Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

In this session, we’ll take a look at QT Market Center, a leading trading platform used by hedgers and professional traders world wide.

When: Tomorrow ( Thursday Apr. 6th) at 2 PM Central Time

Mark Bucaro, an ex floor trader will share some of the features and tools QT offers and how you can possibly use it to help your trading.

In this webinar you will learn and see live examples:

• Proprietary Price Counts Price Forecasting Tool

• Realtime Agricultural/Livestock/Ethanol-Energy News, Weather, Audio Charts, & Quotes and more all from one platform – Desktop, Tablet, Smartphone Accessible

• Daily Chart of the Day Subscription with Price Counts Price Forecasting Levels Included

• Profitability Cost Calculator – Input your costs and get your profitability results in seconds

• Web based Platform Access, Desktop (Smartphone & Tablet Access included Free) from virtually anywhere there is an internet connection

• Cost Effective, Reliable and Fast

• Reduced Live and Snapshot Quotes Fee Cost Options Available

• Realtime Live Streaming Agricultural & World Weather Audio Market Commentary Updates (accessible from Desktop, Tablet & Smartphone when out in the field)

• Access Current and 11+ years of Archived USDA Reports,

SPACE is LIMITED, so reserve your space now!

Heads up everyone, a bit of a different Good Friday schedule than years past.

Good Friday was the one holiday all commodity brokers loved as almost all markets were completely closed. With NFP out this Friday, the CME will have a few markets open to allow for risk management. Equities will remain open until 8:15 AM central Friday. Currencies & rates until 10:15 AM central.

Please see full list below. Happy Easter/ Passover to all.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 04-06-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Thu, Apr 6, 2023 12:01 PM – 1:00 PM PDT

In this session, we’ll take a look at QT Market Center, a leading trading platform used by hedgers and professional traders world wide.

Mark Bucaro, an ex floor trader will share some of the features and tools QT offers and how you can possibly use it to help your TRADING and HEDGING.

• Pre-Opening Comments for Financials, Metals, Ags, and Softs.

• Cycle Timing Commentary for Grains

• David Hightower daily market analysis

• Market Calendar

• Web based Platform Access, Desktop (Smartphone & Tablet Access included Free) from virtually any computer anywhere there is an internet connection

• Easy to use Point and Click with Multi Screen Capability

• Profitability Cost Calculator – Input your costs and get your profitability results in seconds

• Realtime Live Streaming Agricultural & World Weather Audio Market Commentary Updates (accessible from Desktop, Tablet & Smartphone when out in the field)

• Access Current and 11+ years of Archived USDA Reports,

• Realtime Agricultural/Livestock/Ethanol-Energy News, Weather, Audio Charts, & Quotes and more all from one platform – Desktop, Tablet, Smartphone Accessible

• Daily Chart of the Day Subscription with Price Counts Price Forecasting Levels Included

• Proprietary Price Counts Price Forecasting Tool

• Chart Overlays

• Seasonal Charts

• Grain Bids Directory with approximately 16,000 bids

SPACE is LIMITED, so reserve your space now!

https://attendee.gotowebinar.com/register/8469154769041356119

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 03-29-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By John Thorpe, Senior Broker

The simple answer is: No. Clearly, markets need certainty to thrive. Volatility heats up when monetary and fiscal policy uncertainty peak. A National election is an opportunity for the equity markets to react to potential outcomes before, during, and after the election. Behaving just as markets do prior to a FED rate announcement. Market reactions have been historically varied during midterm elections. Currently, several outlets are reporting the least likely election outcome is for Democrats to retain control of the National Government levers. Conversely, the same outlets are calling for a divided government, and will most likely be the outcome of today’s voting. One party controls the House of Representatives and the other controls the Senate. An outcome other than this will roil the markets. A word of caution to not over extend/over-leverage as the results come in after the first polls close on the East coast. Reduce position size if you are trading and be vigilant. “Survive to Trae Another Day”!

Plan your trade and trade your plan.

https://attendee.gotowebinar.com/register/8624681785028468236

In this webinar you will learn and see live examples:

• Proprietary Price Counts Price Forecasting Tool

• Realtime Agricultural/Livestock/Ethanol-Energy News, Weather, Audio

• Daily Chart of the Day Subscription with Price Counts Price Forecasting Levels Included

• Realtime Live Streaming Agricultural & World Weather Audio Market Commentary Updates (accessible from Desktop, Tablet & Smartphone when out in the field)

• Access Current and 11+ years of Archived USDA Reports,

SPACE is LIMITED, so reserve your space now!

https://attendee.gotowebinar.com/register/8624681785028468236

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

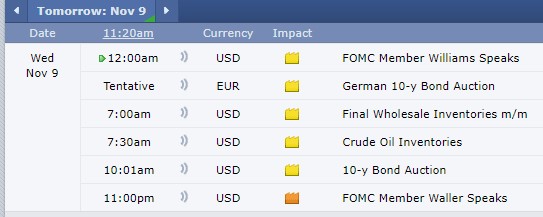

for 11-09-2022

SP500 #ES_FNasdaq100 #NQ_FDow Jones #YM_FMini Russell #RTY_FBitCoin Index #BRTI SP500 Dec. Gold #GC_F Dec. Silver #SI_F Oct. Crude Oil #CL-F Dec. Bonds #ZB_F Dec. 10 yr #ZN_F Dec. Corn #ZC_F Dec. Wheat #ZW_F Nov. Beans #ZS_F Dec. SoyMeal #ZM_F Oct. Nat Gas #NG_F Dec. Coffee #KC_F Dec. Cocoa #CC_F October Sugar #SB_F Dec. Cotton #CT_F Sept. Euro Currency

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 11-01-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

