Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

I may sound like a broken record but make sure you are adapting to the different market conditions we are seeing compare to a month ago or so.

Much higher volatility, speed of price change and wider ranges.

I wrote the following outlook for ForexMagnates.com and sharing it with you as well, again it is just one man’s opinion….mine:

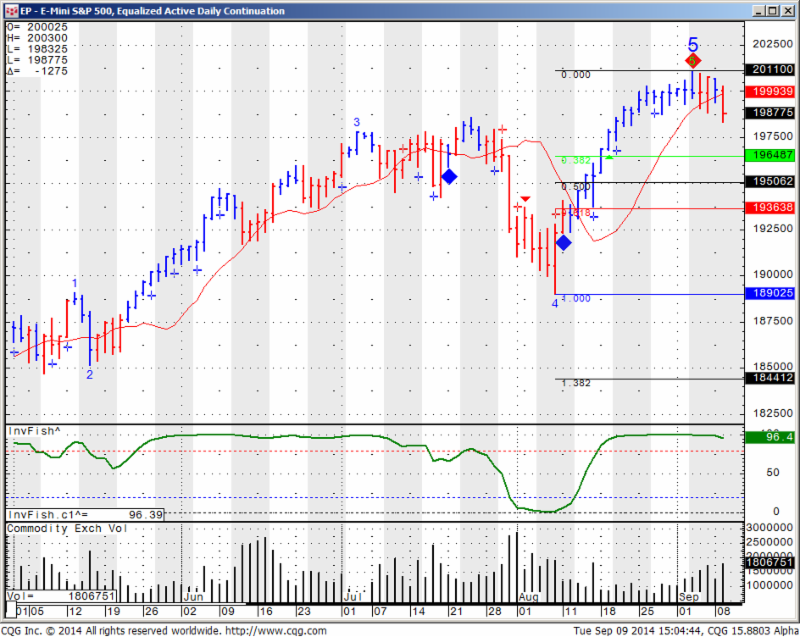

Did AliBaba Mark Stock Market Highs??

Many people have commented about the stock market run of the last few years, its widely perceived “Quantitative Easing” connection, and much more. Some of these people are smarter and more knowledgeable than me when it comes to economics but then again, sometimes the stock market does not react to economics, intuitive correlations, or “brains” but does what it wants to do…..

If you were one of the bulls who bought any significant correction in the past 5-6 years you would have done well, as QE just fueled the stock market into new highs.

To me the big question is: Does this represent the highs for the next few years?

Statistically the right answer is no. There is a higher probability that stocks will recover and make new highs than the chance that this may be the high for the next few months/ few years.

However, in my opinion, there is a much larger room for profits on the downside than there is going long at these levels, especially considering that the FED is unwinding QE.

Read the rest along with charts at:

http://experts.forexmagnates.com/did-alibaba-mark-stock-market-highs/