KCBT Red Wheat Futures Trading - Get current KCBT Red Wheat futures prices, quotes, charts, news and futures contract specifications with grain futures data.

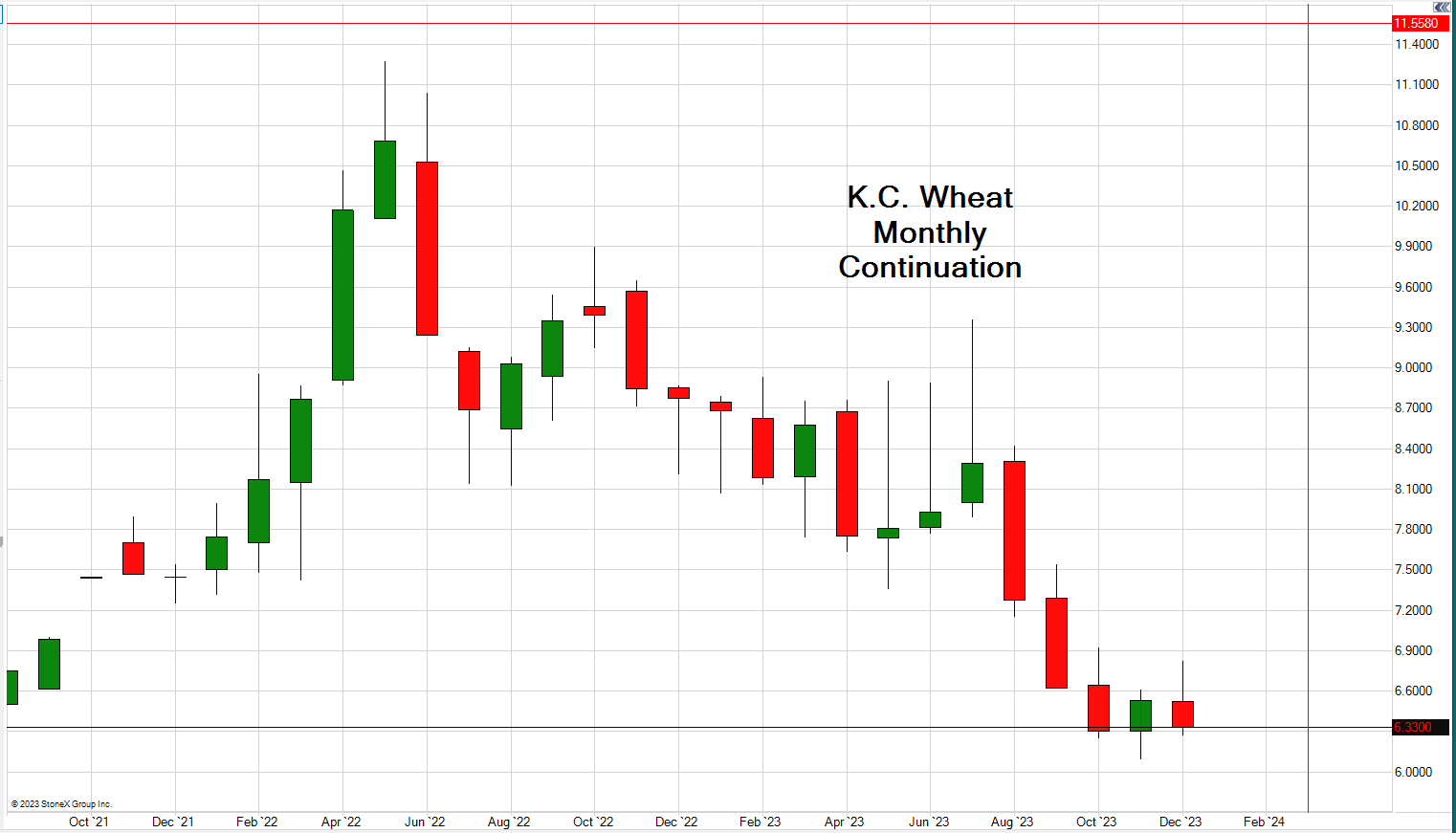

Chart of KCBT Red Wheat Futures futures updated December 25th, 2023. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