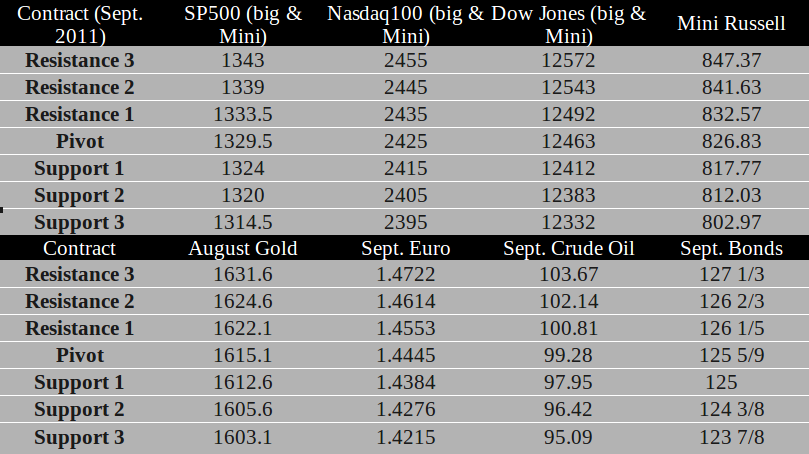

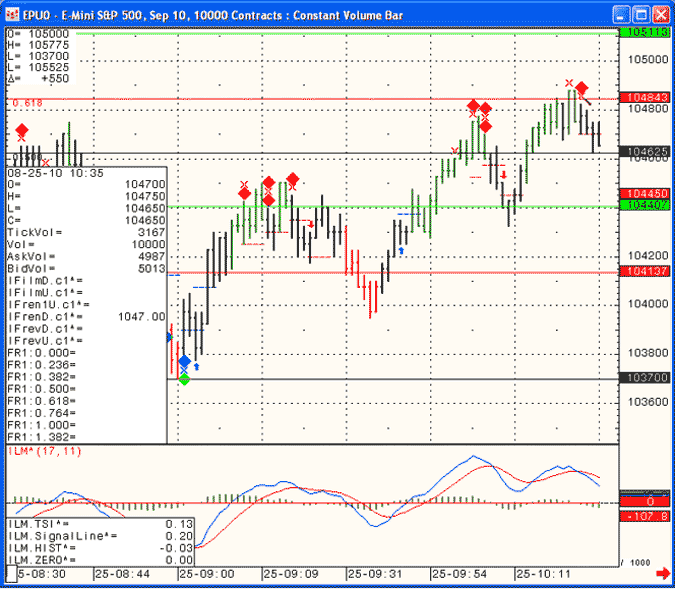

1. Market Commentary

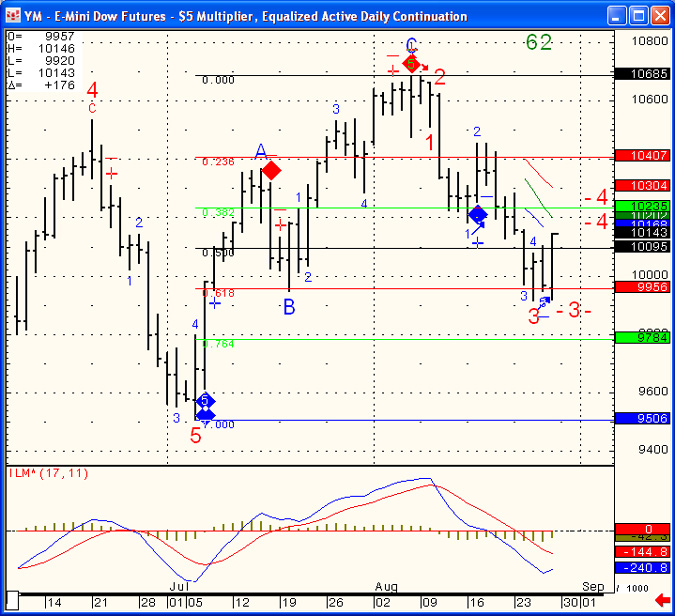

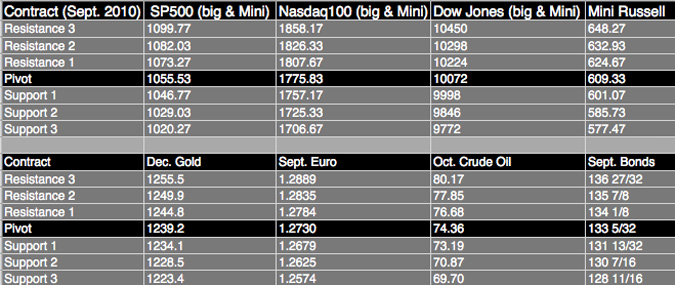

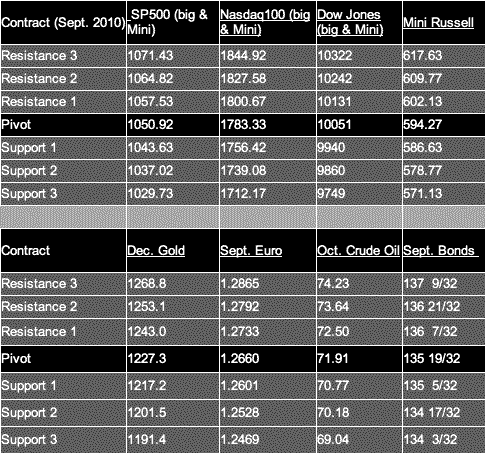

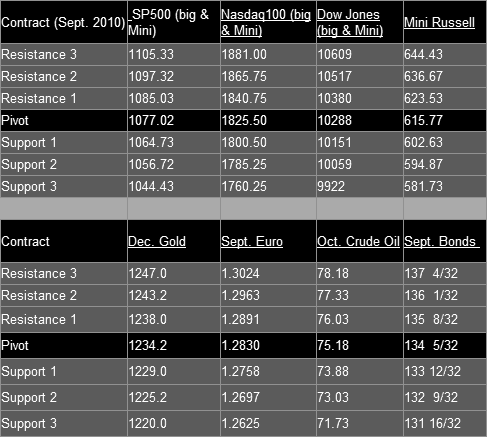

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday November 11, 2016

Greetings!

Would you like to try trading indicators NOT found anywhere else?

If so check out https://www.cannontrading.com/tools/intraday-futures-trading-signals

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Levels for Trade Date of 11.15.2016

| Contract Dec. 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2194.50 | 4874.00 | 19056 | 1337.23 | 101.62 |

| Resistance 2 | 2184.50 | 4829.25 | 18987 | 1322.67 | 100.93 |

| Resistance 1 | 2172.25 | 4762.25 | 18900 | 1310.43 | 100.48 |

| Pivot | 2162.25 | 4717.50 | 18831 | 1295.87 | 99.79 |

| Support 1 | 2150.00 | 4650.50 | 18744 | 1283.63 | 99.34 |

| Support 2 | 2140.00 | 4605.75 | 18675 | 1269.07 | 98.65 |

| Support 3 | 2127.75 | 4538.75 | 18588 | 1256.83 | 98.20 |

| Contract | Dec. Gold | Dec. Silver | Dec. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1249.6 | 18.23 | 45.90 | 157 3/32 | 1.0961 |

| Resistance 2 | 1240.3 | 17.86 | 44.86 | 156 8/32 | 1.0909 |

| Resistance 1 | 1229.7 | 17.36 | 44.29 | 155 5/32 | 1.0828 |

| Pivot | 1220.4 | 16.99 | 43.25 | 154 10/32 | 1.0775 |

| Support 1 | 1209.8 | 16.49 | 42.68 | 153 7/32 | 1.0694 |

| Support 2 | 1200.5 | 16.12 | 41.64 | 152 12/32 | 1.0642 |

| Support 3 | 1189.9 | 15.62 | 41.07 | 151 9/32 | 1.0561 |

| Contract | Dec. Corn | Dec. Wheat | Jan. Beans | Dec. SoyMeal | Dec. Nat Gas |

| Resistance 3 | 342.9 | 403.9 | 996.67 | 318.63 | 2.94 |

| Resistance 2 | 341.1 | 401.3 | 991.58 | 314.97 | 2.86 |

| Resistance 1 | 339.2 | 397.7 | 987.92 | 312.43 | 2.80 |

| Pivot | 337.3 | 395.1 | 982.83 | 308.77 | 2.72 |

| Support 1 | 335.4 | 391.4 | 979.2 | 306.2 | 2.7 |

| Support 2 | 333.6 | 388.8 | 974.08 | 302.57 | 2.59 |

| Support 3 | 331.7 | 385.2 | 970.42 | 300.03 | 2.54 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| 3:54pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | ||

|---|---|---|---|---|---|---|---|---|---|

| TueNov 15 | 2:00am | EUR |

German Prelim GDP q/q

|

0.3% | 0.4% | ||||

| 2:45am | EUR |

French Final CPI m/m

|

0.0% | 0.0% | |||||

| 4:00am | EUR |

Italian Prelim GDP q/q

|

0.2% | 0.0% | |||||

| 5:00am | EUR |

Flash GDP q/q

|

0.3% | 0.3% | |||||

| EUR |

German ZEW Economic Sentiment

|

7.9 | 6.2 | ||||||

| EUR |

Trade Balance

|

22.3B | 23.3B | ||||||

| EUR |

ZEW Economic Sentiment

|

14.3 | 12.3 | ||||||

| 8:30am | USD |

Core Retail Sales m/m

|

0.5% | 0.5% | |||||

| USD |

Retail Sales m/m

|

0.6% | 0.6% | ||||||

| USD |

Empire State Manufacturing Index

|

-1.5 | -6.8 | ||||||

| USD |

Import Prices m/m

|

0.4% | 0.1% | ||||||

| 10:00am | USD |

Business Inventories m/m

|

0.2% | 0.2% |

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

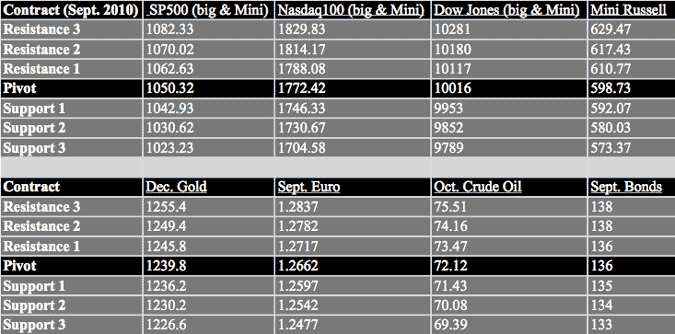

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday June 24, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

Check out the different trading resources we offer for FREE on our website!

and much more……

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Sept. 2015 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2129.50 | 4577.92 | 18186 | 1301.33 | 97.58 |

| Resistance 2 | 2125.00 | 4563.33 | 18147 | 1296.67 | 96.73 |

| Resistance 1 | 2120.25 | 4551.92 | 18102 | 1294.13 | 96.18 |

| Pivot | 2115.75 | 4537.33 | 18063 | 1289.47 | 95.33 |

| Support 1 | 2111.00 | 4525.92 | 18018 | 1286.93 | 94.78 |

| Support 2 | 2106.50 | 4511.33 | 17979 | 1282.27 | 93.93 |

| Support 3 | 2101.75 | 4499.92 | 17934 | 1279.73 | 93.38 |

| Contract | Aug. Gold | July Silver | Aug. Crude Oil | Sept. Bonds | Sept. Euro |

| Resistance 3 | 1196.9 | 16.58 | 63.69 | 151 4/32 | 1.1525 |

| Resistance 2 | 1192.3 | 16.38 | 62.56 | 150 13/32 | 1.1442 |

| Resistance 1 | 1184.8 | 16.08 | 61.82 | 149 18/32 | 1.1311 |

| Pivot | 1180.2 | 15.87 | 60.69 | 148 27/32 | 1.1228 |

| Support 1 | 1172.7 | 15.57 | 59.95 | 148 | 1.1097 |

| Support 2 | 1168.1 | 15.37 | 58.82 | 147 9/32 | 1.1014 |

| Support 3 | 1160.6 | 15.07 | 58.08 | 146 14/32 | 1.0883 |

| Contract | July Corn | July Wheat | July Beans | July SoyMeal | July Nat Gas |

| Resistance 3 | 376.6 | 527.5 | 980.08 | 344.83 | 2.86 |

| Resistance 2 | 372.2 | 524.5 | 971.92 | 340.37 | 2.82 |

| Resistance 1 | 369.8 | 523.0 | 966.33 | 336.13 | 2.78 |

| Pivot | 365.4 | 520.0 | 958.17 | 331.67 | 2.74 |

| Support 1 | 363.1 | 518.5 | 952.6 | 327.4 | 2.7 |

| Support 2 | 358.7 | 515.5 | 944.42 | 322.97 | 2.66 |

| Support 3 | 356.3 | 514.0 | 938.83 | 318.73 | 2.62 |

| Date | 4:30pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedJun 24 | 4:00am | EUR | German Ifo Business Climate | 108.2 | 108.5 | ||||

| All Day | EUR | Eurogroup Meetings | |||||||

| 8:30am | USD | Final GDP q/q | -0.2% | -0.7% | |||||

| USD | Final GDP Price Index q/q | -0.1% | -0.1% | ||||||

| 9:00am | EUR | Belgian NBB Business Climate | -5.2 | -4.9 | |||||

| 10:30am | USD | Crude Oil Inventories | -1.7M | -2.7M |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

A word or two about day-trading and money management…..

