In this post:

1. Market Commentary

2. Support and Resistance Levels

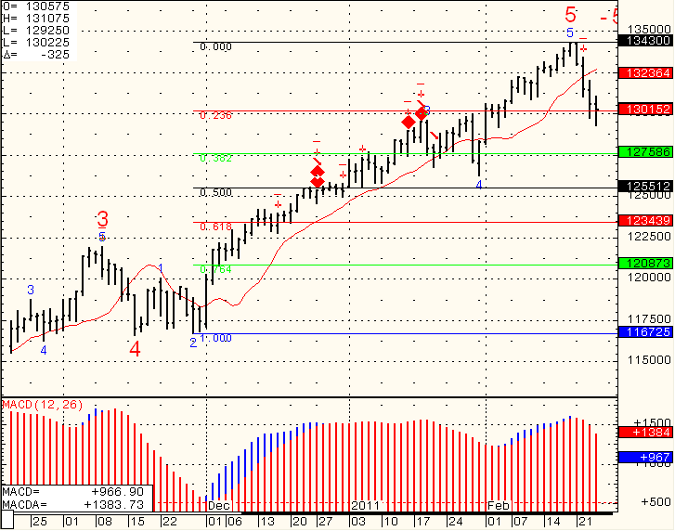

3. December Mini S&P 500 Continuous Futures chart

4. Economic Reports

5. Highlighted Earnings Releases

1. Market Commentary

FRONT MONTH FOR EQUITIES AND BONDS IS DECEMBER

SYMBOL FOR DECEMBER IS Z

We started the new week, right where we left off. With volatile moves in both directions.

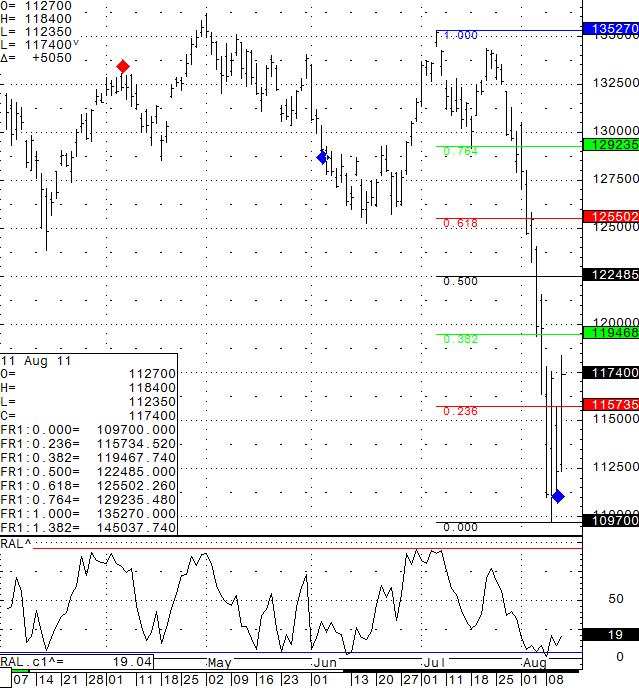

I am sharing my daily Dec. mini Russell 2000 chart with you below.. It seems that at times, the Russell 2000 index has been the leader in the moves of the general stock market. We are currently in a very wide range (volatility definitely expands the “bands”) 739 on top and 654 below.

We are currently closer to the bottom level, hence we may see some more upside before we see sellers step back in. In all honesty, I do NOT have a strong feel for the market right now and do NOT have a preferred way of trading it based on swing or overnight time frame. When I do have a better feel or direction, i will be happy to share with you.

You can also sign up for my real time intraday charts service. Read the rest of this entry »