Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

General: The March Consumer Price Index came in cooler than expected, showing a rise of 0.1% in March. Economists polled by Dow Jones were expecting CPI to rise by 0.2% month over month.

Minutes from the Federal Reserve’s March policy meeting showed officials feared that the economy could tilt into a mild recession later this year in the wake of the U.S. banking crisis.

Yesterday, Bitcoin futures (BTC) pushed over the $30,000 level for the first time since June 2022. This on the heels of a ±10,000-point move from March 10 when the April contract traded to an intraday low of 19,620 and closed at 20,110.

Today, May orange juice futures closed at an all-time high of $2.8490 per pound a remarkable ±80-cent / $12,000 move from late January. This year, the U.S. orange crop is forecast to be the smallest since 1937. Output has generally been in decline since peaking 25 years ago, though this year’s losses in Florida – a global top producer still – are extremely sharp. Yesterday, the USDA pegged the 2022-2023 U.S. orange crop at 62.25 million boxes, an 86-year low and down 23% on the year. That is less than 20% of U.S. output compared to the record 1997-1998 season.

May sugar futures traded today to 6 1/2 -year highs and an intraday high of 24.85 cents/pound continuing its months-long charge from the 17-18-cent range (one cent = $1,120). News of lower-than-expected production in some key regions and tightening supplies have persisted into the year.

For the seventh consecutive session, June gold has closed above $2,000/ounce. Referencing the Fed minutes mentioned above, economists have cited rising interest rates and now a potentially more acute slowdown in lending after the collapse of several U.S. banks as a possible trigger of a recession this year. The prospect of a U.S. recession boosts safe-haven demand for gold, which has been on a tear since early-March – with a ±$200 per ounce / $20,000 move.

Plan your trade and trade your plan.

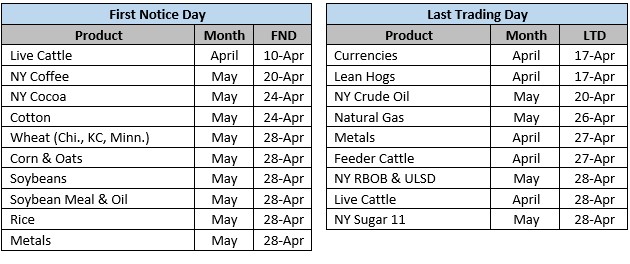

First Notice and Last trading Days for the month of May below

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 04-13-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.