Trading futures and even more so, day-trading futures has grown significantly over the last few years, as seen by the increase in daily volume on some of the more popular electronic markets. (The Mini SP had 3,575,702 contracts traded on February 27th! Yes, that is 3.575 MILLION contracts….)

New traders as well as more experienced traders often wonder and search for the “holy grail” and the answer is different for each trader. Many factors influence what may be a good route for one trader versus a better alternative for another. Experience, risk tolerance, the person’s schedule, financial situation along with other factors will greatly influence what is a suitable trading method for one trader or another.

One COMMON solution different traders can implement when it comes to day-trading is what I call: “Treat your daily Profit/Loss as you would treat an open trade” and allow me to expand:

As brokers we have seen different traders survive in this business, making progress and even getting to the point of consistently finding their set ups, however their main downfall is that “one bad day” where they may give up recent gains, lose a large percentage of their account or even lose their whole account.

A practical solution for eliminating those disastrous days and giving you a better chance for survival is using “stop losses, trailing stop losses and daily stop limits” for every given trading day.

Let’s assume for hypothetical purposes that trader A is day-trading with $10,000 of risk capital. Part of her preparation for trading should be an understanding of her trading style, how active she is, how much on average does she risk per trade and other factors to help her calculate what her DAILY LOSS LIMIT should be. If you as a trader can be discipline enough to set your own daily loss limit and on days when you have reached your daily loss limit, simply stop trading for that day, you will give yourself better odds in surviving the day-trading arena and preventing days where you may loss a big portion of your account. Surviving to trade another day is a crucial element when it comes to day-trading.

The next step, now that we have decided on what our “daily stop loss” should be is to decide at what level of profit do you trigger “BREAKEVEN MONEY MANAGEMENT”? By that I refer to a level of daily profit that you have achieved as a trader and at that point should trigger the concept of “I am up $X amount and if for what ever reason the rest of my trading for today is not doing well and my daily profit/loss is back to zero, I should call it a day”.

Moving on you should also decide on a certain profit target (higher than your “breakeven point” ). That level of profit, when and if achieved during the trading day should trigger a corresponding “TRAILING STOP”. For example, let’s assume the trader A is now up $1,000 during the trading day and after doing her homework, she has decided that if she is ever up a $1,000 during the trading day, her trailing stop is $500. That means that she will continue to trade as long as she does not give up more than $500 from her intraday gains. By implementing this technique a trader allows himself to continue trading as long as he or she does not give up too much of their profit for that day.

Last but not least is the element of “PROFIT TARGET”. There are a few schools of thought when it comes to “daily profit target”. Some say that if a trader is “hot” he/she should continue trading in order to maximize the potential for that day. I disagree. In my opinion setting a DAILY PROFIT TARGET based on your account size and other factors discussed previously will assist you better in the long run. In this example if trader A decided that her daily profit target is $2,000 and on any given day she has reached that profit, that should trigger a feeling of satisfaction and achievement and at that point trader A would close open positions, enjoy her good trading day and call it day.

It is my opinion that a trader will fair better in the long term by initiating these concepts I borrowed from trading system design. Getting to the point of working with these suggestions require one to analyze themselves as a trader, understand basic concepts of money management and have the SELF DISCIPLINE to execute his or hers trading plan.

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Sept. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 1945.17 | 3942.25 | 16637 | 1154.23 | 81.99 |

| Resistance 2 | 1934.33 | 3916.75 | 16540 | 1142.07 | 81.88 |

| Resistance 1 | 1924.67 | 3893.00 | 16467 | 1131.93 | 81.68 |

| Pivot | 1913.83 | 3867.50 | 16370 | 1119.77 | 81.57 |

| Support 1 | 1904.17 | 3843.75 | 16297 | 1109.63 | 81.37 |

| Support 2 | 1893.33 | 3818.25 | 16200 | 1097.47 | 81.26 |

| Support 3 | 1883.67 | 3794.50 | 16127 | 1087.33 | 81.06 |

| Contract | December Gold | Sept.Silver | Sept. Crude Oil | September Bonds | Sept. Euro |

| Resistance 3 | 1338.2 | 2056.5 | 99.21 | 139 28/32 | 1.3461 |

| Resistance 2 | 1324.6 | 2035.0 | 98.67 | 139 18/32 | 1.3425 |

| Resistance 1 | 1315.7 | 2020.0 | 97.77 | 139 2/32 | 1.3406 |

| Pivot | 1302.1 | 1998.5 | 97.23 | 138 24/32 | 1.3370 |

| Support 1 | 1293.2 | 1983.5 | 96.33 | 138 8/32 | 1.3351 |

| Support 2 | 1279.6 | 1962.0 | 95.79 | 137 30/32 | 1.3315 |

| Support 3 | 1270.7 | 1947.0 | 94.89 | 137 14/32 | 1.3296 |

| Contract | Dec Corn | Sept. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 384.3 | 576.3 | 1106.67 | 360.03 | 36.97 |

| Resistance 2 | 379.4 | 574.0 | 1093.33 | 354.47 | 36.63 |

| Resistance 1 | 376.8 | 571.0 | 1086.67 | 351.33 | 36.42 |

| Pivot | 371.9 | 568.8 | 1073.33 | 345.77 | 36.08 |

| Support 1 | 369.3 | 565.8 | 1066.7 | 342.6 | 35.9 |

| Support 2 | 364.4 | 563.5 | 1053.33 | 337.07 | 35.53 |

| Support 3 | 361.8 | 560.5 | 1046.67 | 333.93 | 35.32 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday December 4, 2013

Hello Traders,

For 2013 I would like to wish all of you discipline and patience in your trading!

Day Trading indicators and Algorithm free trial.

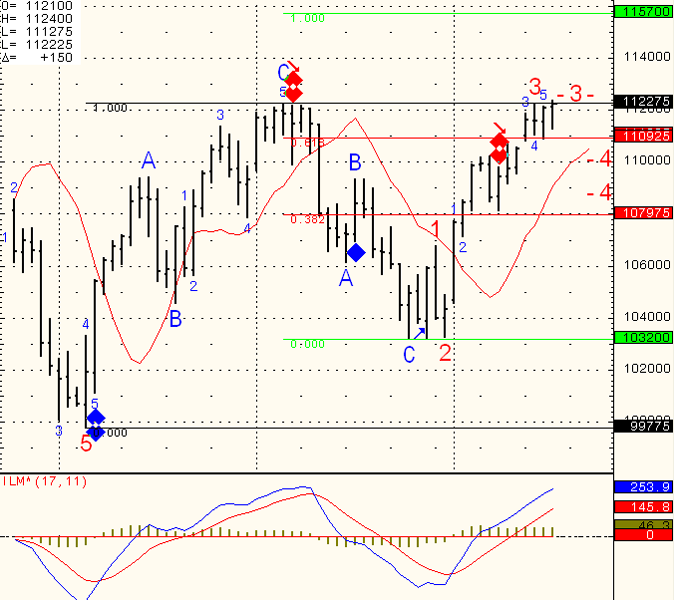

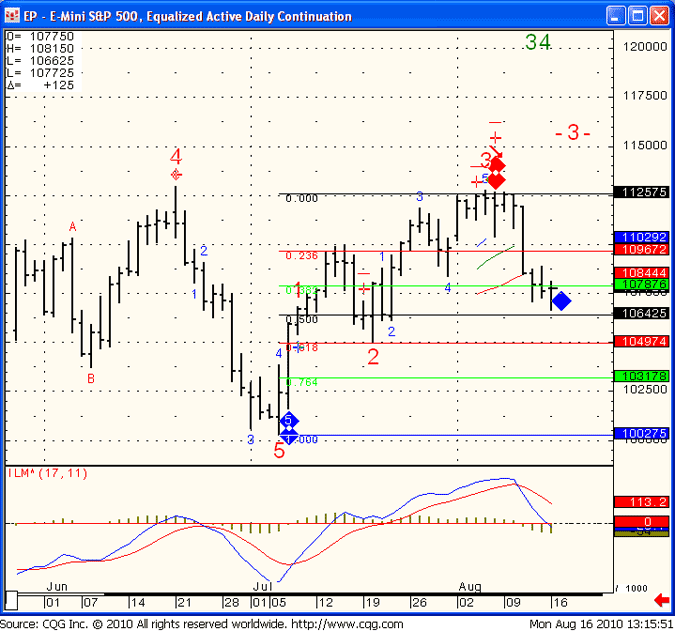

Below is a screen shot of the Mini SP 500 chart from today’s session.

