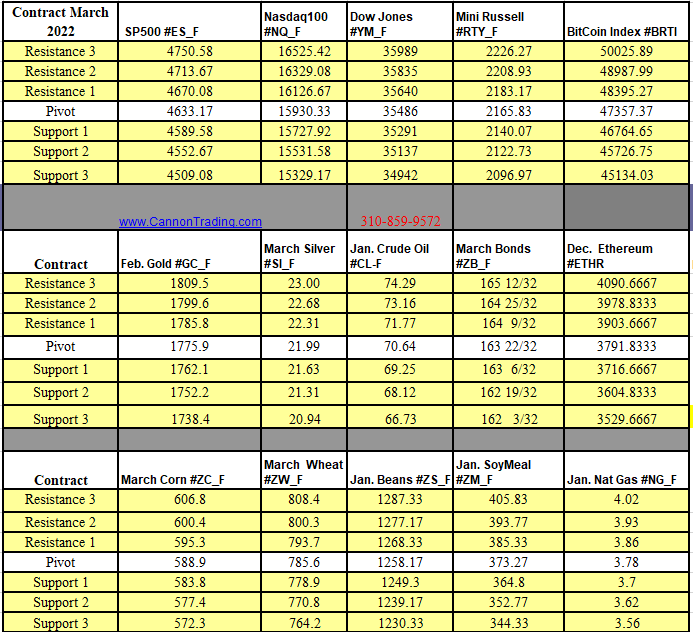

Weekly Levels

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Nearly 10 million contracts traded and counting

For the past five years, Bitcoin futures have provided a regulated, transparent marketplace for cryptocurrency derivatives trading, all backed by CME Group’s time-tested financial safeguards.

Since launching in 2017, Bitcoin futures have seen notable growth in volume, open interest and customer participation, paving the way for additions to CME Group’s market-leading Cryptocurrency product suite in 2022 – including options on Micro Bitcoin and Micro Ether futures, 21 new CME CF cryptocurrency benchmarks (most recently on three more DeFi tokens), and more.

Looking to learn more about Bitcoin futures?

Please contact your broker if you have any questions about your positions. And remember, the next front month for these contracts – March – is already well traded and available.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

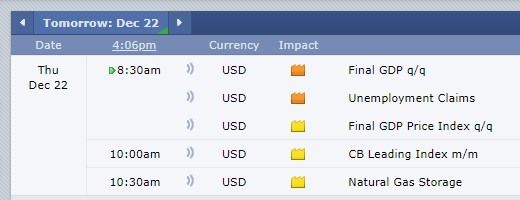

for 12-22-2022

#ES_F, #NQ_F, #YM_F, #RTY_F, #XBT_F, #GC_F, #SI-F, #CL-F, #ZB_F, #6E_F, #ZC_F, #ZW_F, #ZS_F, #ZM_F, #NG_F

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Cannon Trading extends a warm thank you to all of our clients for a memorable and safe holiday. Blessings to all.

