Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Volatile action in the markets as events around the globe are injecting some fear factor into the markets.

It may take a while before the bears get over their fear factor of going short due to QE but at least at this point we are noticing the bulls finally having a little more fear as well……

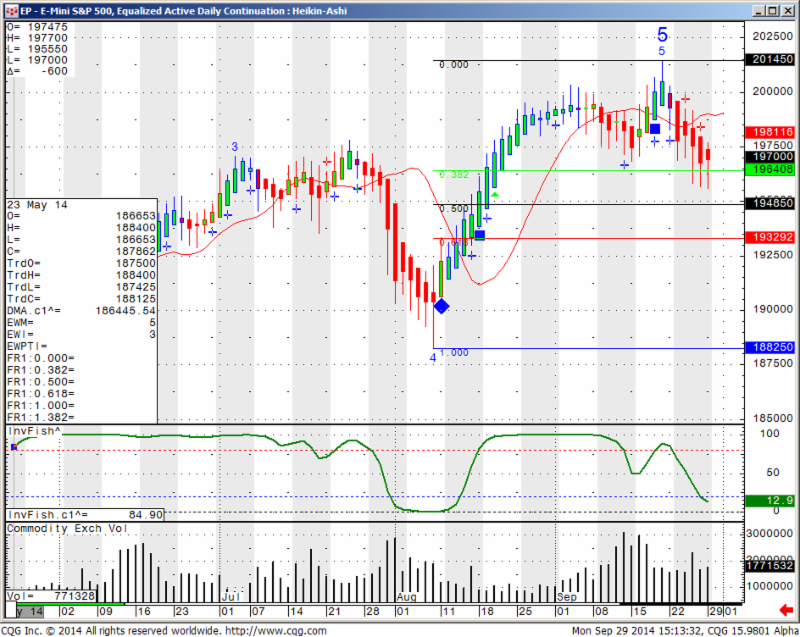

My thought for the SP500 is that we need to see a break below 1955, preferably below 1948.50 to accumulate more momentum and speed to the downside.

At this point I am leaning towards selling rallies but one needs to be flexible and adapt to this market which is picking up volatility and seems to go through a changing personality right now.

Daily Heikin-Ashi chart of Dec. Mini SP 500 futures for your review below:

EP – E Mini S&P 500, Equalized Active Daily Continuation : Heikin-Ashi

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Dec. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2000.17 | 4110.42 | 17250 | 1136.17 | 86.25 |

| Resistance 2 | 1988.58 | 4080.83 | 17145 | 1126.33 | 86.09 |

| Resistance 1 | 1978.67 | 4057.17 | 17059 | 1119.27 | 85.91 |

| Pivot | 1967.08 | 4027.58 | 16954 | 1109.43 | 85.75 |

| Support 1 | 1957.17 | 4003.92 | 16868 | 1102.37 | 85.57 |

| Support 2 | 1945.58 | 3974.33 | 16763 | 1092.53 | 85.41 |

| Support 3 | 1935.67 | 3950.67 | 16677 | 1085.47 | 85.23 |

| Contract | December Gold | Dec.Silver | Nov. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1229.7 | 17.80 | 97.07 | 139 1/32 | 1.2774 |

| Resistance 2 | 1226.8 | 17.72 | 95.85 | 138 26/32 | 1.2748 |

| Resistance 1 | 1221.6 | 17.60 | 95.17 | 138 19/32 | 1.2722 |

| Pivot | 1218.7 | 17.51 | 93.95 | 138 12/32 | 1.2696 |

| Support 1 | 1213.5 | 17.39 | 93.27 | 138 5/32 | 1.2670 |

| Support 2 | 1210.6 | 17.31 | 92.05 | 137 30/32 | 1.2644 |

| Support 3 | 1205.4 | 17.19 | 91.37 | 137 23/32 | 1.2618 |

| Contract | Dec Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 329.2 | 484.2 | 945.83 | 310.93 | 33.98 |

| Resistance 2 | 327.6 | 483.1 | 935.17 | 307.77 | 33.46 |

| Resistance 1 | 326.7 | 482.2 | 929.33 | 305.83 | 33.21 |

| Pivot | 325.1 | 481.1 | 918.67 | 302.67 | 32.69 |

| Support 1 | 324.2 | 480.2 | 912.8 | 300.7 | 32.4 |

| Support 2 | 322.6 | 479.1 | 902.17 | 297.57 | 31.92 |

| Support 3 | 321.7 | 478.2 | 896.33 | 295.63 | 31.67 |

| Date | 4:18pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueSep 30 | 2:00am | EUR | German Retail Sales m/m | 0.6% | -1.4% | ||||

| 2:45am | EUR | French Consumer Spending m/m | -0.2% | ||||||

| Jul Data | EUR | French Consumer Spending m/m | -0.3% | 0.9% | |||||

| 3:55am | EUR | German Unemployment Change | -2K | 2K | |||||

| 4:00am | EUR | Italian Monthly Unemployment Rate | 12.6% | 12.6% | |||||

| 5:00am | EUR | CPI Flash Estimate y/y | 0.3% | 0.4% | |||||

| EUR | Core CPI Flash Estimate y/y | 0.9% | 0.9% | ||||||

| EUR | Unemployment Rate | 11.5% | 11.5% | ||||||

| EUR | Italian Prelim CPI m/m | -0.3% | 0.2% | ||||||

| 9:00am | USD | S&P/CS Composite-20 HPI y/y | 7.5% | 8.1% | |||||

| 9:45am | USD | Chicago PMI | 61.6 | 64.3 | |||||

| 10:00am | USD | CB Consumer Confidence | 92.2 | 92.4 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.