Dear Futures Trader,

Get Real Time updates and more on our private FB group!

FOMC Statement tomorrow:

Interest Rates/Credit Markets – Traders expect the Fed to detail tapering of asset purchases at the FOMC meeting this week.

Traders will pay close attention to the headline change in non-farm payrolls. The expected number is 400,000, up from 194,000 in September. A weak jobs number could have traders positioning a bit sooner for a fed fund rate increase.

Goldman Sachs thinks the Fed will raise its benchmark from a range of zero to 0.25% soon after it stops tapering its asset-purchase program. A second increase will follow in November 2022, and the central bank will then raise rates two times a year after that.

We are expecting the Fed to concede to inflation cryptically in the next few months. Plan on hearing more about multi-year low inflation, historically low interest rates, and only a tiny whiff of inflation.

The following are my PERSONAL suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 4325.00 with a stop at 4319.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 4319.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Keep in mind statement comes out at 1 Pm Central time, the news conference which dissects the language comes out 30 minutes later so the volatility window stretches out.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

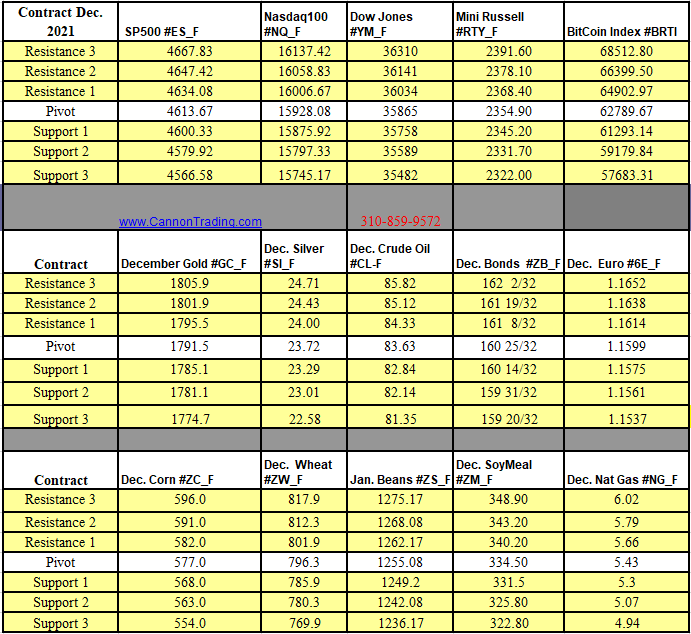

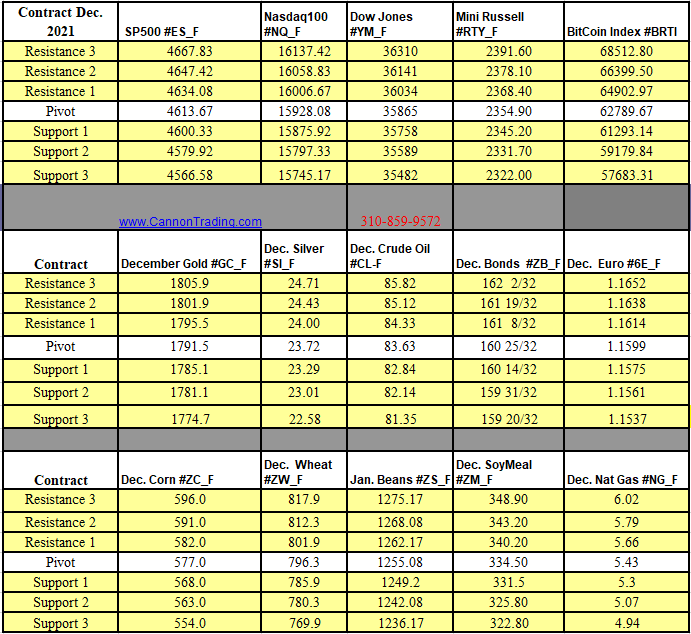

Futures Trading Levels

11-03-2021

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.