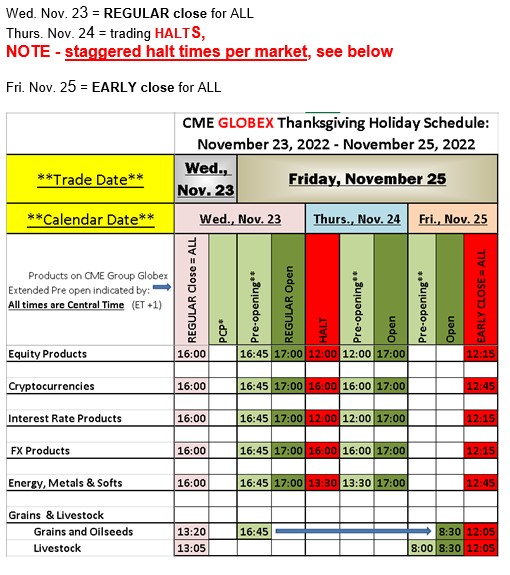

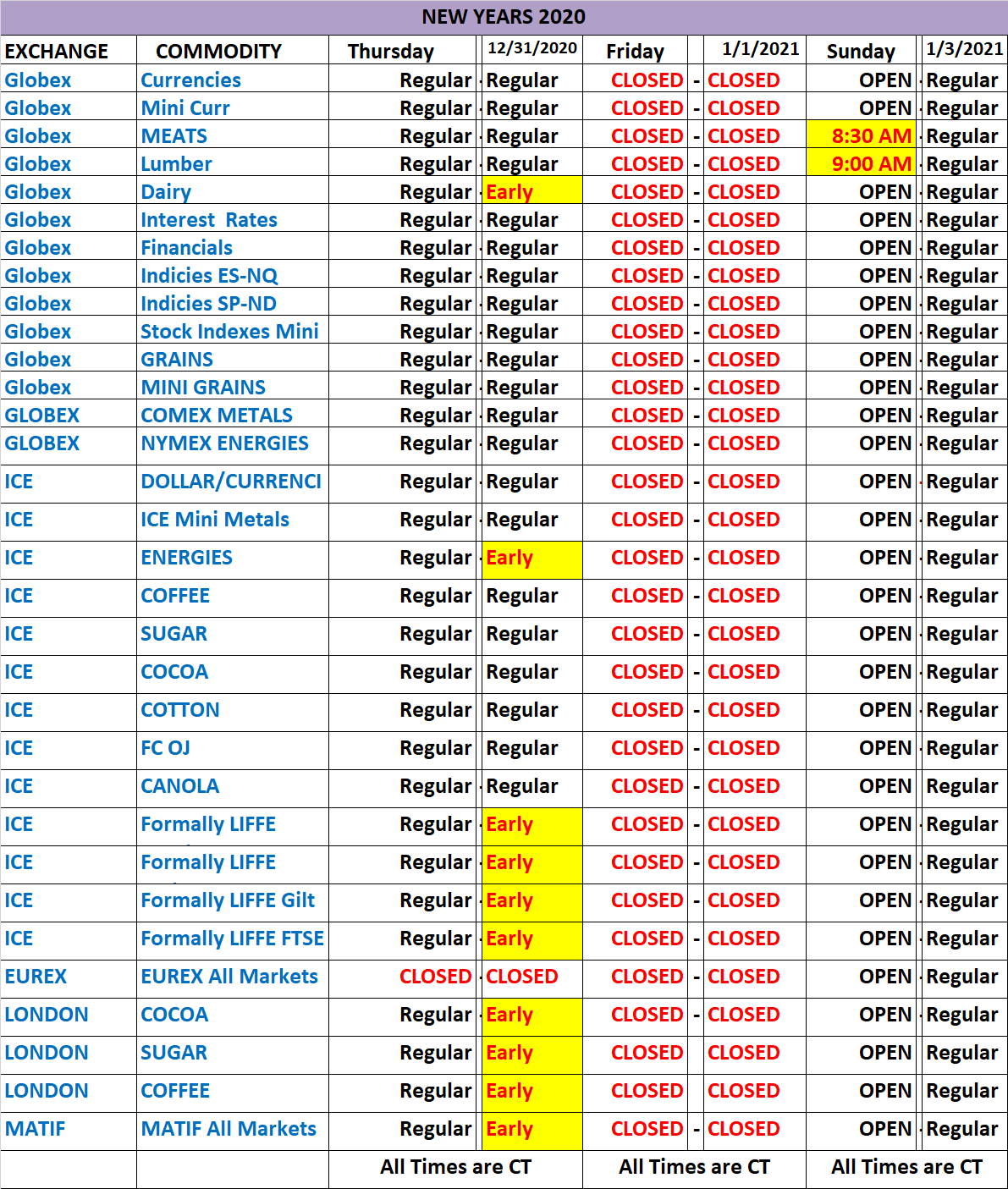

Make sure you are aware of the trading schedule for the markets you trade! Some Markets will be open each day under abbreviated hours, some markets like the agricultural, grain and livestock venues will be closed Thursday and short hours Friday.

By Mark O’Brien

This week, the U.S. Justice Department announced that two Estonian citizens were arrested for their alleged involvement in a $575,000,000 cryptocurrency fraud and money laundering conspiracy.

Also this week, a notable Chinese venture investor, Bo Shen revealed he lost $42 million worth of crypto as a result of a theft from his personal wallet. Most of those assets were denominated in US Dollar Coin (USDC), a stablecoin created jointly by fintech company Circle, and crypto exchange Coinbase.

Most notably in the news recently, the collapse of crypto platform FTX continues to rattle the world of digital assets. In this instance, FTX’s customers’ funds on are still frozen, and they are losing hope they will ever get much back. It’s customers number in the millions. The 50 largest creditors alone are owed more than $3 billion dollars.

It makes you wonder about the safety and integrity of trading crypto assets.

Let this be a reminder that the world’s largest futures and options exchange – the CME Group – offers you a choice for managing cryptocurrency risk with Bitcoin and Micro Bitcoin futures and options. With efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform.

Take the worry out of your crypto trading.

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 11-24-2022

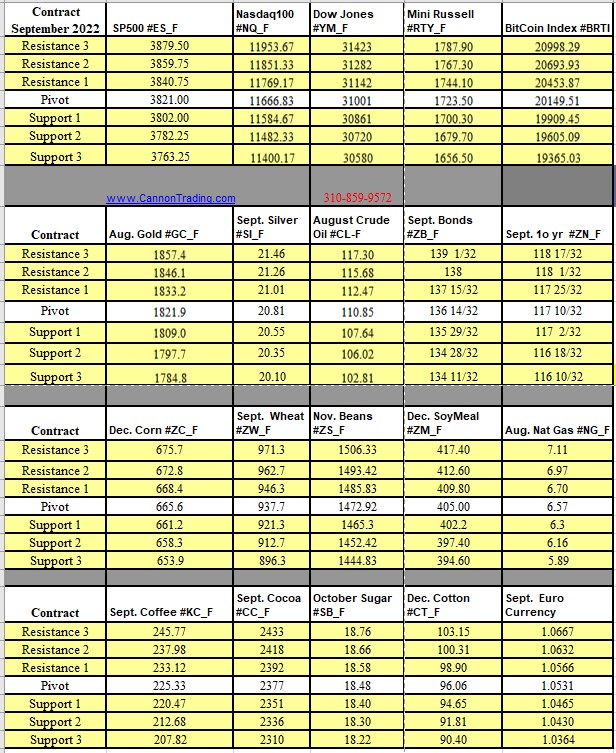

SP500 #ES_FNasdaq100 #NQ_FDow Jones #YM_FMini Russell #RTY_FBitCoin Index #BRTI SP500 Dec. Gold #GC_F Dec. Silver #SI_F Oct. Crude Oil #CL-F Dec. Bonds #ZB_F Dec. 10 yr #ZN_F Dec. Corn #ZC_F Dec. Wheat #ZW_F Nov. Beans #ZS_F Dec. SoyMeal #ZM_F Oct. Nat Gas #NG_F Dec. Coffee #KC_F Dec. Cocoa #CC_F October Sugar #SB_F Dec. Cotton #CT_F Sept. Euro Currency

