Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Tomorrow Fed Members Mester and Bostic are speaking @ 7:15 and 7:55 am CDT respectively. Retail sales numbers will be released during Mester’s words @ 7:30 am CDT. Analysts expect Retail sales to rise .07 % from March’s numbers that were negative for auto’s and gasoline. Industrial production will be released shortly thereafter and during Bostic’s speaking engagement @ 8:15am CDT. Analysts expect a flat IP number with capacity utilization lower by a few percentage points as layoffs may accelerate in the manufacturing sector. Wednesday we will see Housing Starts and permits. Analysts have revealed “Housing starts in March edged lower to a 1.420 million annualized rate; April is expected to slip further to 1.405 million. Permits, at 1.413 million in March and, though lower than expected, very near the starts rate, is expected to rise to 1.430 million.” per Econoday. Jobless claims will be Thursday’s highlighted report and expected to fall within the 250-270K range. Existing Home Sales top of the week’s reports @ 9am CDT sandwiched in between Fed governor speech’s , Jefferson @ 8:05 am CDT and Logan @ 9 am CDT,, remember that markets like to discount expectations and only move when the data is out of line with expectations.. we wrap up the Fed Governor’s speeches for the week when the big Kahuna , Fed Chair Jerome Powell will be speaking publically Friday @ 10am CDT!..

As always, plan your trade and trade your plan!

Then here is your golden opportunity. CME Group will be launching the Go for Gold Precious Metals Trading Challenge coming this June.

You’ll have the opportunity to practice trading highly liquid Precious Metals products while competing against other traders for the chance to win the grand prize of a 1 oz. bar of gold*.

During the challenge, you’ll explore our suite of precious metals contracts and test-drive strategies in a simulated environment. We’ll send you exclusive, daily education materials on precious metals contracts in order for you to feel prepared to trade and confidently compete against your peers.

*Participants will only be eligible to receive a 1 oz. gold bar if permitted in accordance with the applicable laws of their jurisdiction.

START DATE: June 4, 2023

END DATE: June 9, 2023

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

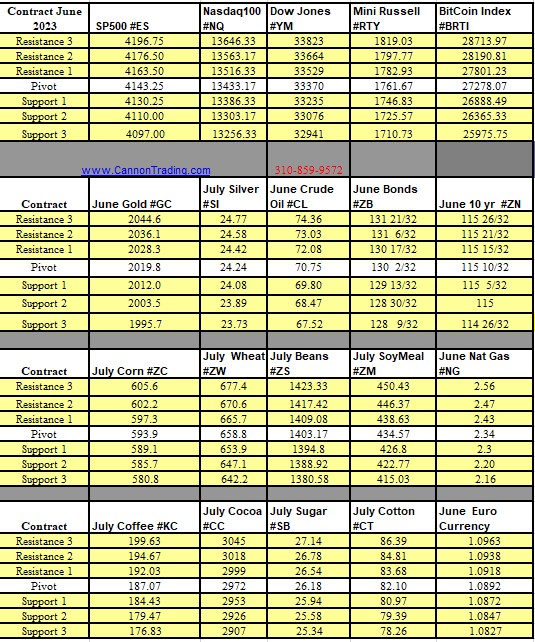

for 05-16-2023

Economic reports for future traders

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.