Jump to a section in this post:

1. Market Commentary

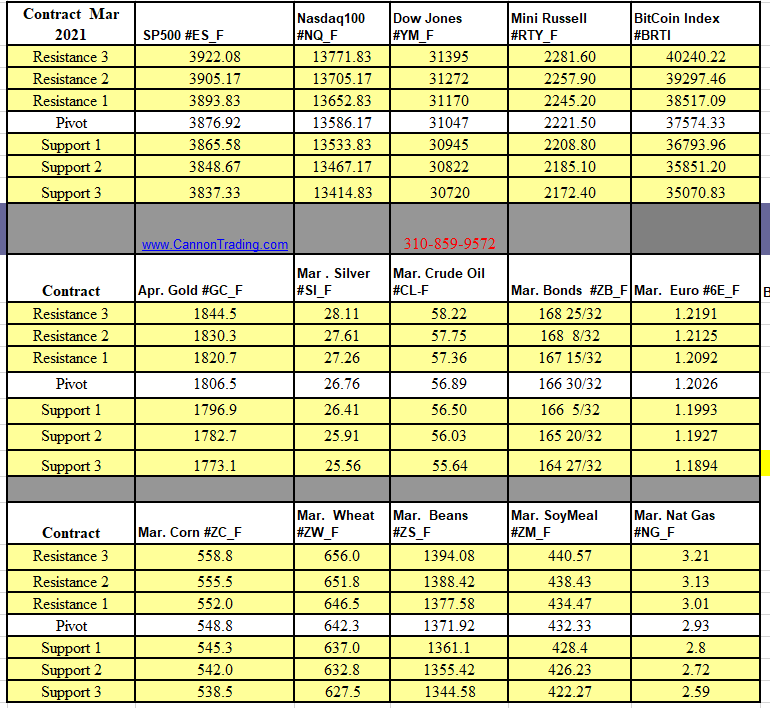

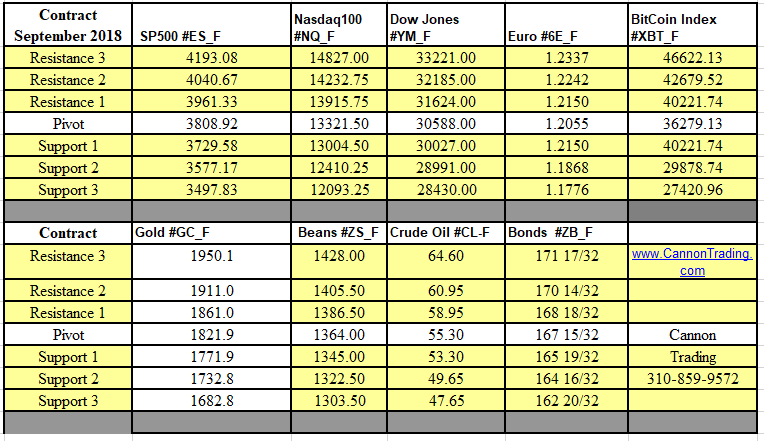

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

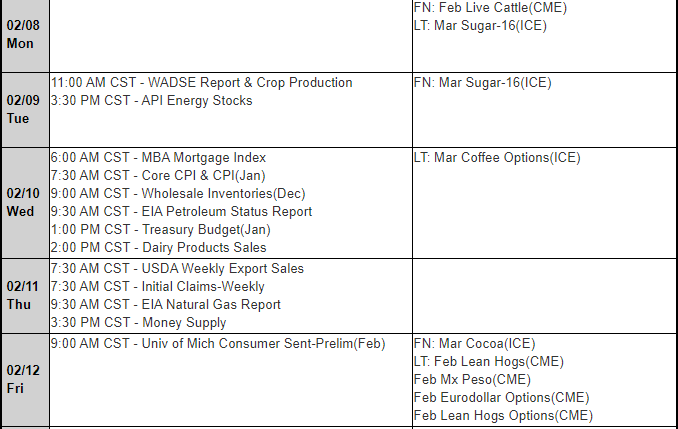

5. Futures Economic Reports for Tuesday April 16, 2013

Hello Traders,

For 2013 I would like to wish all of you discipline and patience in your trading!

Some extreme volatility in the markets to start the week. Historical price moves in gold and silver as well as big moves in crude oil as well as stock indices.

I have been mentioning over the past few weeks that the volatility cycle, which has been very low is due to move into higher volatility. It seems from the action in the markets that this may be the start.

My opinion is that if you are a day-trader you need to understand that we are starting a higher volatility period. I recommend adjusting accordingly and I think the wise thing to do is lower the number of contracts you buy/sell per trade and be aware of the higher time frames on the charts.

