Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for February 9, 2012

1. Market Commentary

Hello Traders,

Another educational piece today:

I am being asked by clients and prospects what do I use for Intra-day support and resistance levels and the answer depends on a few factors like the time frame one trades, risk -reward applied to each trade, personality of trader and much more.

Below is 3 different studies I use for intra-day support and resistance.

All these studies and screen shots are from our ATcharts ( sierra charts) which active clients can get for free and prospects can have a 30 days free trial.

1. For charts of 15 minutes and lower time frames, tick charts, volume charts etc. I like to use the variable pivot levels found in ATcharts from the study menu. I then click on settings and set the variable period to 60 minutes. Here is what it looks like on a 3 minutes chart of the Crude Oil from today:

Market Commentary

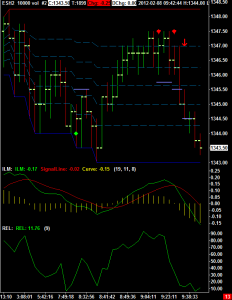

2. Another tool I use for the lower time frames is the Fibonacci Auto retracment, again this is a built in study in the ATcharts. The chart below if mini SP , 10000 volume chart from earlier this morning. WHat I like about the auto fib is that the nature of the formula takes in the days ranges as the market develops.

ATcharts

3. For time frames of 15 minutes and larger, like 30 minutes chart, hourly etc. but smaller than a daily chart, I like to use the simplified levels of market profile, called TPO value area lines in the study menu of sierra charts. The one below shows these levels on an hourly chart of April gold from today:

TPO