Cannon Futures Weekly Newsletter Issue # 1123

How is your IRA / 401k doing?

When the stock market declines, most retirement accounts lose value. That’s because IRA / 401k investments tend to be largely invested in purchased stocks – via stock mutual funds and/or an assortment of individual stocks.

But, did you know there are investments available for IRA’s and 401k’s that can provide positive returns in both up and down markets? Consider making an inquiry into our selection of automated trading systems that trade stock index futures contracts that track the major stock indexes like the

S&P, S&P Midcap,

Nasdaq,

Dow Jones and

Russell 2000.

If you are looking to diversify your current IRA or 401k portfolio with futures trading, but have little time or know-how to pursue things, one great first step would be to explore some of options we offer here at Cannon Trading CO.

Our licensed, experienced brokers are happy to provide feedback any of the automated trading systems from our selection, based on your available risk capital, your risk tolerance, overall financial goals.

Below please find links to some of systems we follow. Some examples of these systems are below for you review. Keep in mind that futures trading is risky and not suitable for everyone.

OR

Call A commodity Trading Specialist at 800-454-9572

Futures trading is complex and carries the risk of substantial losses. It is not suitable for all investors. The ability to withstand losses and to adhere to a particular trading program in spite of trading losses are material points which can adversely affect investor returns.

Hot Market

Gold futures snapped a downtrend of over a few months when they broke above the 1692 levels this week

Short covering rally along with higher interest rates fueled this market. Bitcoin weakness also helped the yellow metal safe heaven status.

Next possible upside target is 1805.

1692 support must hold.

Futures Trading Levels

11-14-2022

Daily Levels

SP500 #ES_FNasdaq100 #NQ_FDow Jones #YM_FMini Russell #RTY_FBitCoin Index #BRTI SP500 Dec. Gold #GC_F Dec. Silver #SI_F Oct. Crude Oil #CL-F Dec. Bonds #ZB_F Dec. 10 yr #ZN_F Dec. Corn #ZC_F Dec. Wheat #ZW_F Nov. Beans #ZS_F Dec. SoyMeal #ZM_F Oct. Nat Gas #NG_F Dec. Coffee #KC_F Dec. Cocoa #CC_F October Sugar #SB_F Dec. Cotton #CT_F Sept. Euro Currency

Weekly Levels

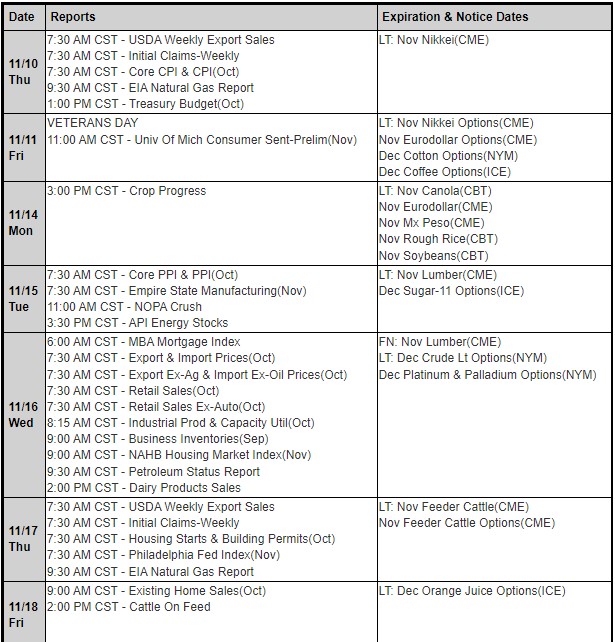

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading