Cannon Futures Weekly Newsletter Issue # 1037

Dear Traders,

Trading 102: Day Trading Mind Traps

“One way our brain helps keep us safe is to protect us from an awareness of our weaknesses. The brain believes that it is better to be falsely confident than recognize the real risks. This protective mechanism tends to work against us in trading.” Kenneth Reid, Ph.D

MINDING THE MIND

The mind can play tricks on us. Intuitive Trading is an attempt to mind read the market, which makes us susceptible to whipsaws. Hindsight Bias causes traders to underestimate the difficulty of trading, while Competency Bias causes us to over-estimate our abilities. These are mental banana peels that set us up for a fall.

INTUITIVE TRADING

Intuitive trading is a natural response to excessive randomness and non-linearity in the market. But making informed guesses is not the same as formulating a rule-based pattern-recognition system that gives a trader a true edge. Without a rule-based plan, intuitive traders expend a great deal of energy mindreading the market, which will not improve your odds of success. In fact, professional traders make a good living exploiting the emotionally-driven behavior of intuitive amateurs.

The Bull / Bear Camps for crude oil

by Mark O’Brien, Senior Broker

For the bulls, when you’re hanging on to news from China that they’ve seen meaningful declines in crude oil stockpiles at key ports and increased refinery run rates playing catch-up to demand, that’s not a strong hand.

The new Biden Administration’s move to cancel the Keystone XL pipeline will likely elicit a muted response as its demise had been generally expected. Covid-related news continues to influence market sentiment, so the new South African variant and its impact on the global health crisis is ammunition for the bear camp. As well, last week’s Baker Hughes US oil rig count rose from 236 up to 289 rigs, within striking distance of the highest U.S. count since early May. It’s rational to view any intra-day price spikes with skepticism. Still, the bulls are not without their own home-court ammunition. Since the Nov./Dec. holidays, U.S. demand has improved and supplies have tightened per this week’s EIA report of a 9.9 million barrel inventory decline.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

2-01-2021

Weekly Levels

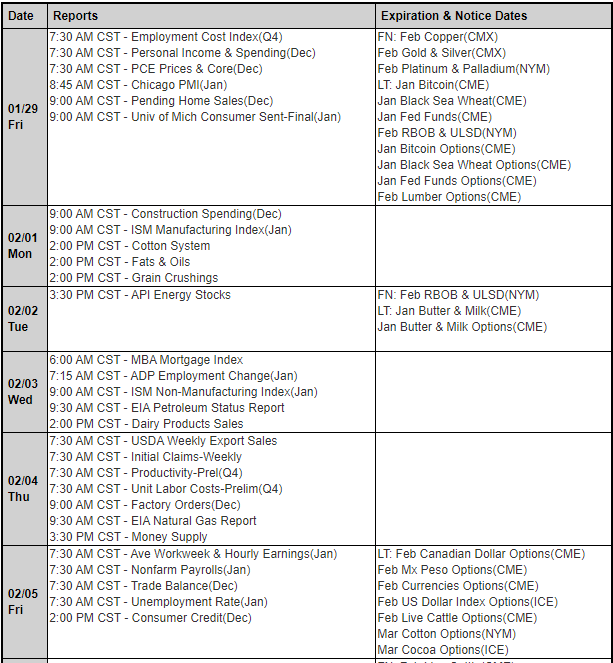

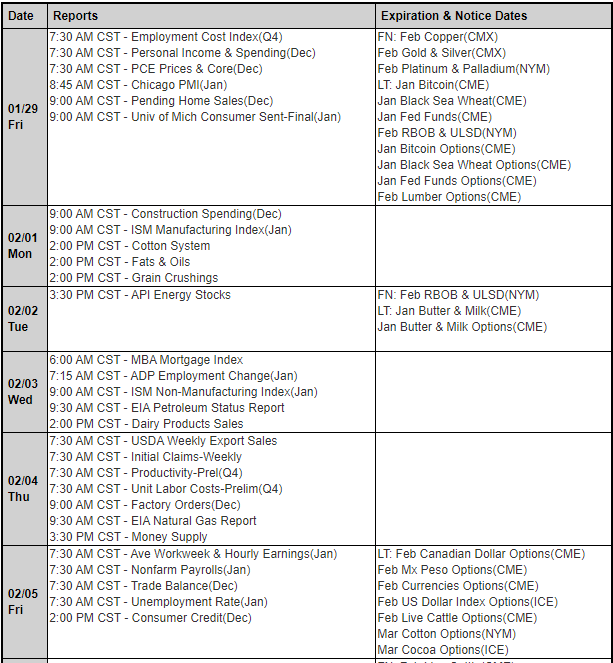

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in tradin