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

06-30-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

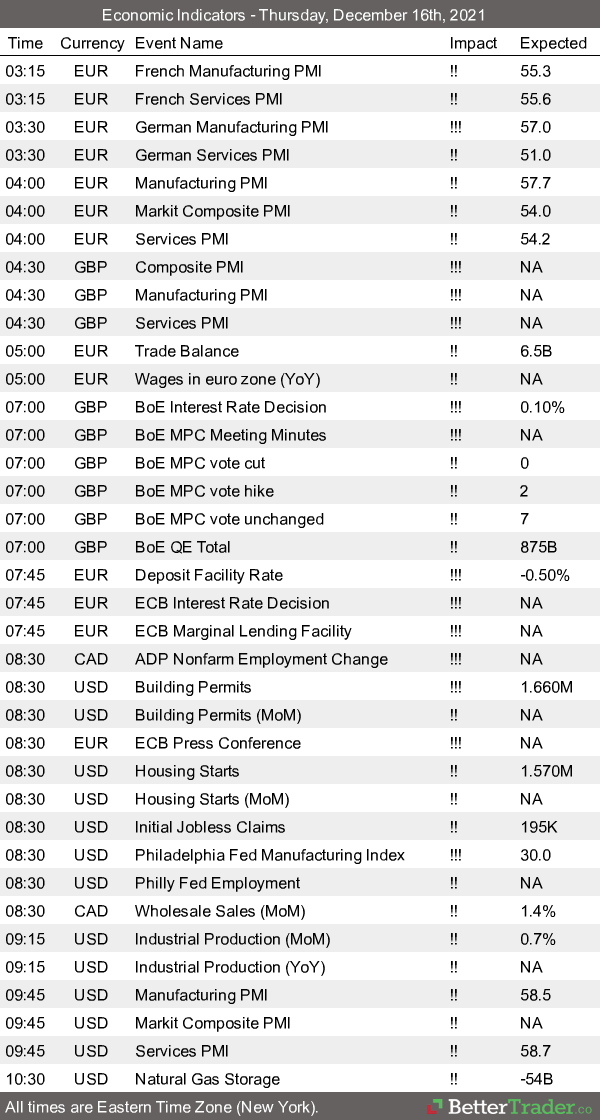

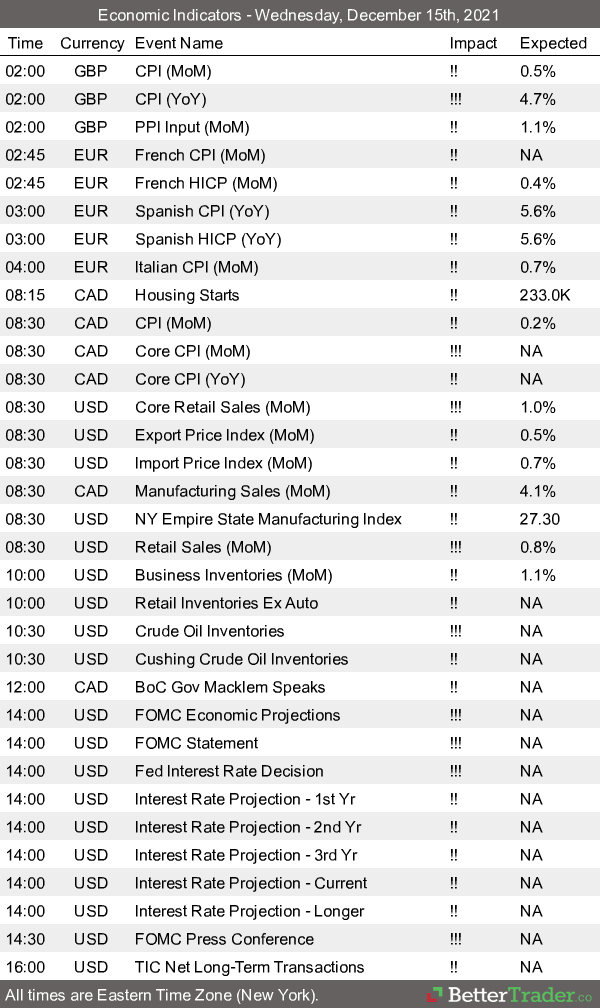

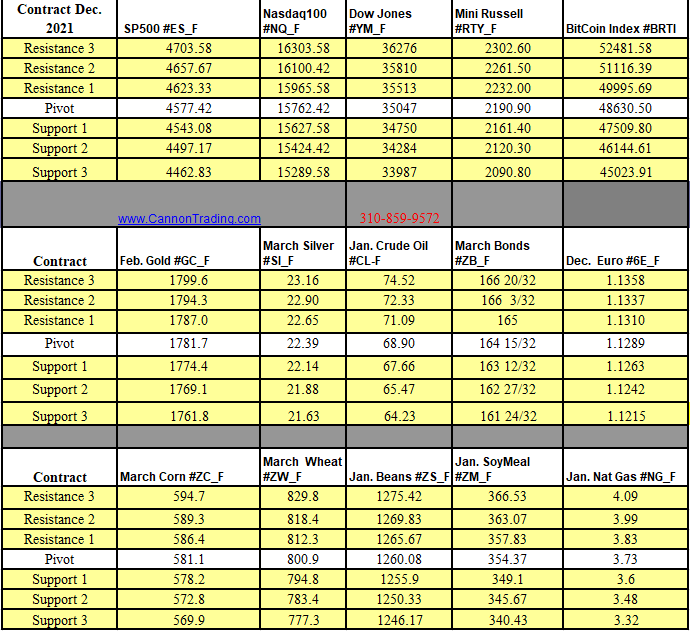

12-16-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-15-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Dear Futures Trader,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-07-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Cryptocurrency has taken off as an encrypted alternative to real spending money, giving people more options for doing business. Bitcoin is one of the leading cryptocurrencies on the market, especially after it boomed in 2017. Nowadays, many websites accept Bitcoin payments, which has helped the cryptocurrency market grow significantly. Micro Bitcoin futures have also made a significant impact on the futures trading industry.

Now, many brokers offer futures for Bitcoin and other types of cryptocurrency. It is easier than ever to trade shares of these types of currency, and traders of all experience levels can trade practically anytime and anywhere.

