Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

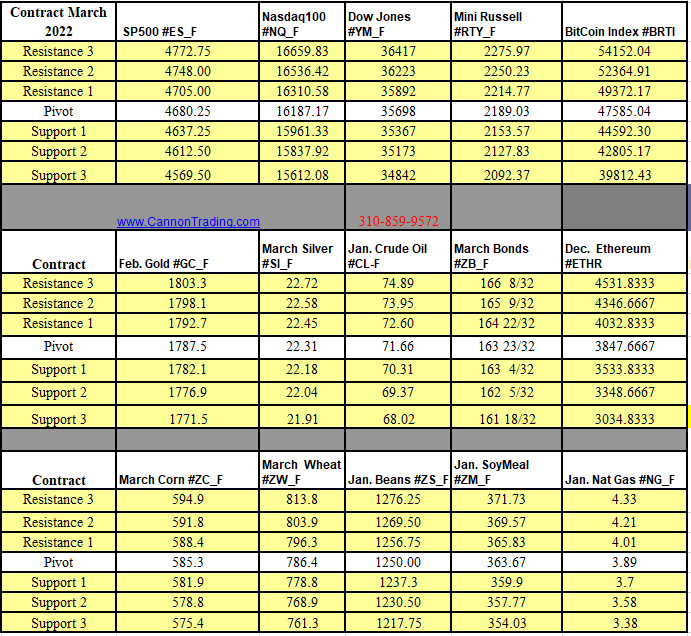

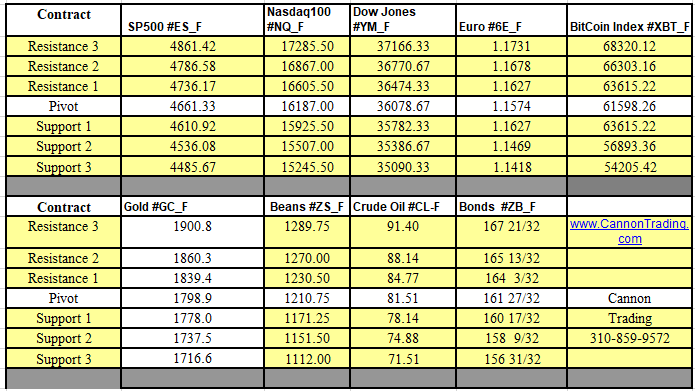

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

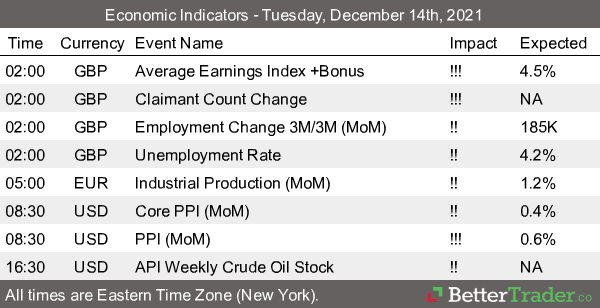

5. Futures Economic Reports for Wednesday September 16, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Big FOMC this week! Meeting takes place tomorrow and Thursday with much anticipated announcement and language on Thursday, 2 PM EST.

Futures Options 101:

Market Strategies

1. Bullish Market Strategies

Futures Options Trading

Spread Strategy |

Description |

Reason to Use |

When to Use |

| Buy a call |

Strongest bullish option position |

Loss limited to premium |

Undervalued option with volatility increasing |

| Sell a put |

Neutral bullish option position |

Profit limited to debt |

Small debit, bullish market |

| Vertical Bull Calls |

Buy call, sell call of higher strike price |

Loss limited to debt |

Small debit, bullish market |

| Vertical Bull Puts |

Buy put, sell put of higher strike price |

Loss limited to price difference |

Large credit, bullish market |

2. Bearish Market Strategies

Futures Options Trading

Spread Strategy |

Description |

Reason to Use |

When to Use |

| Buy a put |

Strongest bearish option position |

Loss limited to premium |

Undervalued option with volatility increasing |

| Sell a call |

Neutral bearish option position |

Profit limited to premium |

Option overvalued, market flat, bearish |

| Vertical Bear Calls |

Buy at the money put, sell out of the money put |

Loss limited to debt |

Small debit, bearish market |

| Vertical Bear Puts |

Sell call, buy call of higher strike price |

Loss limited to stroke price difference minus credit |

Large credit, bearish market |

3. Neutral Market Strategies

Futures Options Trading

Spread Strategy |

Description |

Reason to Use |

When to Use |

| Strangle |

Sell out of the money put and call |

Maximum use of time value decay |

Trading range market with volatility peaking |

| Arbitrage |

Bull and sell similar simultaneously |

Profit limited to debt |

Any time credit received |

| Calendar |

Sell near month, buy far month, same strike price |

Near month time value decays faster |

Small debit, trading range market |

| Butterfly |

Buy at the money call (put), sell 2 out of the money calls (puts), buy out of the money call (put) |

|

Any time credit received |

| Guts |

Sell in the money put and call |

Receive large premium |

Futures Options have time premium and market in trading range |

| Box |

Buy at the money put, sell out of the money put |

|

Small debit, bearish market |

| Ratio Call |

Buy call, sell calls of higher strike price |

Neutral, slightly bullish |

Large credit and difference between stroke price of option bought and sold |

| Conversion |

Buy futures, buy at the money put, and sell out of the money call |

|

Any time credit received |

Futures Options Writing

Have you ever wondered who sells the futures options that most people buy? These people are known as the option writers/sellers. Their sole objective is to collect the premium paid by the option buyer. Option writing can also be used for hedging purposes and reducing risk. An option writer has the exact opposite to gain as the option buyer. The writer has unlimited risk and a limited profit potential, which is the premium of the option minus commissions. When writing naked

futures options your risk is unlimited, without the use of stops. This is why we recommend exiting positions once a market trades through an area you perceived as strong

support or resistance. So why would anyone want to write an option? Here are a few reasons: