Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

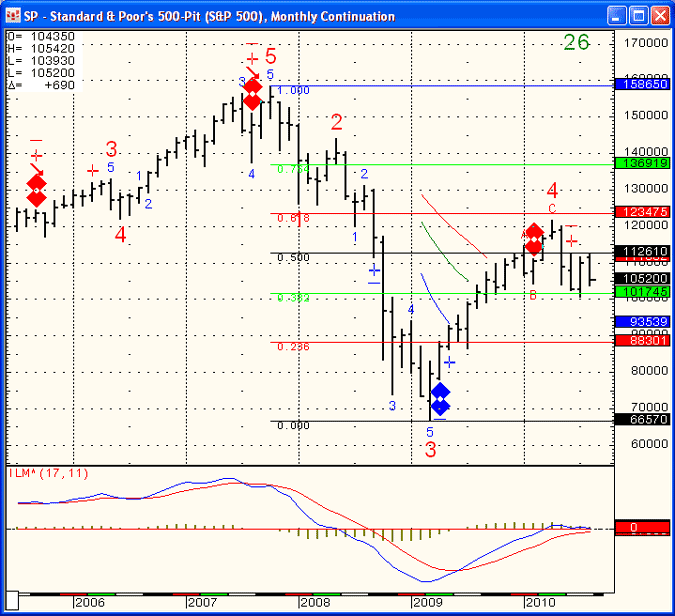

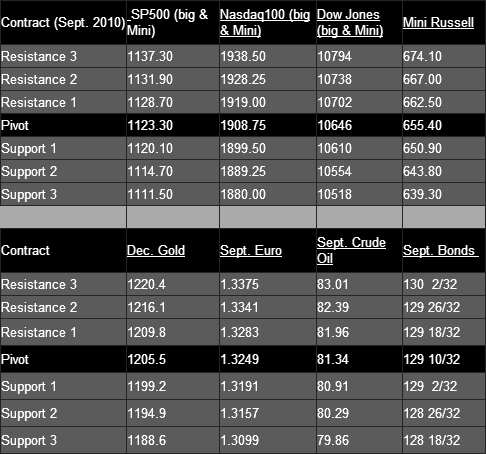

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday January 21, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Some more light on what happened last week with the Swiss Franc which affects all markets across the board in one way or another. From our friends at Trade The News:

TradeTheNews.com Weekly Market Update: Swiss Mess

The Swiss National Bank roiled global markets this week by unceremoniously removing the 1.2000 floor put under the EUR/CHF cross back in 2011, prompting the franc to gain as much as 35% versus the euro on Thursday. Social media christened the move “Francogeddon” and the CEO of Swatch called it a tsunami. SNB Chief Jordan said his strategy was to “take markets by surprise,” and he succeeded. The SNB move was widely taken as another confirmation that the ECB will move on its QE program next week. Just 24-hours earlier the EU’s highest court gave the ECB a green light to proceed with QE, even as December euro zone CPI data showed most member states in negative inflation. Front-month WTI and Brent crude reached parity on Tuesday for the first time since the summer of 2013, as both February contracts traded below $46, but prices regained some ground later in the week. In the US, December inflation readings slipped lower, giving the doves on the Fed ammunition for their arguments that rate hikes can wait. Note that the yield on the 10-year UST has contracted nearly every session in January, and traded as low as 1.70% after the SNB’s move on Thursday. Gold rallied pushing the futures back above the 200-day moving average for the first time since late summer. For the week, the DJIA fell 1.3%, the S&P500 dipped 1.2% and the Nasdaq lost 1.5%.

Eleven out of 18 euro zone nations reported negative inflation rates for the month of December, while total Eurozone CPI in December was -0.2% y/y, at its lowest rate since September 2009. The biggest downward impacts in the reports were from fuel prices, clearly demonstrating the impact of the oil meltdown. ECB’s Coeure responded to the data by saying the euro zone is still not in deflation but the risk of deflation has worsened.

With inflation on a slippery slope, few doubt that the ECB QE is right around the corner (the SNB least of all). On Wednesday, the European Court of Justice handed down a non-binding opinion that the 2012 OMT bond-buying blueprint did not break EU law. Anti-QE German hawks had brought the case, hoping to forestall what they saw was bad policy. Not surprisingly, Bundesbank Chief Weidmann claimed the court’s opinion also showed that there were legal limits on the ECB, citing commentary in the opinion that said the ECB’s activities need safeguards to prevent violations of the prohibition against direct financing of governments. By Friday reports were suggesting Draghi presented Merkel and her staff a plan for QE that they could live with which will be centered on national central banks purchasing their own countries bonds.