One of the most convenient ways for traders to get the results from cryptocurrency is by trading micro futures. Recently, the CME Group announced new Micro Bitcoin futures, which have revolutionized futures trading. Now, for 1/10 the cost of the average Bitcoin share, a trader can purchase shares of this new type of future.

Cannon Trading has the tools traders need to begin trading cryptocurrency futures. We have various platforms that meet all needs, allowing traders to trade what they want when they want them.

Our experienced brokers are here to help traders of all levels through the process. We specialize in developing innovative platforms that help traders navigate the market.

Whether a trader is part of a professional trading organization or participating in day trading, our brokers can help. We work with clients from various backgrounds, providing everything from multilingual trading services to broker-assisted trading. If a trader is interested in our services, our customer support team of qualified brokers would be happy to help.

Micro Bitcoin Futures and Bitcoin Futures are both offered by CME to traders around the world. These contracts vary in size, depending on whether a client pursues a regular Bitcoin future or a Micro Bitcoin future.

Micro Bitcoin Futures allow traders to access Bitcoin Futures for a tenth of the cost of a regular Bitcoin future. Both types of contracts make it easy to get into the Bitcoin market, allowing clients to get the most out of their trading process.

The CME Group launched Micro Bitcoin Futures in May of 2021 and it has been a successful contract from the start. With Bitcoin rising in prominence worldwide, it is easy to see why this type of futures contract appears to be here to stay.

Bitcoin futures trading has been prominent since 2017 when the CME Group introduced it. Micro futures allow traders to speculate and hedge using 1/10th the size of a single coin of this iconic cryptocurrency. With Bitcoin still dominating the cryptocurrency industry, it is easy to see why many traders prefer the Micro futures over the traditional larger Bitcoin futures as the good faith deposit required is 1/10th of that of the standard Bitcoin contract.

While the new Micro Bitcoin Futures provide a value of 1/10 of a Bitcoin, these contracts are 1/50th the good faith deposit required of a traditional Bitcoin contract. This lower margin requirement allows traders to access more futures, giving them greater control of how much they can invest.

The versatility of the market, along with the lower capital involved, helps more traders access this type of future. It is for this reason that Micro Bitcoin Futures are popular with both active traders and cryptocurrency users.

There are many benefits involved in trading Micro Bitcoin Futures, which can help traders who have just started participating in the market.

Micro Bitcoin futures allow traders to take advantage of the many benefits of Bitcoin futures without investing as much. The CME Group saw the need for a minor Bitcoin futures contract, especially since the traditional contract was worth 5 Bitcoin.

More people could participate in cryptocurrency futures trading by creating this new, minor contract, which helped liquidity.

The institutional volume for Micro Bitcoin Futures has allowed the market to reach over a million contracts in just a short period. While this type of trading launched in the summer of 2021, it has become a popular choice, even seeming to outpace the traditional Bitcoin futures market.

The team here at Cannon Trading can help traders understand this type future, allowing them to get the most out of their opportunities. We understand that our traders have varying needs, which has led us to develop innovative solutions and platforms to achieve them.

Our team wants to help people get the most out of their Micro Bitcoin futures, which is why we have a dedicated group of brokers ready to assist our traders.

We also have platforms for various needs and trading opportunities, from mobile platforms to desktop applications. Our products were designed with traders in mind, giving people the functionality to access the market.

While Micro Bitcoin Futures are relatively new to the market, they have made a significant impact on trading as a whole. This type of contract allows traders to explore the cryptocurrency futures market without spending as much capital as a traditional contract would require or coin in the Cash marketplace..

We understand that new traders may have a lot of questions regarding this type of cryptocurrency futures trading venue. There are risks involved in trading futures and even greater risks when trading Bitcoin and MICRO bitcoin futures. Our team is here to help field any questions a person might have regarding the trading process as a whole. Cannon Trading makes it easy to navigate the market, as we provide cutting-edge platforms that simplify the trading process.

Our brokers have been assisting traders since 1988, which has allowed Cannon Trading to become a leading name in the futures trading business. We opened our online trading service in 1998, which allowed more traders than ever to participate in the market. Over 20 years later, traders have continually recognized us as one of the leading brokerage services.

At Cannon Trading, we have the tools traders need to make informed decisions before investing in the futures market.

We provide access to cutting-edge software and programs that put our traders at the forefront of the industry.

Cannon Trading’s experienced brokers can help clients learn more about oil futures, offering insight into the overall market, as well.

Whether you’re a beginning trader or an experienced one, our brokers can help you navigate the market. We have direct experience with the market so that we can help our clients best navigate the market.

We also provide them with the tools to make the most of markets and manage risk during volatile times.

Our professional commodities brokers will work with you to understand your specific trading style and requirements and provide you the essential advice and information you need to thrive in this highly lucrative market.

As an example, Cannon Trading’s Broker-assisted Trading solution provides traders new to the field with the essential advice and tools they need to accelerate their understanding of some of the mechanisms that affect prices in any futures contract market.

Contact us today to learn more about commodities trading and information on futures options and other listed commodity contracts.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve a substantial risk of loss and are not suitable for all investors.

Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you regarding your circumstances, knowledge, and financial resources.

You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

5-19-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

5-03-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

4-26-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Bitcoin Futures Monthly Chart

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

2-18-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-29-2020

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Cryptocurrency, most notably Bitcoin, has become a new frontier for investors since its inception in the wake of the 2008 financial crisis. Since then, bitcoin has been used for buying, trading, and selling in the digital space. Cryptocurrency is a digital or virtual form of currency that is secured by cryptography, making it almost impossible to be counterfeited or double-spent. Bitcoin is also kept record of through Blockchain, its own uniquely designed record-keeping technology. Blockchain is a distributed ledger that allows Bitcoin to be traded safely across a disparate network of computers. For this reason, cryptocurrencies like Bitcoin are decentralized and exist outside of the control or authority of any government or governing agency. These features are very attractive to investors for their dependability and their ease of transfer. High volatility and hedging opportunities included, Bitcoin futures were launched in December 2017. How can you determine if Bitcoin futures are right for you? Get started exploring your Bitcoin futures investing options with Cannon Trading.