The signals that appear are based on proprietary indicators developed by Ilan Levy-Mayer of LEVEX Capital Mgmt Inc. and VP of Cannon Trading Co, Inc.

The concept looks for exhaustion in either buying/ selling and reversal. The signals that appear on the charts are alerting you for potential buy or sell IF/ONCE price confirmation occurred. Full explanation along with chart samples included in the 23 page PDF booklets that comes with the free trial.

EP – E Mini S&P 500, Equalized Active 15 Min Continuation

Would you like to have access to the DIAMOND and TOPAZ and 5T ALGOs as shown above

and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where the ALGO is enabled along with few studies for your own sierra/ ATcharts OR CQG Trader and CQG Q Trader. The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details.

To start your free 3 weeks trial, please send me an email with the following information:

TRADING COMMODITY FUTURES AND OPTIONS INVOLVE SUBSTANTIAL RISK OF LOSS. THE RECOMMENDATIONS CONTAINED IN THE LETTER IS OF OPINION AND DOES NOT GUARANTEE ANY PROFITS. THERE IS NOT AN ACTUAL ACCOUNT TRADING THESE RECOMMENDATIONS. THESE ARE RISKY MARKETS AND ONLY RISK CAPITAL SHOULD BE USED. PAST PERFORMANCES ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NO INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS

If you like the information we share? We would appreciate your positive reviews on our new yelp!!

GOOD TRADING/

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Dec. 2013 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1815.92 | 3510.42 | 16138 | 1143.57 | 81.43 |

| Resistance 2 | 1808.83 | 3499.58 | 16071 | 1137.63 | 81.22 |

| Resistance 1 | 1800.42 | 3487.92 | 15981 | 1130.07 | 80.92 |

| Pivot | 1793.33 | 3477.08 | 15914 | 1124.13 | 80.72 |

| Support 1 | 1784.92 | 3465.42 | 15824 | 1116.57 | 80.42 |

| Support 2 | 1777.83 | 3454.58 | 15757 | 1110.63 | 80.21 |

| Support 3 | 1769.42 | 3442.92 | 15667 | 1103.07 | 79.91 |

| Contract | Feb. Gold | Mar. Silver | Jan. Crude Oil | Mar. Bonds | Dec. Euro |

| Resistance 3 | 1238.0 | 1966.5 | 99.52 | 130 25/32 | 1.3721 |

| Resistance 2 | 1231.9 | 1950.0 | 97.86 | 130 20/32 | 1.3668 |

| Resistance 1 | 1226.8 | 1930.5 | 96.98 | 130 11/32 | 1.3630 |

| Pivot | 1220.7 | 1914.0 | 95.32 | 130 6/32 | 1.3577 |

| Support 1 | 1215.6 | 1894.5 | 94.44 | 129 29/32 | 1.3539 |

| Support 2 | 1209.5 | 1878.0 | 92.78 | 129 24/32 | 1.3486 |

| Support 3 | 1204.4 | 1858.5 | 91.90 | 129 15/32 | 1.3448 |

| Contract | Dec Corn | March Wheat | Jan .Beans | Jan. SoyMeal | Jan. bean Oil |

| Resistance 3 | 443.3 | 669.5 | 1339.67 | 440.77 | 40.85 |

| Resistance 2 | 437.8 | 669.3 | 1332.58 | 436.33 | 40.68 |

| Resistance 1 | 434.5 | 668.8 | 1326.17 | 432.57 | 40.39 |

| Pivot | 429.0 | 668.5 | 1319.08 | 428.13 | 40.22 |

| Support 1 | 425.8 | 668.0 | 1312.7 | 424.4 | 39.9 |

| Support 2 | 420.3 | 667.8 | 1305.58 | 419.93 | 39.76 |

| Support 3 | 417.0 | 667.3 | 1299.17 | 416.17 | 39.47 |

| Date | 3:54pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedDec 4 | 3:15am | EUR | Spanish Services PMI | 50.7 | 49.6 | ||||

| 3:45am | EUR | Italian Services PMI | 51.2 | 50.5 | |||||

| 4:00am | EUR | Final Services PMI | 50.9 | 50.9 | |||||

| All Day | ALL | OPEC Meetings | |||||||

| 5:00am | EUR | Retail Sales m/m | 0.2% | -0.6% | |||||

| EUR | Revised GDP q/q | 0.1% | 0.1% | ||||||

| 8:15am | USD | ADP Non-Farm Employment Change | 172K | 130K | |||||

| 8:30am | USD | Trade Balance | -40.3B | -41.8B | |||||

| 10:00am | USD | ISM Non-Manufacturing PMI | 55.4 | 55.4 | |||||

| USD | New Home Sales | 432K | |||||||

| Sep Data | USD | New Home Sales | 427K | 421K | |||||

| 10:30am | USD | Crude Oil Inventories | -0.5M | 3.0M | |||||

| 11:20am | USD | President Obama Speaks | |||||||

| 2:00pm | USD | Beige Book |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday October 08, 2013

Hello Traders,

For 2013 I would like to wish all of you discipline and patience in your trading!

Day-Trading Gold Futures Webinar: Trade Set-ups, Methodology, Money Management and More!

Space is limited. Join us for a Webinar on October 9

Reserve your Webinar seat now at:

https://www2.gotomeeting.com/register/198800538

Join us for a 90-minute LIVE trading and screen sharing, Wednesday, Oct. 9th at 9:15 A.M., Central Time.

During this presentation, Ilan Levy-Mayer, VP of Cannon Trading and Principal of LEVEX Capital Management will share with you details of his approach to day-trading futures, he calls “Nazlan Day-Trading Model & Rules.” and will focus on Gold futures.

In this webinar, Ilan will:

Space is limited!

Reserve your space today at: https://www2.gotomeeting.com/register/198800538

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Title: | Day-Trading Gold Futures Webinar: Trade Set-ups, Methodology, Money Management and More! |

| Date: | Wednesday, October 9, 2013 |

| Time: | 9:15 AM – 10:15 AM PDT |

After registering you will receive a confirmation email containing information about joining the Webinar.

| System Requirements PC-based attendees Required: Windows® 8, 7, Vista, XP or 2003 Server |

| Mac®-based attendees Required: Mac OS® X 10.6 or newer |

| Mobile attendees Required: iPhone®, iPad®, Android™ phone or Android tablet |

If you like the information we share? We would appreciate your positive reviews on our new yelp!!

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Dec. 2013 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1691.83 | 3260.25 | 15054 | 1079.20 | 80.42 |

| Resistance 2 | 1685.67 | 3246.50 | 15003 | 1075.40 | 80.33 |

| Resistance 1 | 1678.83 | 3229.25 | 14944 | 1069.70 | 80.18 |

| Pivot | 1672.67 | 3215.50 | 14893 | 1065.90 | 80.08 |

| Support 1 | 1665.83 | 3198.25 | 14834 | 1060.20 | 79.93 |

| Support 2 | 1659.67 | 3184.50 | 14783 | 1056.40 | 79.84 |

| Support 3 | 1652.83 | 3167.25 | 14724 | 1050.70 | 79.69 |

| Contract | Dec. Gold | Dec. Silver | Nov. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1353.8 | 2351.8 | 105.83 | 134 8/32 | 1.3650 |

| Resistance 2 | 1341.7 | 2300.7 | 104.79 | 133 31/32 | 1.3622 |

| Resistance 1 | 1332.2 | 2267.3 | 103.95 | 133 22/32 | 1.3601 |

| Pivot | 1320.1 | 2216.2 | 102.91 | 133 13/32 | 1.3573 |

| Support 1 | 1310.6 | 2182.8 | 102.07 | 133 4/32 | 1.3552 |

| Support 2 | 1298.5 | 2131.7 | 101.03 | 132 27/32 | 1.3524 |

| Support 3 | 1289.0 | 2098.3 | 100.19 | 132 18/32 | 1.3503 |

| Contract | Dec Corn | Dec. Wheat | Nov.Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 457.7 | 699.8 | 1308.83 | 430.17 | 40.33 |

| Resistance 2 | 453.6 | 697.3 | 1303.17 | 426.43 | 40.23 |

| Resistance 1 | 451.4 | 696.0 | 1299.83 | 423.57 | 40.07 |

| Pivot | 447.3 | 693.5 | 1294.17 | 419.83 | 39.97 |

| Support 1 | 445.2 | 692.3 | 1290.8 | 417.0 | 39.8 |

| Support 2 | 441.1 | 689.8 | 1285.17 | 413.23 | 39.71 |

| Support 3 | 438.9 | 688.5 | 1281.83 | 410.37 | 39.55 |

| Date | 4:01pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueOct 8 | 2:00am | EUR | German Trade Balance | 15.1B | 14.5B | ||||

| 2:45am | EUR | French Gov Budget Balance | -80.8B | ||||||

| EUR | French Trade Balance | -4.8B | -5.1B | ||||||

| 6:00am | EUR | German Factory Orders m/m | 1.2% | -2.7% | |||||

| 7:30am | USD | NFIB Small Business Index | 95.2 | 94.1 | |||||

| 10:00am | USD | IBD/TIPP Economic Optimism | 46.2 | 46.0 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday October 04, 2013

Hello Traders,

For 2013 I would like to wish all of you discipline and patience in your trading!

