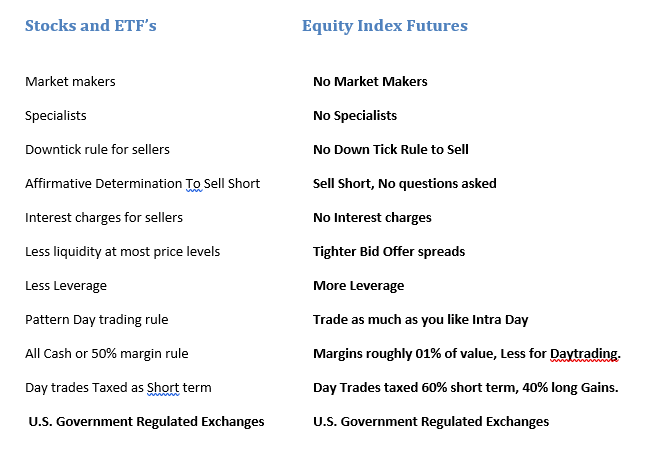

There many different financial instruments one can trade: Stocks, ETFs, futures, options, Crypto, FX and much more. Below we will examine how trading futures compares to trading ETF's

by John D. Thorpe, Senior Broker

According to Statista.com assets in Exchange Traded Funds, “ETFs”, have grown to roughly $5.5 trillion dollars since their inception. Exchange Traded Funds were meant to challenge the $25 trillion dollar Mutual Fund Market which was the only market in which you could achieve broad class diversity outside of individual stocks. The problem that ETFs were designed to overcome, which was the hallmark of mutual funds, was that mutual funds could only settle on the close of daily business at their Net Asset Value or “NAV”. Broad diversification across market sectors could only be purchased or sold at the close of business based on the equity, bond or raw material elements included in the weighted averages of every component of the sector mutual fund—ETFs solved that problem.

The first Exchange Traded Fund, the Spider or “SPDR”, was the S&P 500 depository receipt, which was designed to track the S&P 500 stock market Index and began trading in January of 1993 NYSE: SPY. No longer could an investor achieve broad market exposure on just the close of business, but could now buy and sell the broad market at any time throughout the trading day. Market makers and specialists provided liquidity for ETFs and continue to do so.

During the May 2010 so-called “Flash Crash”, the NYSE canceled all trades that were more than 60% away from pre-crash prices; leaving some with dangerous consequences. This was arbitrary and arguably covered up liquidity issues at the largest stock exchange in the world. E-Mini S&P 500, E-Mini Dow 30, E-mini Nasdaq 100 or Mini Russell 2000 Futures were not canceled as a result of this market event. None of the above futures contracts were even down 10%. The Dow was down 5.7% at its worst.

Fast Forward to August 24th, 2015. Another rocky moment in the market’s history as several ETFs were down double-digit percentages and not even trading. Yet, in comparison, the weighted stocks that made up the ETFs value were only down a few percentage points. According to FactSet, the IShares Dividend ETF NASDAQ, DVY was down 35% while the combined values of the stocks held in that ETF were only down 2.7 %. One of the possible reasons for this disparity? Perhaps, market makers backed away and pulled their bids creating an enormously wide bid and offer spread which is symptomatic of an illiquid market. A wider bid and offer spread creates a situation where the small investor pays more than the issue is worth by paying an inflated price at the ask and receives less in return for selling at a bid price that is less than the issue is worth.

SPDR, QQQ, SPY and stocks are all traded during normal and extended trading hours of 6 AM to 8PM Eastern, whereas all futures are traded virtually around the clock. 6PM to 5PM Sun-Fri Eastern or NY Time.

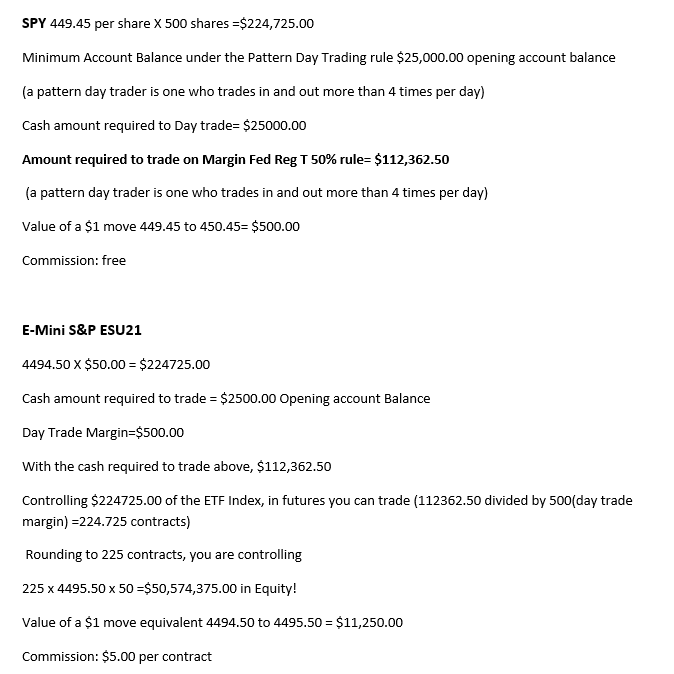

Margin in the Securities Industry is a term used to describe taking a loan from the Clearing organization to purchase a stock, ETF or other asset. A Margin account is required to sell a security or ETF short. You cannot margin securities in an IRA account as the IRS prohibits charging Interest in a retirement account or qualified retirement plan. Margin in the Futures industry refers to a good faith deposit, rather than a loan amount. You can sell a futures contract even if you don’t own it without incurring an interest expense because you are not taking out a loan. There are no restrictions by the IRS prohibiting Futures trading in a qualified plan or Individual retirement account. So with a 20,000.00 Stock Brokerage account, you can purchase 88 shares on margin or 44 shares in a cash account and cannot day trade more than three times. With a 20,000.00 Futures Brokerage account, you can trade 40 contracts at a time or (let’s calculate the notional value of 40 x 4494.50 x 50 contracts) $8,989,000 worth of equity,

Call a Cannon Broker at 800-454-9572 if you have any questions about the differences between Stocks, ETF’s and Futures.

Disclaimers:

Cannon Trading Co. Inc. is registered with the C.F.T.C. Commodity Futures Trading Commission as an Introducing Broker and members of N.F.A. National Futures Association. We are not a Broker/Dealer that requires registration under a different regulatory agency FINRA, because we do not offer trading in Equities, Mutual Funds, Bonds, ETF’s Muni’s etc. We are also not accountants or CPA’s. All reference to stocks, tax levels etc. in the article are made in reference to the topic and as opinion only.

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to the accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!