As a budding asset class, Bitcoin is still unpredictable. Like most other asset classes, Bitcoin’s volatility is measured by the volatility index (VIX) in traditional markets. This index originated from the Chicago Board of Options Exchange or CBOE and has become the most widely used and trusted proxy for market volatility. This proxy, while robust, is still unable to determine a generally accepted index and will still need more time to do so. What we do know is that Bitcoin is currently a volatile option, and has fluctuated in price significantly within its first decade of existence.

As a new resource, investors are more hesitant to invest. It is still unclear whether Bitcoin will ever be regulated by national governments. It is due to this lack of regulation that Bitcoin has also received some bad press for being used for illegal activity. Naturally, the ebb and flow of good and bad news has hurt Bitcoin’s adoption rate, causing its value to fluctuate significantly.

While still uncertain, Bitcoin and cryptocurrency are becoming another asset class/ trading vehicle for futures traders. Bitcoin’s volatility allows for stark fluctuations and price swings that create trading opportunities and risks for risk takers. These are the price swings and opportunities are characteristics that lend themselves to futures trading. Investors will be able to hedge their existing assets and/or speculate on fluctuating value in order to make a profit. As a purely online asset, bitcoin futures will bring a level of transparency and liquidity to the futures market.

When trading bitcoin futures, you can assume either a long or short strategy or in other words, speculate on whether the price of your asset will go up or down and acting accordingly. A long strategy would attempt to predict a rise in Bitcoin’s value. If the price of bitcoin is currently 4,000 USD and you predict it will rise to 5,000 USD later this year, you will speculate on that by going long a bitcoin futures contract and if you are correct, you will gain profit, if you are wrong, your account will suffer a loss. Conversely, a short strategy attempts to predict a fall in bitcoins value. In this strategy, you will want to sell your Bitcoin futures for a profit. If in the same example, the price of Bitcoin is currently 4,000 USD and you expect it to fall to 3,000 USD later in the year, you will go short, or sell the contract ( even though you don’t own it) in an attempt to gain from this speculation.

Bitcoin is a new contact for futures traders. In this ever-evolving landscape, you will need to partner with a professional to help guide you in your futures trading decisions. After doing your research to determine if bitcoin futures are right for you, we recommend partnering with one of our professional brokers to build out your strategy. Our team will help you to set clearly defined goals and parameters to help you navigate the market and have a clear picture of both risks and opportunities. Count on our team to guide you through setting up your futures account and be there every step of the way to navigate the trading platform, futures trading, reset your strategy in case of a misstep, and help you make the most out of your bitcoin futures trading.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Bitcoin futures, in particular, may experience significant price volatility. All futures contracts, including bitcoin futures, utilize significant leverage. With leverage, a small price move of the contract against your position may result in a large loss, potentially including loss of more than your entire account balance.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Bitcoin Nipping At Gold Demand

by DEBBIE CARLSON

Supply & Demand

The World Gold Council (WGC), the trade group representing the gold industry, said in its fourth-quarter Gold Demand Trends report that the yellow metal’s global, full-year demand fell by 7% last year. ETF demand in 2017 was one-third of 2016’s pace, although 2016 was the second-highest year on record.

Rhind and Thomas say the people who were interested in bitcoin were drawn to the parabolic price rise, rather than viewing it as having the same risk management role in their portfolio as gold does.

“Almost to the person, they all thought bitcoin was exploding, and they didn’t want to miss ‘the move’ … no one ever mentioned safety to me,” Thomas said.

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

4-24-2018

| Contract June 2018 | SP500 #ES_F | Nasdaq100 #NQ_F | Dow Jones #YM_F | Mini Russell #RTY_F | BitCoin Index #XBT_F |

| Resistance 3 | 2713.42 | 6846.83 | 24807 | 1592.07 | 9985.37 |

| Resistance 2 | 2699.08 | 6787.42 | 24681 | 1583.13 | 9507.13 |

| Resistance 1 | 2685.92 | 6735.58 | 24543 | 1574.57 | 9178.35 |

| Pivot | 2671.58 | 6676.17 | 24417 | 1565.63 | 8700.11 |

| Support 1 | 2658.42 | 6624.33 | 24279 | 1557.07 | 8371.33 |

| Support 2 | 2644.08 | 6564.92 | 24153 | 1548.13 | 7893.09 |

| Support 3 | 2630.92 | 6513.08 | 24015 | 1539.57 | 7564.31 |

| Contract | June Gold #GC_F | May Silver #SI-F | June Crude Oil #CL-F | June Bonds #ZB_F | June Euro #6E_F |

| Resistance 3 | 1348.5 | 17.53 | 71.47 | 143 22/32 | 1.2406 |

| Resistance 2 | 1343.0 | 17.33 | 70.25 | 143 12/32 | 1.2372 |

| Resistance 1 | 1334.7 | 16.97 | 69.58 | 143 5/32 | 1.2314 |

| Pivot | 1329.2 | 16.78 | 68.36 | 142 27/32 | 1.2280 |

| Support 1 | 1320.9 | 16.42 | 67.69 | 142 20/32 | 1.2222 |

| Support 2 | 1315.4 | 16.22 | 66.47 | 142 10/32 | 1.2188 |

| Support 3 | 1307.1 | 15.86 | 65.80 | 142 3/32 | 1.2130 |

| Contract | July Corn #ZC_F | July Wheat #ZW_F | July Beans #ZS_F | July SoyMeal #ZM_F | May Nat Gas #NG_F |

| Resistance 3 | 382.3 | 487.9 | 1052.00 | 385.90 | 2.82 |

| Resistance 2 | 380.7 | 484.3 | 1046.75 | 383.60 | 2.79 |

| Resistance 1 | 379.6 | 479.4 | 1039.50 | 379.90 | 2.77 |

| Pivot | 377.9 | 475.8 | 1034.25 | 377.60 | 2.74 |

| Support 1 | 376.8 | 470.9 | 1027.0 | 373.9 | 2.7 |

| Support 2 | 375.2 | 467.3 | 1021.75 | 371.60 | 2.69 |

| Support 3 | 374.1 | 462.4 | 1014.50 | 367.90 | 2.66 |

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

What a wild ride in the Bitcoin contract specifically and the cryptocurrencies in general.