Be prepared for wider swings which may require wider stops and probably being a little more selective on entry points.

Weekly chart of the June SP500 mini below for your review. I think that 1543 and 1524 stick out as near term important levels.

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

| Contract June 2013 |

SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

Dollar Index |

| Resistance 3 |

1609.00 |

2896.17 |

14990 |

968.00 |

82.98 |

| Resistance 2 |

1596.00 |

2873.58 |

14894 |

953.90 |

82.76 |

| Resistance 1 |

1572.50 |

2834.92 |

14723 |

929.30 |

82.62 |

| Pivot |

1559.50 |

2812.33 |

14627 |

915.20 |

82.41 |

| Support 1 |

1536.00 |

2773.67 |

14456 |

890.60 |

82.27 |

| Support 2 |

1523.00 |

2751.08 |

14360 |

876.50 |

82.05 |

| Support 3 |

1499.50 |

2712.42 |

14189 |

851.90 |

81.91 |

|

|

|

|

|

|

| Contract |

June Gold |

May Silver |

May Crude Oil |

June Bonds |

June Euro |

| Resistance 3 |

1599.4 |

2835.8 |

93.20 |

149 22/32 |

1.3172 |

| Resistance 2 |

1547.2 |

2720.2 |

92.09 |

149 |

1.3143 |

| Resistance 1 |

1452.9 |

2504.3 |

90.08 |

148 18/32 |

1.3093 |

| Pivot |

1400.7 |

2388.7 |

88.97 |

147 28/32 |

1.3064 |

| Support 1 |

1306.4 |

2172.8 |

86.96 |

147 14/32 |

1.3014 |

| Support 2 |

1254.2 |

2057.2 |

85.85 |

146 24/32 |

1.2985 |

| Support 3 |

1159.9 |

1841.3 |

83.84 |

146 10/32 |

1.2935 |

|

|

|

|

|

|

| Contract |

May Corn |

May Wheat |

May Beans |

May SoyMeal |

May bean Oil |

| Resistance 3 |

661.2 |

714.2 |

1433.00 |

409.13 |

50.11 |

| Resistance 2 |

657.6 |

708.6 |

1425.00 |

405.57 |

49.71 |

| Resistance 1 |

652.2 |

701.2 |

1410.00 |

399.43 |

48.94 |

| Pivot |

648.6 |

695.6 |

1402.00 |

395.87 |

48.54 |

| Support 1 |

643.2 |

688.2 |

1387.0 |

389.7 |

47.8 |

| Support 2 |

639.6 |

682.6 |

1379.00 |

386.17 |

47.37 |

| Support 3 |

634.2 |

675.2 |

1364.00 |

380.03 |

46.60 |

For complete contract specifications for the futures markets listed above

click here!

5. Economic Reports

| Date |

4:00pm |

Currency |

Impact |

|

Detail |

Actual |

Forecast |

Previous |

Graph |

|

| TueApr 16 |

4:00am |

EUR |

|

Italian Trade Balance |

|

|

-1.41B |

-1.62B |

|

|

5:00am |

EUR |

|

German ZEW Economic Sentiment |

|

|

41.5 |

48.5 |

|

|

|

EUR |

|

CPI y/y |

|

|

1.7% |

1.7% |

|

|

|

EUR |

|

Core CPI y/y |

|

|

1.4% |

1.3% |

|

|

|

EUR |

|

ZEW Economic Sentiment |

|

|

31.5 |

33.4 |

|

|

8:00am |

USD |

|

FOMC Member Dudley Speaks |

|

|

|

|

|

|

8:30am |

USD |

|

Building Permits |

|

|

0.94M |

0.94M |

|

|

|

USD |

|

Core CPI m/m |

|

|

0.2% |

0.2% |

|

|

|

USD |

|

CPI m/m |

|

|

0.0% |

0.7% |

|

|

|

USD |

|

Housing Starts |

|

|

0.93M |

0.92M |

|

|

9:00am |

EUR |

|

ECB President Draghi Speaks |

|

|

|

|

|

|

9:15am |

USD |

|

Capacity Utilization Rate |

|

|

78.4% |

79.6% |

|

|

|

USD |

|

Industrial Production m/m |

|

|

0.3% |

0.7% |

|

|

10:00am |

USD |

|

Treasury Sec Lew Speaks |

|

|

|

|

|

|

12:00pm |

USD |

|

FOMC Member Duke Speaks |

|

|

|

|

|

|

3:00pm |

USD |

|

FOMC Member Yellen Speaks |

|

|

|

|

|

|

|

USD |

|

Treasury Sec Lew Speaks |

|

|

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading