Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

I was asked this morning, “what futures markets would you recommend a newcomer to start with?”

While the answer will vary based on perspective trader risk capital, risk tolerance, personality etc. I do think that there are a few markets that might be a better start for first time futures day trader.

I personally would say, leave the mini SP alone. yes it has the biggest volume but there is quite a bit of size on the bid/ask that may make this frustrating for new traders.

My favorite markets to share with first time traders are:

The mini Dow moves similar to mini sp but the value per point/tick is smaller, still has good volume but not as hard to get filled on the limits as the mini SP

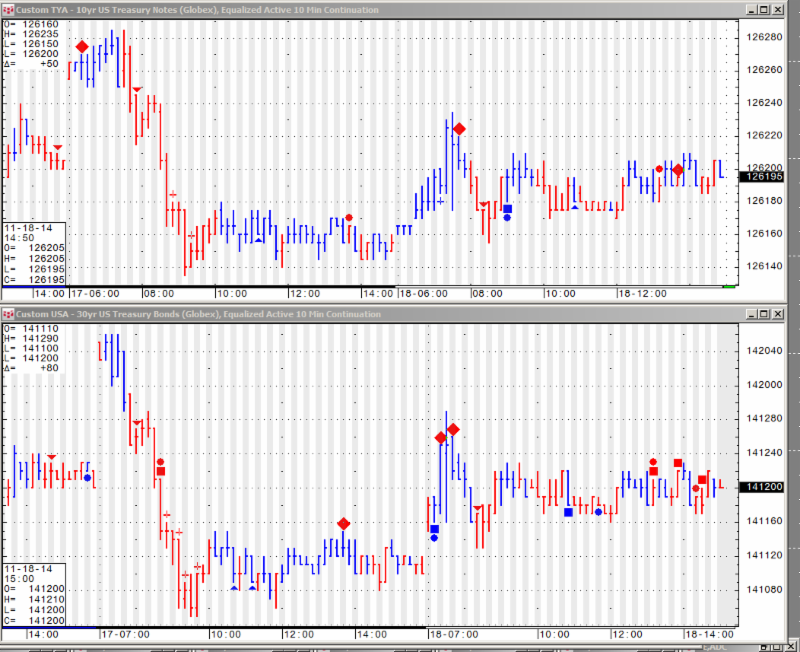

The 10 year notes are usually less volatile than the other markets mentioned. Completely different type of trading personality and offer a good diversification option for new traders and experienced traders. The 30 year bonds will move a bit more than the 10 years and are a bit more volatile but very similar. If you are moving from beginner to intermediate, trading the spread between the 10 years and the 30 years is an option to explore! I included a chart of both for reference below.

The mini gold and mini crude are another good option because it is the smaller contract size of two markets that can really move, offer volatility and RISK but the availability of the mini sized contracts make these two a better option for beginners until one has experience / risk capital and appetite for the standard contract sizes of gold and crude oil.

Ten Years and 30 years 10 minutes chart:

Custom TYA – 10 YR US Treasury Notes (Globex), Equalized Active 10 Min Continuation

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Dec. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2075.50 | 4304.75 | 17806 | 1188.23 | 88.29 |

| Resistance 2 | 2064.75 | 4276.75 | 17753 | 1182.37 | 88.13 |

| Resistance 1 | 2057.25 | 4259.00 | 17706 | 1175.23 | 87.89 |

| Pivot | 2046.50 | 4231.00 | 17653 | 1169.37 | 87.73 |

| Support 1 | 2039.00 | 4213.25 | 17606 | 1162.23 | 87.48 |

| Support 2 | 2028.25 | 4185.25 | 17553 | 1156.37 | 87.32 |

| Support 3 | 2020.75 | 4167.50 | 17506 | 1149.23 | 87.08 |

| Contract | Dec. Gold | Dec.Silver | Dec. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1227.4 | 16.83 | 77.96 | 142 13/32 | 1.2679 |

| Resistance 2 | 1215.8 | 16.62 | 77.20 | 142 5/32 | 1.2613 |

| Resistance 1 | 1206.0 | 16.40 | 75.75 | 141 29/32 | 1.2576 |

| Pivot | 1194.4 | 16.19 | 74.99 | 141 21/32 | 1.2510 |

| Support 1 | 1184.6 | 15.97 | 73.54 | 141 13/32 | 1.2473 |

| Support 2 | 1173.0 | 15.76 | 72.78 | 141 5/32 | 1.2407 |

| Support 3 | 1163.2 | 15.54 | 71.33 | 140 29/32 | 1.2370 |

| Contract | Dec Corn | Dec. Wheat | Jan. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 379.0 | 552.3 | 1050.83 | 402.83 | 33.17 |

| Resistance 2 | 377.5 | 551.0 | 1044.42 | 397.67 | 33.04 |

| Resistance 1 | 374.8 | 550.0 | 1033.83 | 387.83 | 32.84 |

| Pivot | 373.3 | 548.8 | 1027.42 | 382.67 | 32.71 |

| Support 1 | 370.5 | 547.8 | 1016.8 | 372.8 | 32.5 |

| Support 2 | 369.0 | 546.5 | 1010.42 | 367.67 | 32.38 |

| Support 3 | 366.3 | 545.5 | 999.83 | 357.83 | 32.18 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.