Below you can see a 60 minutes chart on the XBT, the CBOE contract ( traded over 15,000 contracts today!!)

More on bitcoin futures:

https://www.cannontrading.com/community/bitcoin-futures

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

1-18-2018

| Contract March 2018 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | BitCoin Index |

| Resistance 3 | 2846.33 | 6946.75 | 26571 | 1614.23 | 14686.67 |

| Resistance 2 | 2827.92 | 6890.50 | 26345 | 1603.77 | 13243.33 |

| Resistance 1 | 2815.83 | 6857.25 | 26226 | 1596.73 | 12111.67 |

| Pivot | 2797.42 | 6801.00 | 26000 | 1586.27 | 10668.33 |

| Support 1 | 2785.33 | 6767.75 | 25881 | 1579.23 | 9536.67 |

| Support 2 | 2766.92 | 6711.50 | 25655 | 1568.77 | 8093.33 |

| Support 3 | 2754.83 | 6678.25 | 25536 | 1561.73 | 6961.67 |

| Contract | Feb. Gold | Mar. Silver | Feb. Crude Oil | Mar. Bonds | Mar. Euro |

| Resistance 3 | 1357.6 | 17.54 | 65.13 | 151 31/32 | 1.2464 |

| Resistance 2 | 1351.0 | 17.43 | 64.65 | 151 19/32 | 1.2416 |

| Resistance 1 | 1340.1 | 17.23 | 64.27 | 150 31/32 | 1.2337 |

| Pivot | 1333.5 | 17.12 | 63.79 | 150 19/32 | 1.2289 |

| Support 1 | 1322.6 | 16.92 | 63.41 | 149 31/32 | 1.2210 |

| Support 2 | 1316.0 | 16.81 | 62.93 | 149 19/32 | 1.2162 |

| Support 3 | 1305.1 | 16.61 | 62.55 | 148 31/32 | 1.2083 |

| Contract | Mar. Corn | Mar. Wheat | March Beans | Mar. SoyMeal | Feb. Nat Gas |

| Resistance 3 | 359.8 | 432.4 | 979.58 | 330.13 | 3.53 |

| Resistance 2 | 356.5 | 427.8 | 974.42 | 327.37 | 3.41 |

| Resistance 1 | 354.8 | 424.7 | 971.58 | 325.83 | 3.34 |

| Pivot | 351.5 | 420.1 | 966.42 | 323.07 | 3.22 |

| Support 1 | 349.8 | 416.9 | 963.6 | 321.5 | 3.1 |

| Support 2 | 346.5 | 412.3 | 958.42 | 318.77 | 3.03 |

| Support 3 | 344.8 | 409.2 | 955.58 | 317.23 | 2.96 |

Economic Reports, source:

http://app.bettertrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

The weekend of December 16-17, 2017 saw new highs in the bitcoin futures index. Is it a bubble? CNN’s Daniel Shane said bitcoin futures trading “just got a whole lot bigger.” As the bubble got bigger, the warnings got louder.

The involvement of top financial institutions in the bitcoin market underscores its growing mainstream acceptance even as government officials, business leaders, and economists continue to warn people against investing in it. -Daniel Shane

Bitcoin value dropped about $1,000 between December 16-17, and bitcoin cash soared to a record high then lost half its value within that 24-hour period. Taking an average from several exchanges, CME bitcoins futures index must be traded in blocks of five. Opening trades in bitcoin futures on a reputable exchange could calm the nervous bitcoin value volatility. The New York Nasdaq is anticipated to offer bitcoin futures trading in 2018.

About Bitcoins

Bitcoins are more than a fad, says a recent Cambridge University study of cryptocurrencies. Bitcoins are the world’s first decentralized digital currency, or “virtual currency.” Bitcoins are also called “cryptocurrency,” and what distinguishes them most – aside from being the first virtual money – is they are not administered or managed by a single authority, government or bank.

Bitcoin Futures Trading

Trading bitcoin futures will offer investors some level of protection against major losses due to the commodity’s squirrely fluctuation. Traders are urged to research the bitcoin market and check the dates on blogs and other information because much of the data in November 2017 internet posts about bitcoins were outdated by December 2017. Bitcoins and what we know about them is evolving quickly.

The CME opened trading in bitcoin futures December 18, 2017, a move that gave bitcoins the legitimacy of mainstream trading. Eight hours into the day, the trading was going smoothly as the spot price reached $20,000 and eased back to $18,800. The January 2018 futures price dipped down during the first hours of trading from $19,500 to $19,370, which indicates investors believe bitcoin will hold its value through and into January 2018.

Bitcoin is Becoming a Major Player

Investors feel if a trusted group like CME offers bitcoin futures trading, it validates the commodity’s authenticity. However, CME “also has a track record of getting into some pretty esoteric products,” says Jeremy Grant of strategy+business.com. In 2006, CME initiated a futures contract based on the likelihood of snowfall at various locations. Futures and options based on the weather must’ve made sense to someone at the time . . . and so investors are wondering if bitcoin futures index is a lot like snow.

It might melt.