Two notes for today: Gmail updates and Gold Futures Day trading Webinar.

1. If you are using Gmail and our a client of mine, you may see my daily updates go into your “promotions folder”. To have my daily updates delivered into your primary inbox do the following:

The easiest way to move an email in your inbox is to left-click and hold on the email to drag it from the Promotions tab over to the Primary tab.

Releasing the mouse drops the email into the newly selected tab. Once dropped, Gmail displays a yellow box asking if you want to make this change permanent. ClickYes to ensure that all messages with the same from address will appear in the Primary tab going forward.

2.

| Day-Trading Gold Futures Webinar: Trade Set-ups, Methodology, Money Management and More! |

Join us for a Webinar on October 9

Space is limited.

Reserve your Webinar seat now at:

https://www2.gotomeeting.com/register/198800538

Join us for a 90-minute LIVE trading and screen sharing, Wednesday, Oct. 9th at 9:15 A.M., Central Time.

During this presentation, Ilan Levy-Mayer, VP of Cannon Trading and Principal of LEVEX Capital Management will share with you details of his approach to day-trading futures, he calls “Nazlan Day-Trading Model & Rules.” and will focus on Gold futures.

In this webinar, Ilan will:

1. Explain his entry signals

2. Review trading size

3. Explain multi time frame correlation

4. Review the charts he likes to use for different markets

5. Review his proprietary ALGO’s and trade indicators

6. present exit techniques

And much more…

Ilan has over 15 years of experience and has observed many traders as well as assisted many clients with different approaches to trading. He will be answering your questions and sharing as much of his philosophy as time allows. If markets are willing and trade set-ups occur, Ilan will take these set-ups using a real time simulation account and will review these trades.

As a thank you, attendees will receive a 3-week free trial to the day-trading indicators and Algorithms along with a 23-page PDF booklet with chart examples and explanations.

Space is limited!

Reserve your space today at: https://www2.gotomeeting.com/register/198800538

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Title: | Day-Trading Gold Futures Webinar: Trade Set-ups, Methodology, Money Management and More! |

| Date: | Wednesday, October 9, 2013 |

| Time: | 9:15 AM – 10:15 AM PDT |

After registering you will receive a confirmation email containing information about joining the Webinar.

| System Requirements PC-based attendees Required: Windows® 8, 7, Vista, XP or 2003 Server |

| Mac®-based attendees Required: Mac OS® X 10.6 or newer |

| Mobile attendees Required: iPhone®, iPad®, Android™ phone or Android tablet |

If you like the information we share? We would appreciate your positive reviews on our new yelp!!

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Dec. 2013 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1702.92 | 3297.00 | 15160 | 1094.53 | 80.31 |

| Resistance 2 | 1693.83 | 3272.50 | 15096 | 1086.57 | 80.16 |

| Resistance 1 | 1681.42 | 3238.25 | 14999 | 1076.43 | 80.01 |

| Pivot | 1672.33 | 3213.75 | 14935 | 1068.47 | 79.86 |

| Support 1 | 1659.92 | 3179.50 | 14838 | 1058.33 | 79.71 |

| Support 2 | 1650.83 | 3155.00 | 14774 | 1050.37 | 79.56 |

| Support 3 | 1638.42 | 3120.75 | 14677 | 1040.23 | 79.41 |

| Contract | Dec. Gold | Dec. Silver | Nov. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1345.7 | 2229.7 | 105.44 | 135 1/32 | 1.3722 |

| Resistance 2 | 1334.3 | 2207.8 | 104.91 | 134 15/32 | 1.3686 |

| Resistance 1 | 1324.9 | 2187.7 | 103.94 | 133 31/32 | 1.3653 |

| Pivot | 1313.5 | 2165.8 | 103.41 | 133 13/32 | 1.3617 |

| Support 1 | 1304.1 | 2145.7 | 102.44 | 132 29/32 | 1.3584 |

| Support 2 | 1292.7 | 2123.8 | 101.91 | 132 11/32 | 1.3548 |

| Support 3 | 1283.3 | 2103.7 | 100.94 | 131 27/32 | 1.3515 |

| Contract | Dec Corn | Dec. Wheat | Nov.Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 445.3 | 700.5 | 1297.83 | 428.80 | 41.19 |

| Resistance 2 | 443.8 | 697.8 | 1293.42 | 424.30 | 40.73 |

| Resistance 1 | 441.5 | 693.5 | 1290.83 | 419.80 | 40.50 |

| Pivot | 440.0 | 690.8 | 1286.42 | 415.30 | 40.04 |

| Support 1 | 437.8 | 686.5 | 1283.8 | 410.8 | 39.8 |

| Support 2 | 436.3 | 683.8 | 1279.42 | 406.30 | 39.35 |

| Support 3 | 434.0 | 679.5 | 1276.83 | 401.80 | 39.12 |

| Date | 4:19pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriOct 4 | 2:00am | EUR | German PPI m/m | 0.1% | -0.1% | ||||

| 5:00am | EUR | PPI m/m | 0.1% | 0.3% | |||||

| 9:15am | USD | FOMC Member Dudley Speaks | |||||||

| 9:30am | USD | FOMC Member Stein Speaks |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

So you got a taste of the markets and trading and now you are getting more involved, excited and looking to progress. Many questions ahead for you as a trader and as time progresses you will evolve and find out if trading is suitable for you and if so what type of trading, what type of risk capital and other questions that will come up. Many of these will appear as you progress and your knowledge increase. Some of these questions need to be answered before you start trading.

The answer to question 1 will vary for each trader based on their financial situation but the bottom line is, make sure you trade with money you can afford to lose.

The answer to question 2 has a few levels: First is what asset class are you looking to trade? Stocks/equities? perhaps FOREX or maybe futures? Since my area of expertise is futures, commodities and future options I would like to expand on this asset class.

Trading futures offers many advantages as well as some drawbacks. For many traders who prefer to day trade ( you enter and exit the position during the same session and avoid holding positions from one day to another), trading futures is a great alternative to day trading stocks. In stocks you need to have minimum of $25,000 to day-trade. In futures you only need $2500. The build in leverage in the futures market, intensified by the even more so reduced day trading margins, creates a double edge sword: Small moves can translate into big wins in your pocket BUT small moves against you will also translate into big losses in your account….

Even within the futures asset class you still need to decide what specific market is suitable for your trading style, risk tolerance and personal preferences.

Different markets have different personalities. Some of the most popular markets traders will choose from within the futures markets are:

Stock index futures like mini SP 500, mini NASDAQ futures, mini Dow and Mini Russell. Movement will track the cash index and the overall stock market which most people are familiar with. Great trading volume. Main activity is during the open of the US stock market.

Another popular market is the crude oil futures. A volatile market. Main activity is between midnight to 11 Am EST. This market can experience big moves and sharp moves. Will punish or reward you quickly.

Similar to the crude oil in many ways is gold futures. Each $1 move in gold price will equal $100 in your favor or against you per contract. I have seen gold move $3 to $10 in couple of minutes during volatile times…

This post is probably to short to share everything about the different markets. However, Cannon Trading offers more than a few tools to help you and I highly recommend you take advantage of it.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Wednesday May 30, 2012

Hello Traders,

Join us for a Webinar on May 30

https://www2.gotomeeting.com/register/877581714

Join Greg Weitzman, president and founder of TheTradingZone.com for this educational webinar Market Profile and Volume Nodes, How to locate unique and accurate Support and resistance levels for your intraday trading.

Because Volume is what drives the markets!

In this hour presentation Greg will show you just how easy it is to use Volume based Market Profile in your own trading to locate these highly accurate levels.

As a bonus, all attendees will also get

1. A 30 day demo account from Cannon Trading with our live, advanced charting package

2. A7 day pass to the Live Trading Room

3. a substantial discount on membership at TheTradingZone.com

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Title: Locating accurate, real-time support & resistance levels for intraday trading

Date: Wednesday, May 30, 2012

Time: 1:30 PM – 2:30 PM PDT

After registering you will receive a confirmation email containing information about joining the Webinar.

