Get Real Time updates and more on our private FB group!

“I use mental stops”…..Said the trader who just blew up his account day trading crude oil the wrong way…..

By Mark O’Brien

As futures brokers, we’ve heard clients share their thoughts on trading and truly, their strategies are as unique as the individual trader. With that said, there are a number of “nuts and bolts” to trading that all traders can employ – or not. One example of these is the

STOP order. We as brokers hear a variety of assertions from our clients as to the virtues or evils of employing STOP orders in their trading.

In this blog we’re going to showcase today’s price activity in

April crude oil to make a case for the virtues of employing STOP orders.

Notwithstanding the almost unheard-of ±$23/$23,000 per contract price range, at one point, the April crude oil contract fell ±$10 per barrel/$10,000 per contract in the span of five minutes.

As we’ve spelled out in recent blogs, with the Russian attack on Ukraine and all the geopolitical moving parts now involved in the conflict, commodity price volatility has reached remarkable heights across several asset classes – energies in particular. So be it, but this provides us with low hanging fruit, as it were, to advocate for the use of STOP orders. Price moves like this literally scream for the implementation of STOP orders, lest you find your proverbial trading legs cut off at the knees – or worse. If you find yourself eyeing

crude oil,

unleaded gas,

gold, wheat, any stock index, just to list the recent headliners, transpose those mental stops to actual orders. Trade safely and sanely.

5 min chart of crude oil from today when the news on OPEC send crude oil tumbling over $15 in minutes. If you were long, with “mental stops”….good luck.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

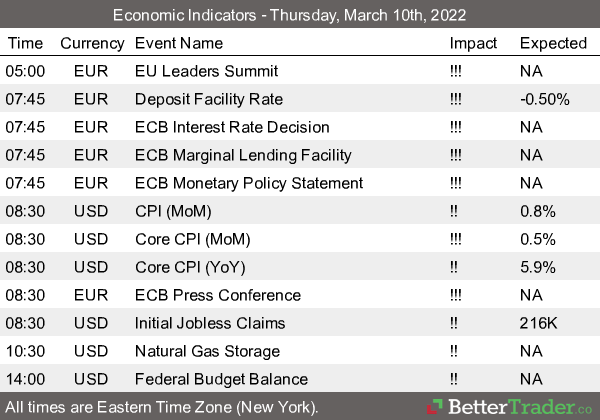

03-10-2022

Improve Your Trading Skills

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.