The bottom line, Grant continues, is bitcoin is not as speculative as snowflakes because the planned futures contract is cash-settled as opposed to physically settled. “Futures traders love cash-settled plays because there’s no need to store or hold a particular commodity or underlying asset to make good on the bet.; it’s a purely financial transaction.” Traditionally, traders do well in a volatile market and bitcoin futures trading is all that.

Are You Ready for Bitcoin Futures Trading?

The online application to open an account for bitcoin and other commodity futures trading takes about 20 minutes to complete; approval is somewhere between 24-48 hours. Cannon Trading Vice President Ilan Levy-Mayer says, “Just like you, we’re excited but cautious about investing in bitcoin futures.” The more we learn, the more you will learn because we keep our clients informed. Trading commodity futures and options involves a substantial risk of loss. Here’s what may influence or add to the volatility of the bitcoins futures index:

Call 310.859.9572, 800.454.9572, or contact us today about commodities futures trading. We’ll always tell you what we know.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Christmas Holiday trading Schedule is now available!

Bitcoin updates:

The CBOE 1 bitcoin contract been trading a full week. The CBOE contract represents one bitcoin while the CME contract represents 5 bitcoins.

We saw approx. 4250 contracts traded on the January contract of the CBOE today.

We saw approx. 1076 contracts traded on the January contract of the CME today, the contract’s first day.

Open an Account to Trade Bitcoin Futures:

In Order to Trade bitcoin futures and other commodity futures, please complete the following online application and fund the account with $10,000 min. to trade CBOE and $50,000 min. to trade the CME contract.

If you already have an account with us, please communicate with your broker to make sure you are set up to trade these contracts, discuss risks and more.

Here’s the link to the on-line account application (takes about 15-20 mins.)

Generally, application approval usually takes a day or two, if it is an urgent set-up, we should be able to get you up and running within a day.

If you have ANY questions, feel free to call, chat or contact us!

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

12-19-2017

| Contract March 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | BitCoin Index |

| Resistance 3 | 2715.67 | 6596.00 | 25113 | 1582.63 | 23338.60 |

| Resistance 2 | 2706.83 | 6569.00 | 25004 | 1569.97 | 21539.22 |

| Resistance 1 | 2700.17 | 6551.50 | 24910 | 1561.13 | 20143.17 |

| Pivot | 2691.33 | 6524.50 | 24801 | 1548.47 | 18343.79 |

| Support 1 | 2684.67 | 6507.00 | 24707 | 1539.63 | 16947.74 |

| Support 2 | 2675.83 | 6480.00 | 24598 | 1526.97 | 15148.36 |

| Support 3 | 2669.17 | 6462.50 | 24504 | 1518.13 | 13752.31 |

| Contract | Feb. Gold | Mar. Silver | Feb. Crude Oil | Mar. Bonds | Mar. Euro |

| Resistance 3 | 1281.0 | 16.40 | 58.69 | 155 7/32 | 1.2003 |

| Resistance 2 | 1274.0 | 16.31 | 58.25 | 154 24/32 | 1.1961 |

| Resistance 1 | 1269.3 | 16.24 | 57.76 | 154 1/32 | 1.1913 |

| Pivot | 1262.3 | 16.14 | 57.32 | 153 18/32 | 1.1871 |

| Support 1 | 1257.6 | 16.07 | 56.83 | 152 27/32 | 1.1823 |

| Support 2 | 1250.6 | 15.98 | 56.39 | 152 12/32 | 1.1781 |

| Support 3 | 1245.9 | 15.91 | 55.90 | 151 21/32 | 1.1733 |

| Contract | Mar. Corn | Mar. Wheat | January Beans | Mar. SoyMeal | Jan. Nat Gas |

| Resistance 3 | 350.6 | 426.8 | 982.17 | 327.67 | 2.94 |

| Resistance 2 | 349.7 | 425.2 | 976.33 | 325.03 | 2.86 |

| Resistance 1 | 348.3 | 422.8 | 968.92 | 321.77 | 2.80 |

| Pivot | 347.4 | 421.2 | 963.08 | 319.13 | 2.72 |

| Support 1 | 346.1 | 418.8 | 955.7 | 315.9 | 2.7 |

| Support 2 | 345.2 | 417.2 | 949.83 | 313.23 | 2.57 |

| Support 3 | 343.8 | 414.8 | 942.42 | 309.97 | 2.51 |

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

March is now the FRONT MONTH for all e-mini contracts. March is H8

so YMH8 is the March mini Dow futures

Bitcoin updates:

The CBOE 1 bitcoin contract been trading almost a full week. The CBOE contract represents one bitcoin while the CME contract set to launch this coming Sunday evening controls 5 bitcoins.

We saw approx. 1200 contracts traded on the January contract of the CBOE today.

The contract is very volatile and the bid-ask spread is still wide.

Open an Account to Trade Bitcoin Futures:

In Order to Trade bitcoin futures and other commodity futures, please complete the following online application and fund the account with the minimums listed above.

If you already have an account with us, please communicate with your broker to make sure you are set up to trade these contracts, discuss risks and more.

Here’s the link to the on-line account application (takes about 15-20 mins.)

Generally, application approval usually takes a day or two, if it is an urgent set-up, we should be able to get you up and running within a day.

If you have ANY questions, feel free to call, chat or contact us!

Open an Account to Trade Bitcoin Futures:

In Order to Trade bitcoin futures and other commodity futures, please complete the following online application and fund the account with the minimums listed above.

Here’s the link to the on-line account application (takes about 15-20 mins.)

Generally, application approval usually takes a day or two, if it is an urgent set-up, we should be able to get you up and running within a day.

If you have ANY questions, feel free to call, chat or contact us!

