Cannon Futures Weekly Newsletter Issue # 1143

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – FOMC is this Week!

- Trading Resource of the Week – What are the “Big Boys” Up To?

- Hot Market of the Week – June Heating Oil

- Broker’s Trading System of the Week – Free Consultation

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices – FOMC this week with statement and rate decision due Wednesday

The following are my PERSONAL suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 3925.00 with a stop at 3919.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 3919.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Keep in mind statement comes out at 1 Pm Central time, the news conference which dissects the language comes out 30 minutes later so the volatility window stretches out.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

-

Trading Resource of the Week – What are the Big Boys up to?

Trading 102: Commitment of Traders Report – What Lies beneath

In this 24 page PDF booklet, Gary Kamen of Trends in Futures reviews the commitment of traders report, what it means, how traders can utilize it and much more.

Sign up and instantly download the booklet and learn about:

* History of the COT report

* Why is this report important?

* The new COT report

* How can you use the information in this report?

* And much more….

A Cannon broker will be able to assist, provide feedback and answer any questions.

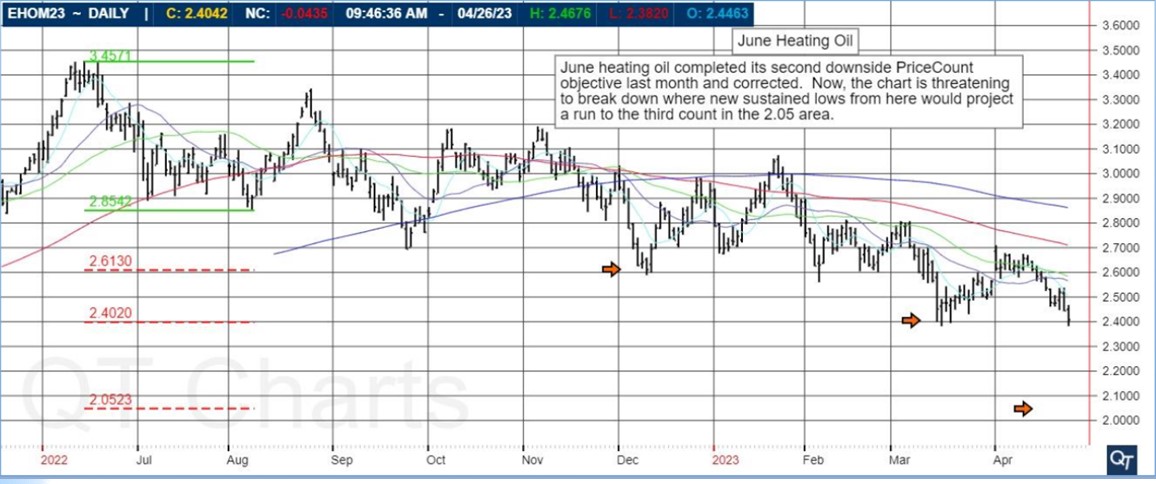

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

June heating oil completed its second downside PriceCount objective last month and corrected. Now, the chart is threatening to break down where new sustained lows from here would project a run to the third count in the 2.05 area

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at

www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

Are you too busy to trade? Perhaps you’re not confident enough and you’re trading. Maybe you’re looking to the diversify your own trading with algorithmic trading or what we call automated trading. One of the best resources you can utilize is our Brokers will be happy to provide feedback and consultation based on your specific needs, risk tolerance, and goals.

Questions about the markets? trading? platforms? technology? trading systems? Get answers with a complimentary,

confidential consultation with a Cannon Trading Company series 3 broker.

-

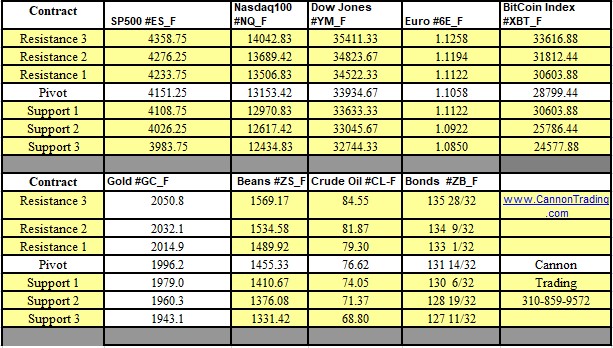

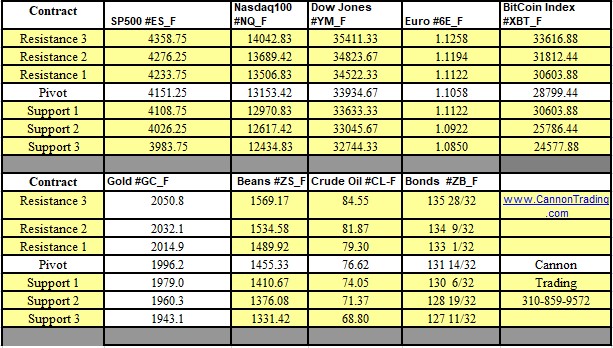

Trading Levels for Next Week

Daily Levels for May 1st, 2022

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Weekly Levels

-

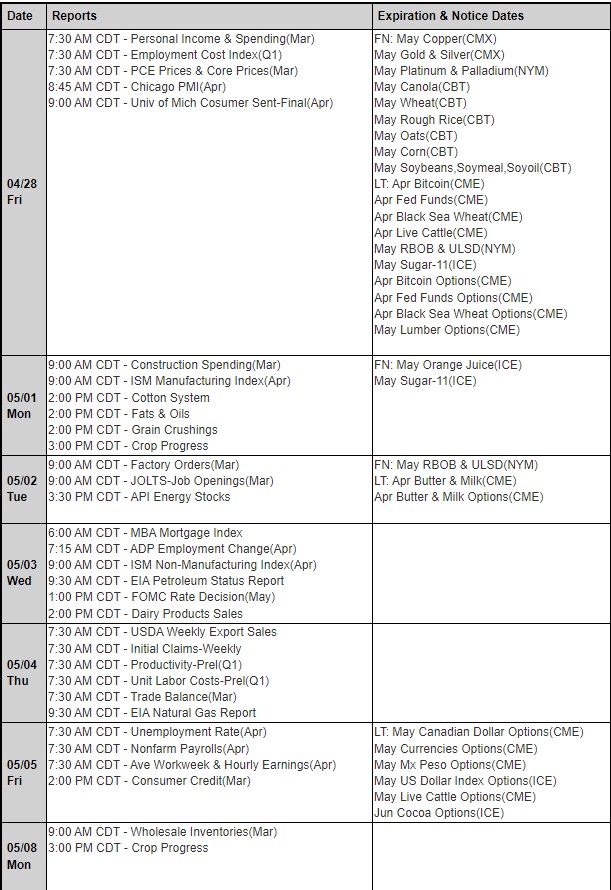

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading