Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Somewhat of a quiet day on the futures exchange to start the week after some volatile sessions last week. As I’ve said many times before, if a trader can recognize early enough during the trading session, what type of trading day is about to unfold, then one can use the proper day-trading technique more suitable for that day.

Some examples may include: join the trend on trending day, mean aversion techniques on choppy days and much more.

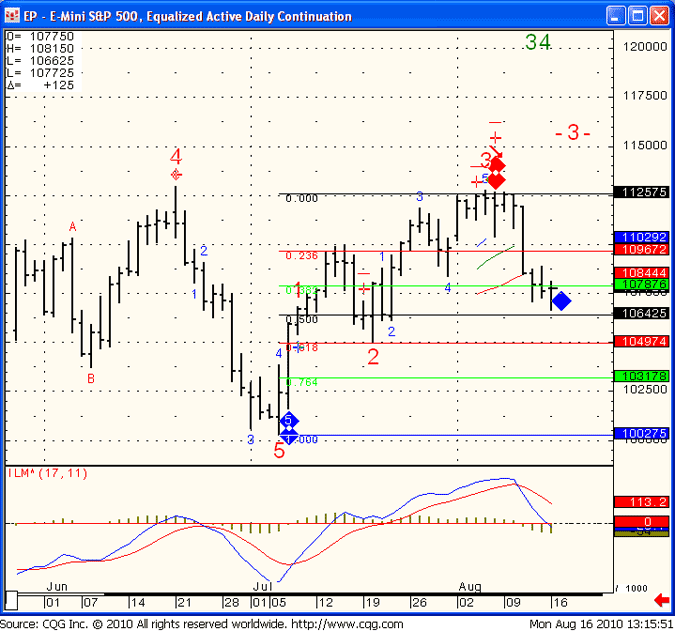

On a different note, I got a blue diamond for tomorrow’s session which can mean potential up day if the market can break above 1083.00 or….continued decline if it fails to gain some upside momentum. Daily chart for review below:

EP – E- Mini S&P 500, Equal Active Daily Continuation

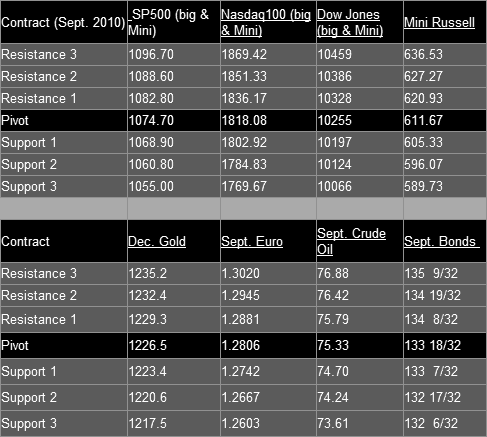

Futures & Commodity Trading Levels (Potential Support/Resistance)

This Week’s Calendar from Econoday.Com

All reports are EST time

Tuesday August 17th – http://mam.econoday.com/byweek.asp?cust=mam

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!