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

12-15-2017

| Contract March 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | BitCoin Index |

| Resistance 3 | 2687.00 | 6475.42 | 24820 | 1552.97 | 17786.32 |

| Resistance 2 | 2680.25 | 6459.58 | 24762 | 1542.53 | 17381.78 |

| Resistance 1 | 2668.25 | 6435.67 | 24657 | 1526.17 | 16948.02 |

| Pivot | 2661.50 | 6419.83 | 24599 | 1515.73 | 16543.48 |

| Support 1 | 2649.50 | 6395.92 | 24494 | 1499.37 | 16109.72 |

| Support 2 | 2642.75 | 6380.08 | 24436 | 1488.93 | 15705.18 |

| Support 3 | 2630.75 | 6356.17 | 24331 | 1472.57 | 15271.42 |

| Contract | Feb. Gold | Mar. Silver | Jan. Crude Oil | Mar. Bonds | Dec. Euro |

| Resistance 3 | 1269.2 | 16.40 | 58.56 | 155 17/32 | 1.1937 |

| Resistance 2 | 1265.4 | 16.27 | 57.86 | 154 27/32 | 1.1901 |

| Resistance 1 | 1260.4 | 16.10 | 57.49 | 154 15/32 | 1.1844 |

| Pivot | 1256.6 | 15.98 | 56.79 | 153 25/32 | 1.1808 |

| Support 1 | 1251.6 | 15.81 | 56.42 | 153 13/32 | 1.1752 |

| Support 2 | 1247.8 | 15.68 | 55.72 | 152 23/32 | 1.1716 |

| Support 3 | 1242.8 | 15.51 | 55.35 | 152 11/32 | 1.1659 |

| Contract | Mar. Corn | Mar. Wheat | January Beans | Mar. SoyMeal | Jan. Nat Gas |

| Resistance 3 | 352.9 | 424.4 | 981.50 | 330.97 | 2.80 |

| Resistance 2 | 351.8 | 422.6 | 978.25 | 328.93 | 2.76 |

| Resistance 1 | 350.2 | 420.4 | 973.00 | 325.27 | 2.72 |

| Pivot | 349.1 | 418.6 | 969.75 | 323.23 | 2.68 |

| Support 1 | 347.4 | 416.4 | 964.5 | 319.6 | 2.6 |

| Support 2 | 346.3 | 414.6 | 961.25 | 317.53 | 2.61 |

| Support 3 | 344.7 | 412.4 | 956.00 | 313.87 | 2.57 |

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

March is now the FRONT MONTH for all e-mini contracts. March is H8

so YMH8 is the March mini Dow futures

Market Movers: December 12 Crop Report

Industry experts Dave Hightower, of The Hightower Report, and Virginia McGathey, President of McGathey Commodities, preview the December 12 USDA report discussing corn and soybean yields in advance of its publication.

Bitcoin updates:

The CBOE 1 bitcoin contract launched last night in what I consider a relatively successful first day. The CBOE contract controls one bitcoin while the CME contract set to launch this coming Sunday evening controls 5 bitcoins.

We saw approx. 4000 contracts traded on the January contract of the CBOE with a high of 18850 and a low of 15,000 ( where the market opened…) The contract is very volatile and the bid-ask spread is still wide.

Open an Account to Trade Bitcoin Futures:

In Order to Trade bitcoin futures and other commodity futures, please complete the following online application and fund the account with the minimums listed above

Here’s the link to the on-line account application (takes about 15-20 mins.)

Generally, application approval usually takes a day or two, if it is an urgent set-up, we should be able to get you up and running within a day.

If you have ANY questions, feel free to call, chat or contact us!

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

12-11-2017

| Contract March 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | BitCoin Index |

| Resistance 3 | 2677.17 | 6487.50 | 24500 | 1540.30 | 20536.86 |

| Resistance 2 | 2670.08 | 6451.50 | 24455 | 1535.90 | 18953.83 |

| Resistance 1 | 2666.42 | 6431.00 | 24428 | 1529.30 | 18073.55 |

| Pivot | 2659.33 | 6395.00 | 24383 | 1524.90 | 16490.52 |

| Support 1 | 2655.67 | 6374.50 | 24356 | 1518.30 | 15610.24 |

| Support 2 | 2648.58 | 6338.50 | 24311 | 1513.90 | 14027.21 |

| Support 3 | 2644.92 | 6318.00 | 24284 | 1507.30 | 13146.93 |

| Contract | Feb. Gold | Mar. Silver | Jan. Crude Oil | Mar. Bonds | Dec. Euro |

| Resistance 3 | 1262.1 | 16.07 | 59.55 | 153 30/32 | 1.1850 |

| Resistance 2 | 1257.8 | 15.99 | 58.80 | 153 25/32 | 1.1833 |

| Resistance 1 | 1251.1 | 15.86 | 58.40 | 153 11/32 | 1.1805 |

| Pivot | 1246.8 | 15.78 | 57.65 | 153 6/32 | 1.1788 |

| Support 1 | 1240.1 | 15.66 | 57.25 | 152 24/32 | 1.1759 |

| Support 2 | 1235.8 | 15.58 | 56.50 | 152 19/32 | 1.1742 |

| Support 3 | 1229.1 | 15.45 | 56.10 | 152 5/32 | 1.1714 |

| Contract | Mar. Corn | Mar. Wheat | January Beans | Mar. SoyMeal | Jan. Nat Gas |

| Resistance 3 | 353.8 | 422.6 | 994.25 | 335.47 | 2.89 |

| Resistance 2 | 352.5 | 419.7 | 991.50 | 333.63 | 2.87 |

| Resistance 1 | 350.8 | 416.6 | 987.00 | 330.67 | 2.84 |

| Pivot | 349.5 | 413.7 | 984.25 | 328.83 | 2.81 |

| Support 1 | 347.8 | 410.6 | 979.8 | 325.9 | 2.8 |

| Support 2 | 346.5 | 407.7 | 977.00 | 324.03 | 2.76 |

| Support 3 | 344.8 | 404.6 | 972.50 | 321.07 | 2.73 |

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Bitcoin: Will Stunning Rally Sustain or Sour in 2018?