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.5 or newer

GOOD TRADING!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract June 2012 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1347.77 | 2612.67 | 12708 | 793.40 | 83.37 |

| Resistance 2 | 1340.63 | 2591.83 | 12652 | 785.90 | 83.04 |

| Resistance 1 | 1336.07 | 2575.67 | 12613 | 780.90 | 82.79 |

| Pivot | 1328.93 | 2554.83 | 12557 | 773.40 | 82.46 |

| Support 1 | 1324.37 | 2538.67 | 12518 | 768.40 | 82.21 |

| Support 2 | 1317.23 | 2517.83 | 12462 | 760.90 | 81.88 |

| Support 3 | 1312.67 | 2501.67 | 12423 | 755.90 | 81.63 |

| Contract | Aug Gold | June Euro | July Crude Oil | June Bonds | |

| Resistance 3 | 1615.2 | 1.2672 | 93.88 | 149 4/32 | |

| Resistance 2 | 1600.0 | 1.2623 | 93.04 | 148 22/32 | |

| Resistance 1 | 1578.4 | 1.2559 | 91.92 | 148 3/32 | |

| Pivot | 1563.2 | 1.2510 | 91.08 | 147 21/32 | |

| Support 1 | 1541.6 | 1.2446 | 89.96 | 147 2/32 | |

| Support 2 | 1526.4 | 1.2397 | 89.12 | 146 20/32 | |

| Support 3 | 1504.8 | 1.2333 | 88.00 | 146 1/32 |

| Contract | July Corn | July Wheat | July Beans | July Silver | |

| Resistance 3 | 601.7 | 673.2 | 1418.50 | 2938.5 | |

| Resistance 2 | 591.8 | 669.6 | 1410.25 | 2902.5 | |

| Resistance 1 | 577.2 | 663.2 | 1398.50 | 2843.0 | |

| Pivot | 567.3 | 659.6 | 1390.25 | 2807.0 | |

| Support 1 | 552.7 | 653.2 | 1378.5 | 2747.5 | |

| Support 2 | 542.8 | 649.6 | 1370.25 | 2711.5 | |

| Support 3 | 528.2 | 643.2 | 1358.50 | 2652.0 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

http://www.forexfactory.com/calendar.php

Jump to a section in this post:

1. Market Commentary

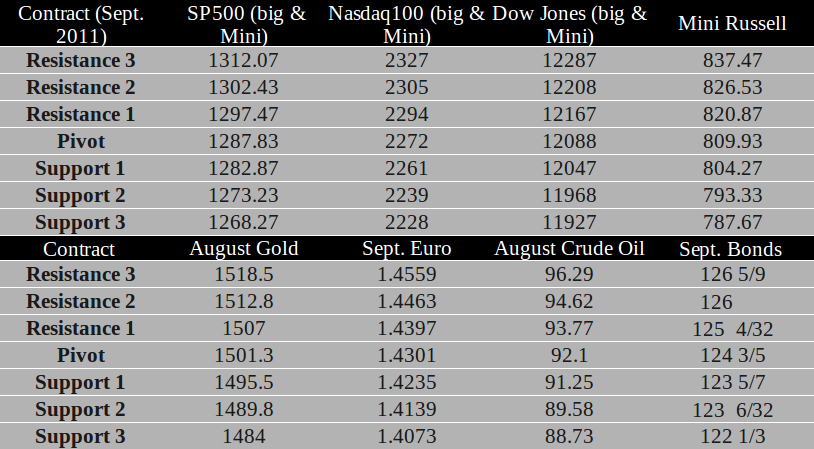

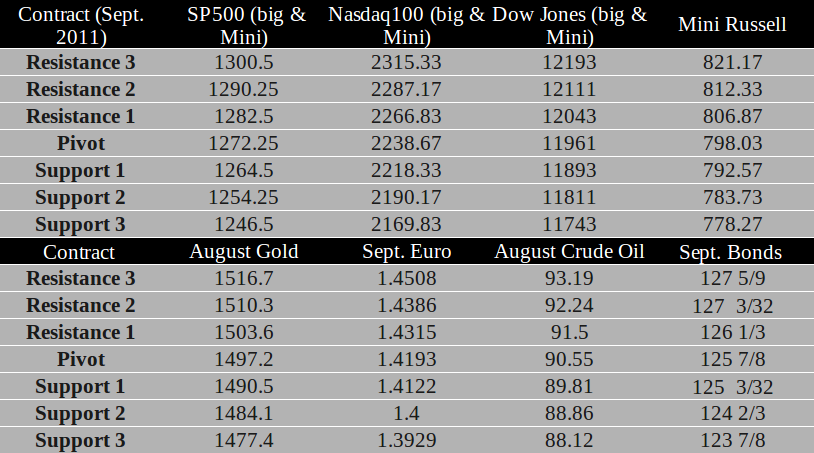

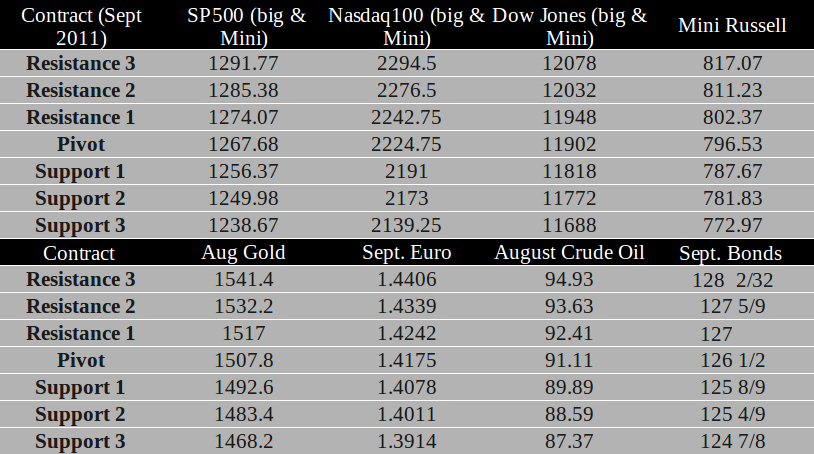

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

| Simple yet Powerful approach to using Market Profile in your trading | |||||||||||||||||||

|

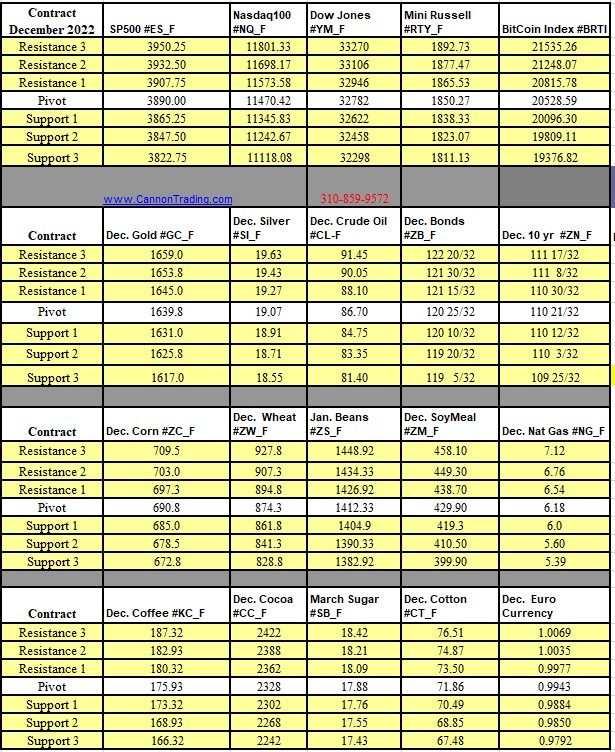

| Contract (Dec. 2011) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1308.77 | 2422.00 | 12592 | 786.33 |

| Resistance Level 2 | 1303.78 | 2412.00 | 12553 | 780.67 |

| Resistance Level 1 | 1296.27 | 2401.00 | 12487 | 771.93 |

| Pivot Point | 1291.28 | 2391.00 | 12448 | 766.27 |

| Support Level 1 | 1283.77 | 2380.00 | 12382 | 757.53 |

| Support Level 2 | 1278.78 | 2370.00 | 12343 | 751.87 |

| Support Level 3 | 1271.27 | 2359.00 | 12277 | 743.13 |

| Contract | Feb. Gold | Dec. Euro | Jan. Crude Oil | March. Bonds |

| Resistance Level 3 | 1691.7 | 1.2991 | 103.09 | 146 21/32 |

| Resistance Level 2 | 1679.9 | 1.2906 | 102.05 | 146 |

| Resistance Level 1 | 1665.8 | 1.2822 | 101.41 | 145 16/32 |

| Pivot Point | 1654.0 | 1.2737 | 100.37 | 144 27/32 |

| Support Level 1 | 1639.9 | 1.2653 | 99.73 | 144 11/32 |

| Support Level 2 | 1628.1 | 1.2568 | 98.69 | 143 22/32 |

| Support Level 3 | 1614.0 | 1.2484 | 98.05 | 143 6/32 |

| Contract | March Corn | March Wheat | Jan. Beans | March. Silver |

| Resistance Level 3 | 614.6 | 614.8 | 1205.67 | 3124.7 |

| Resistance Level 2 | 611.7 | 611.9 | 1195.83 | 3090.8 |

| Resistance Level 1 | 607.8 | 608.3 | 1189.67 | 3046.2 |

| Pivot Point | 604.9 | 605.4 | 1179.83 | 3012.3 |

| Support Level 1 | 601.1 | 601.8 | 1173.7 | 2967.7 |

| Support Level 2 | 598.2 | 598.9 | 1163.83 | 2933.8 |

| Support Level 3 | 594.3 | 595.3 | 1157.67 | 2889.2 |

For your review, you can see my intra-day chart for the mini SP from today’s session.

