Get Real Time updates and more on our private FB group!

Happy and prosperous New Year from the Cannon Trading Team!

We appreciate the chance to serve your futures trading needs and are here to assist.

Energies Insight by John Thorpe, Senior Broker

O.P.E.C. will make a decision on output policy for February when they meet tomorrow. Please expect and prepare accordingly in the early A.M. and anticipate additional volatility not only in the energy markets ,

CL,

NG,

RBOB and

Heating oil but also in the Equity indices

ES, MES,

NQ, MNQ,

YM, MYM,

RTY , and food markets as OPEC will be meeting in Vienna at 8a.m. EST (1 p.m. Central European TIme zone ) in light of the current restrictions and challenges related to the COVID-19 pandemic, please find the expected hours of release useful. Will their decision add to the existing inflationary concerns or will OPEC concede it’s output tightening instituted in 2020 has run it’s course and agree to raise it’s output limits in a measured approach or more substantially? The

bond market has taken a nose dive in recent days and interest rates are expected to rise , tightening credit, Metals have also sold off in anticipation of easing inflationary pressures. Manage your risk well this week.

1. The 36th JMMC Meeting is scheduled to take place on Tuesday, 4 January 2022, at

13:00 (CET) via videoconference.

2. On the same day, 4 January 2022, the 24th OPEC and non-OPEC Ministerial Meeting

is slated to convene at 14:00 (CET) via videoconference.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

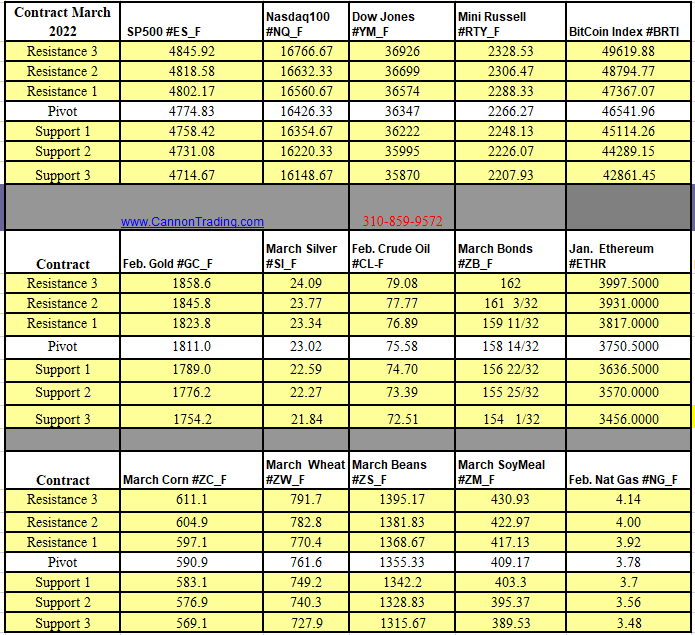

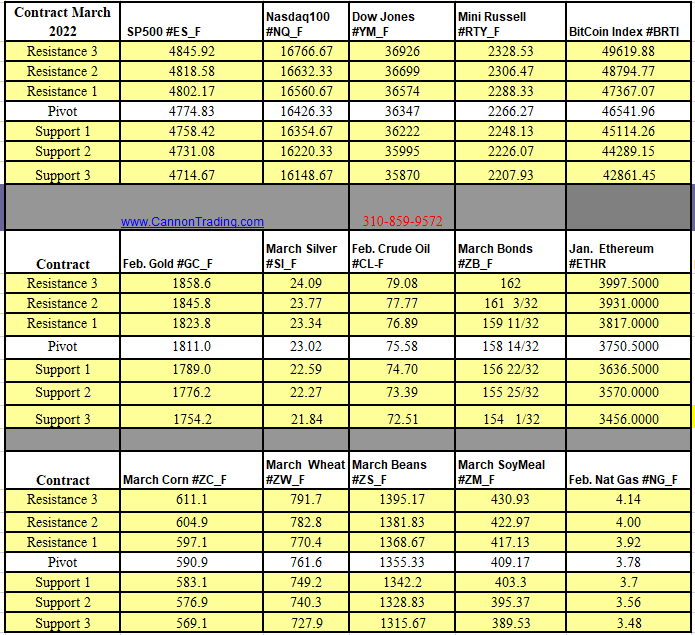

Futures Trading Levels

01-04-2022

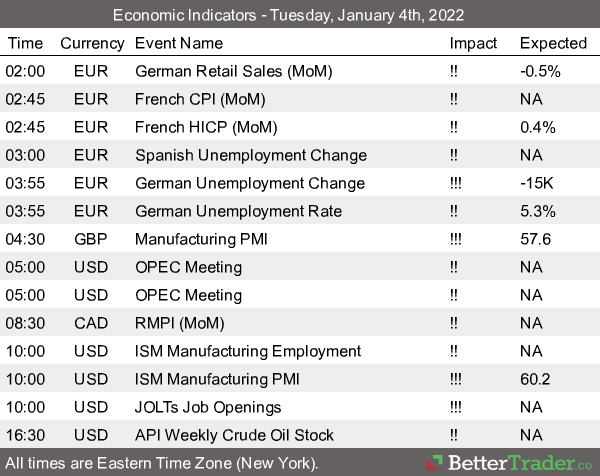

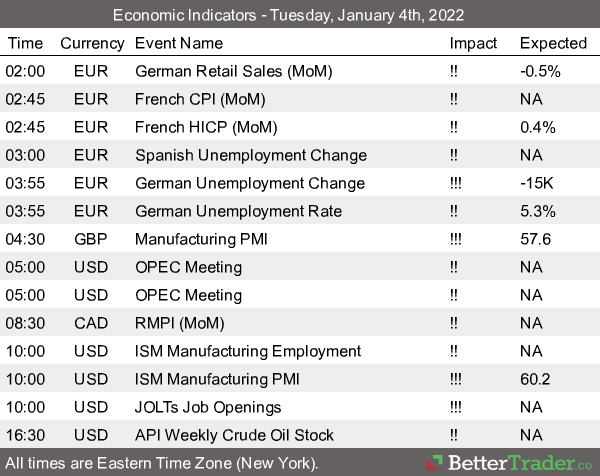

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.