Take a look at Sugar

by Mark O’Brien, Senior Broker

As with the first report on the Friday after the U.S. Thanksgiving holiday, the Omicron variant has settled into a dominant market force. News in the next few weeks could result in near-term trends in a long list of commodities – in the form of significant euphoria events or aggressive risk-off plunges similar to ones already seen since Nov. 24th. With that said, global markets – and traders – can also keep an eye on other big-picture fundamentals that can be more important drivers of price. Take for example

sugar. Since the U.S. Thanksgiving holiday, sugar prices have moved sharply to the downside, and reached a four-month low on December 2.

sugar should still have a bullish supply outlook this season even if energy prices stay well below their recent highs. Brazil’s Center-South sugar production is expected to decline more than 6 million tonnes from last season, a deficit that cannot be offset by other producing nations. With the market well below its November highs, sugar could see a significant recovery in the face of any Omicron news.

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this letter are of opinion only and do not guarantee any profits.

There is not an actual account trading these recommendations.

Past performances are not necessarily indicative of future results.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

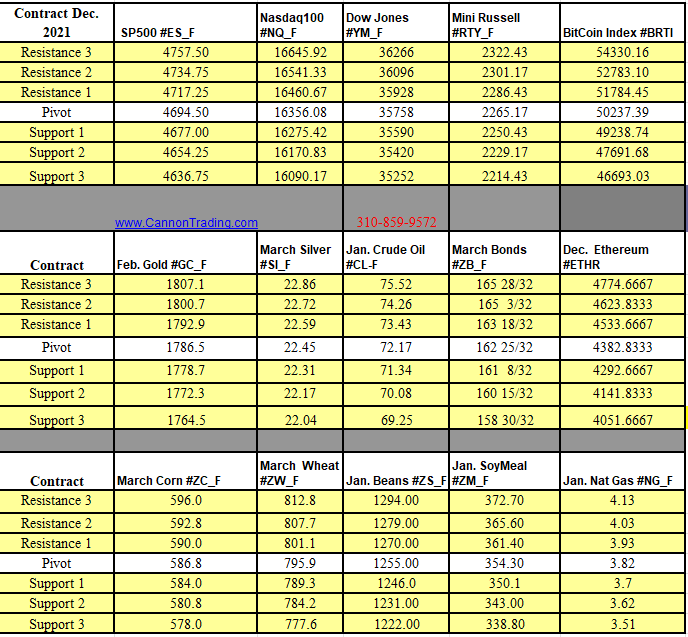

Futures Trading Levels

12-09-2021

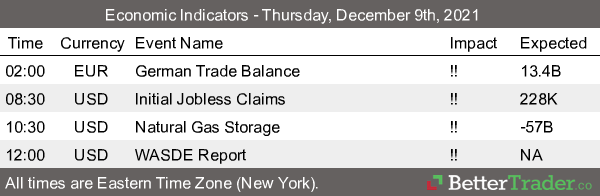

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.