You can view this chart and other charts by registering to the daily , live charts service trial at:

Would you like to have access to my DIAMOND ALGO as shown above?

Come and view it in real time by visiting:

GOOD TRADING!

Core Durable Goods Orders m/m

8:30am USD

Durable Goods Orders m/m

8:30am USD

Crude Oil Inventories

10:30am USD

Beige Book

2:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer

GOOD TRADING!

Pending Home Sales m/m

10:00am USD

Crude Oil Inventories

10:30am USD

FOMC Member Raskin Speaks

12:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer

GOOD TRADING!

S&P/CS Composite-20 HPI y/y

9:00am USD

CB Consumer Confidence

10:00am USD

Richmond Manufacturing Index

10:00am USD

FOMC Member Fisher Speaks

12:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer

GOOD TRADING!

Core PCE Price Index m/m

8:30am USD

Personal Spending m/m

8:30am USD

Personal Income m/m

8:30am USD

FOMC Member Kocherlakota Speaks

11:00am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Join us for a Webinar on February 23

Space is limited.

Reserve Your Webinar Seat Now at: https://www2.gotomeeting.com/register/477215826

This Wednesday, February 23rd , Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 8:15 AM central time.

During the webinar you will see chart like the one below from today’s sessions and Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Title: | life after mini SP – Day trading crude oil futures ” buying the fear, selling the greed” | |

| Date: | Wednesday, February 23, 2011 | |

| Time: | 6:15 AM – 8:00 AM PST |

| After registering you will receive a confirmation email containing information about joining the Webinar. |

| System Requirements PC-based attendees Required: Windows® 7, Vista, XP or 2003 Server |

| Macintosh®-based attendees Required: Mac OS® X 10.4.11 (Tiger®) or newer |

GOOD TRADING!

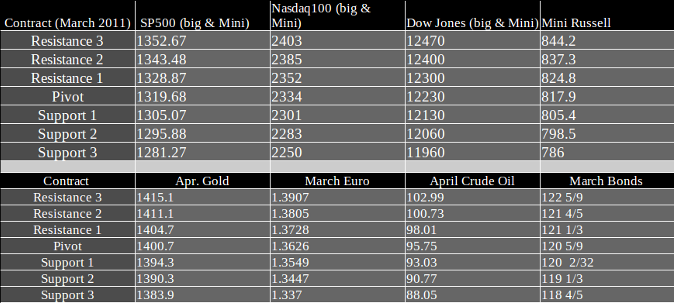

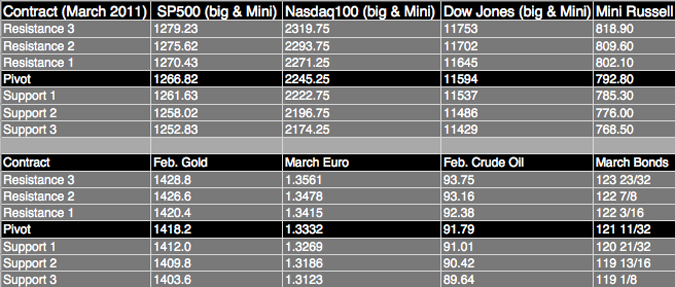

Futures trading levels February 23

Economics Report Source: http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

Wed Feb 23

Existing Home Sales

10:00am USD

FOMC Member Plosser Speaks

1:30pm USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Join us for a Webinar on January 5th

Space is limited.

Reserve your Webinar seat now at:

https://www2.gotomeeting.com/register/834358098

This Wednesday, January 5th , Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 8:15 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Title: Live Day-Trading webinar with real time mini SP, Crude Oil and Euro Currency set ups

Date: Wednesday, January 5, 2011

Time: 6:15 AM – 10:00 AM PST

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

GOOD TRADING!

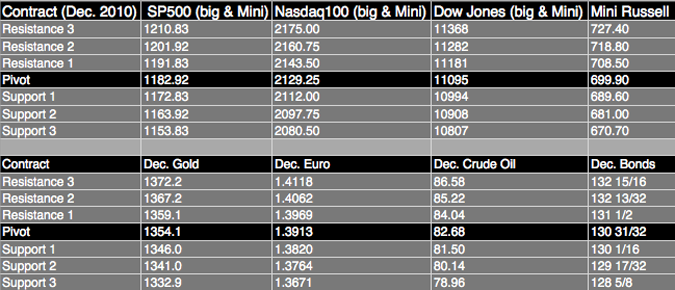

Trading Levels

Economics Report Source: http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

Tuesday, January 4, 2011

Factory Orders m/m

10:00am USD

Total Vehicle Sales

All Day USD

FOMC Meeting Minutes

2:00pm USD

Treasury Currency Report

Tentative USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Two day FOMC starts tomorrow along with preliminary election news. Should provide for some interesting action in the second part of the trading week.

In between I still don’t see a longer term or a medium term swing trading set up I like, hence I currently focus on intraday set ups which I share in my daily “live charts/ webinar” service.

Daily Futures Day Trading Webinar:

**************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************

GOOD TRADING!

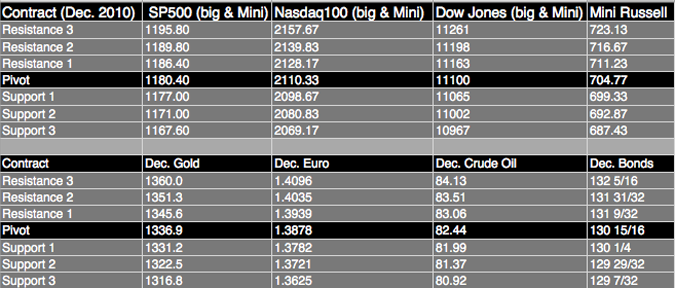

TRADING LEVELS

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Tuesday, November 2nd 2010 – http://mam.econoday.com/byweek.asp?cust=mam

FOMC Meeting Begins

Motor Vehicle Sales

ICSC-Goldman Store Sales

7:45 AM ET

Redbook

8:55 AM ET

4-Week Bill Auction

11:30 AM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Stocks finished pretty much unchanged today, which brings me to another point….

There ARE OTHER MARKETS one can day-trade….Most day-traders focus on the Mini SP 500 and it’s relatives:

Mini Nasdaq, Mini Dow, Mini Russell etc. because of volume, familiarity, trading hours etc.

However, markets like bonds, Euro Currency, Crude oil, beans, corn to name a few do offer day trading opportunities and risks. Different market have different personalities which may fit different traders. Different markets also have different trading hours when volatility is present, different volatility at different times and other

characteristics which traders may want to explore. During the day-trading charts service I hold daily, I feature the mini SP 500 chart along with Euro currency and Crude oil and possible trade set ups.

As always I recommend using demo account when exploring trading in market you normally don’t trade, as well as performing some research regarding tick size, price behavior and more.

FREE Trial for the Day-Trading Charts Service:

*************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

*************************************************************

GOOD TRADING!

TRADING LEVELS

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Wednesday, October 27th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

MBA Purchase Applications

[Bullet7:00 AM ET

Durable Goods Orders

[Report][Star]8:30 AM ET

New Home Sales

[Report][djStar]10:00 AM ET

EIA Petroleum Status Report

[djStar]10:30 AM ET

5-Yr Note Auction

[Bullet1:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Have a great weekend!! take time to clear your “trading brain” and allow it to recharge.

Screen shot from today’s session during our “live charts” service where one can see real-time trade set ups like below

(blue diamonds = possible buy, red diamonds = possible sell)

Charts included in this service are: Mini SP 500, Euro Currency and Crude oil.

For a Free Day Trading Webinar Trial Please Visit:

**************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************************

SP 500 Day Trading

GOOD TRADING!

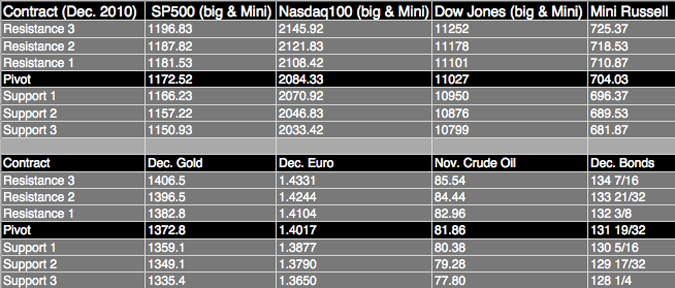

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Monday, October 18th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Same comments from yesterday and the day before still hold true….main difference is the tomorrow is quadruple witching day so I am hopeful that we finally break out one way or the other……

Well by now this is the 3rd or 4th time we are knocking on 1122.75…..that means one out of two (in my opinion): Tomorrow morning reports help this market break this level and start another leg up towards 1157.00

OR…..

Market fails one more time against this level, fills the gap below ( 1105.75) before giving us some additional clues.

I would love to have the “correct answer” to give you but only time and price action will tell….

SP 500 Day Trading

GOOD TRADING!

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Friday, September 17th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

Quadruple Witching

Market Focus »

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

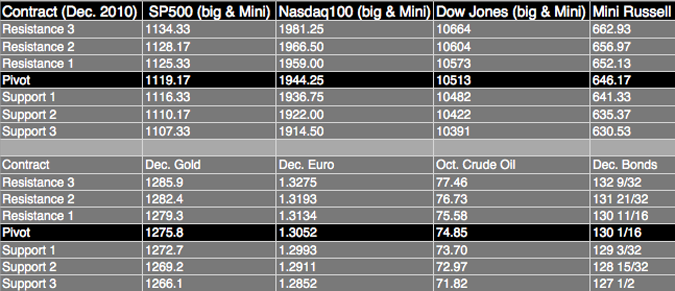

We bounced pretty good from major support early this morning. Some levels to pay attention to as we start a new week in the mini Dow chart below. Until then, relax, clear your head from trading, “what you could have done and should have done” etc…..write a journal if needed, learn from mistakes when you can but don’t let negative energy hurt your trading.

Have a great weekend!

YM – E-Mini Dow Futures – $5 Multiplier, Equalized Active Daily Continuation

GOOD TRADING!

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Monday, August 30th – http://mam.econoday.com/byweek.asp?cust=mam

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

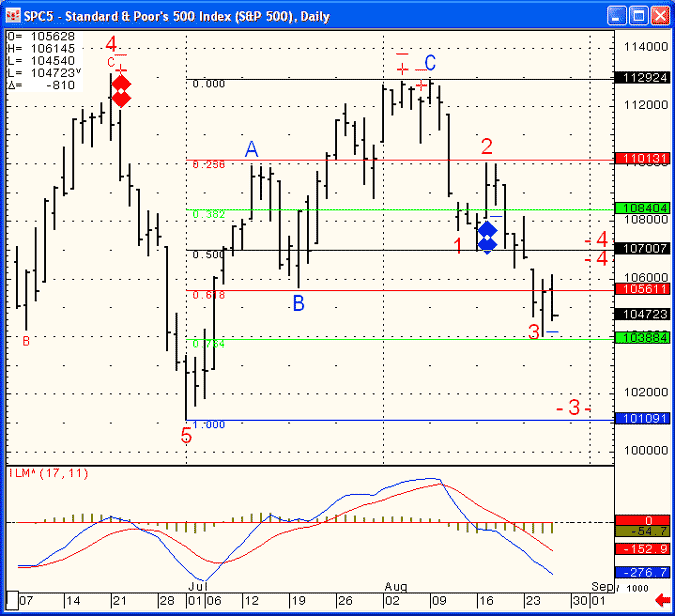

Market is showing weakening signs. We need to hold previous lows of 1037 and rally in order to gain any upside momentum. Break of this level can bring 1000.75 much quicker.

I have a feeling traders will have potential for trades on both sides depending on volatility and pre market GDP report tomorrow.

A chart of the SP 500 CASH INDEX for your review below:

SPC5 – Standard & Poor’s 500 Index (S&P 500), Daily

GOOD TRADING!

Futures Trading Levels

This Week’s Calendar from Econoday.Com

All reports are EST time

Friday, August 27th – http://mam.econoday.com/byweek.asp?cust=mam

Weekly Bill Settlement

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

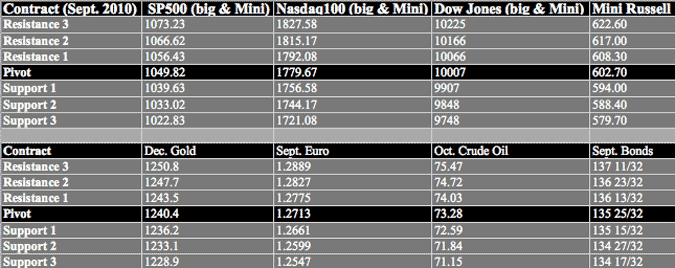

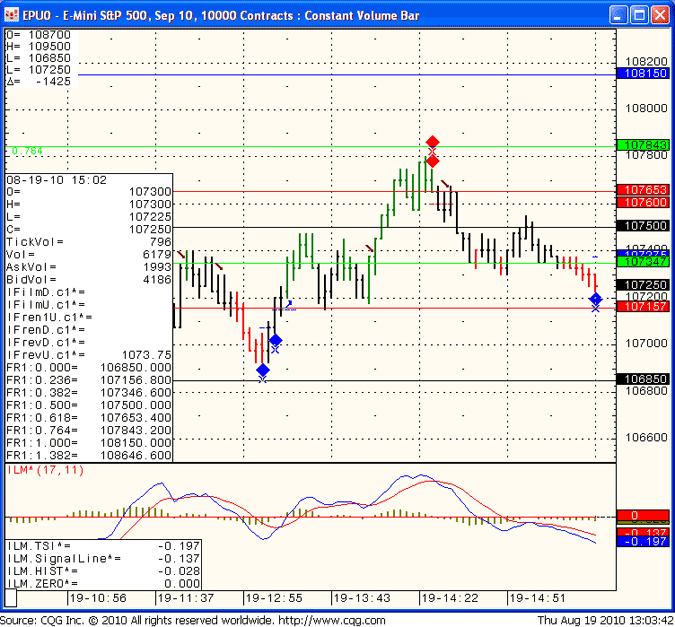

Below is a screen shot from today’s “Live Chart” service I provide. If you are interested in 2 weeks free trail,

please visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

EPUO – E-mini S&P 500, Sep 10, 10000 Contracts : Constant Volume Bar

Futures & Commodity Trading Levels (Potential Support/Resistance)

This Week’s Calendar from Econoday.Com

All reports are EST time

Thursday, August 26th – http://mam.econoday.com/byweek.asp?cust=mam

Weekly Bill Settlement

Jobless Claims

8:30 AM ET

EIA Natural Gas Report

10:30 AM ET

3-Month Bill Announcement

11:00 AM ET

6-Month Bill Announcement

11:00 AM ET

7-Yr Note Auction

1:00 PM ET

Fed Balance Sheet

4:30 PM ET

Money Supply

4:30 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Yesterday I mentioned the following:

Daily chart of the mini Russell, which I consider the leader, for review below. Looks like we may get a test of previous lows and if and then the big question.. do we bounce or do we start a new leg lower:

Well the big question for this point in time is here.. we met the initial target of 1049 and from a technical point of view we are looking at some wide bands. 1049 being pivot line, 1080 being resistance and 1000.75 being major support.

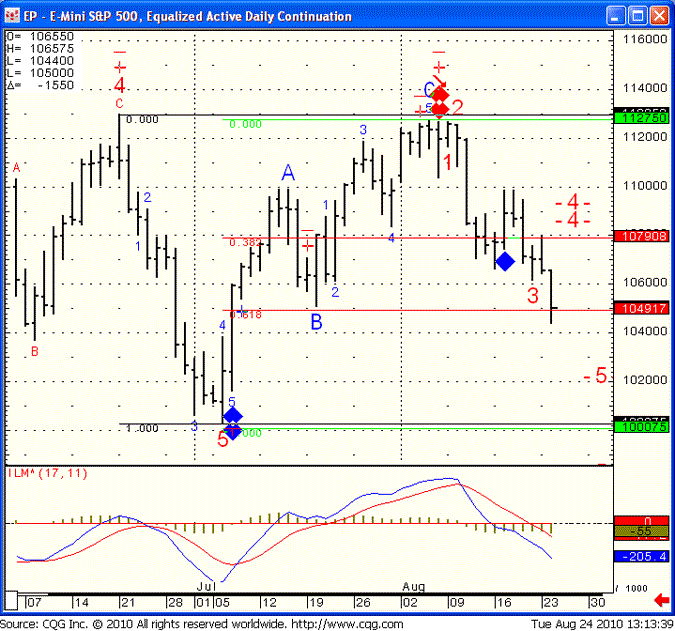

Today I am sharing daily chart of the mini SP 500 for review:

to sign for free trail, visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

EP – E- Mini S&P 500, Equal Active Daily Continuation