![]()

| Contract Specification | KCBT Red Wheat Futures |

| KCBT Product Symbol (Electronic Trading) | KE |

| Open Outcry Product Symbol (Trading Floor) | KW |

| Contract Size | Contracts and deliveries on wheat futures shall be in units of 5,000 (five thousand) bushels. |

| Price Quotation | Dollars, cents, 1/4 cents |

| Venue | KCBT, Open Outcry |

| KCBT Hours | Electronic: 6:00 p.m. to 7:15 a.m. Sunday through Friday; 9:30 a.m. to 1:15 p.m. Monday through Friday |

| Open Outcry Hours | 9:30 am - 1:15 pm Central Time, Monday - Friday |

| Minimum Fluctuation | The minimum price fluctuation is one-quarter of a cent (1/4¢) |

| Daily Price Limits | Pursuant to a Resolution of the Board of Directors on March 5, 2008, there shall be no trading in wheat futures at a price more than $0.60 per bushel ($3,000 per contract) above or below the previous day’s settlement price. Should two or more wheat futures contract months within the first five listed non-spot contracts (or the remaining contract month in a crop year) close at limit bid or limit offer, the daily price limits for all contract months shall increase to $0.90 per bushel the next business day. Should two or more wheat futures contract months within the first five listed non-spot contracts (or the remaining contract month in a crop year) close at limit bid or limit offer while price limits are $0.90 per bushel, daily price limits for all contract months shall increase to $1.35 per bushel the next business day. If price limits are $1.35 per bushel and no wheat futures contract month closes limit bid or limit offer, daily price limits for all contract months shall revert back to $0.90 per bushel the next business day. If price limits are $0.90 per bushel and no wheat futures contract month closes limit bid or limit offer, daily price limits for all contract months shall revert back to $0.60 per bushel the next business day. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month. |

| Settlement Price |

The settlement price shall be determined in the following manner: a. Immediately following the closing bell, all brokers and traders in the pit shall report to the pit reporter and the Wheat Pit Committee all outright trades, bids and offers and all spread trades, bids and offers made in the closing period that are relevant in determining settlement prices in accordance with Sections (b), (c) & (d) below. b. The settlement price of the lead contract month (determined by the Wheat Pit Committee based on criteria such as volume, open interest and historical experience) shall be determined by the weighted average method of the trades in the closing period as reflected in the information reported to the pit reporter and Committee in accordance with subpart "a" of this Rule. c. The remaining contract months shall be settled based on spread price relationships, considering spread trades reported during the close. If individual spreads trade at multiple prices during the close, the Committee shall use the weighted average of spread prices in determining the settlement. The lead contract month settlement price shall serve as the initial spread relationship basing point for adjacent contract months, whose settlement can then be used in chronology to determine deferred month settlements. d. If no spreads involving a particular contract month traded during the close, the Committee shall take into consideration other market information available to the Committee that is pertinent to such contract month, including but not limited to, spread bids and offers, the latest quoted spread trade, the latest outright trades, bids or offers and the settlement price differentials that existed on the previous day in order to determine a settlement price that most accurately reflects the relationship between such month and surrounding contract months. e. If any settlement price is not consistent with market information known to the Wheat Pit Committee supervising the closing, or if trading is terminated without a closing period, then the Committee may establish a settlement price at a level consistent with such market information and shall cause to be prepared a written record setting forth the basis for such settlement price. Note: It is possible that the settlement prices established as a result of spread price relationships could result in settlement prices that violate either open outright contract month or spread orders. No such orders shall be elected and brokers shall not be held liable on orders violated as a result of such settlement price procedure. |

| Position Limits | No person may own or control positions, separately or in combination, net long or net short, for the purchase or sale of commodity futures and options contracts, on a Net Equivalent Futures Position basis, in excess of the following: 1. Spot Month – 600 contracts 2. Single Month – 5,000 contracts 3. All Months – 6,500 contracts |

| Position Limits Exemptions | 1. Bona fide hedging transactions as defined by Commodity Futures Trading Commission Regulation 1.3(z)(1); provided however, that positions established for purposes of hedging cash commodity index exposure, commodity swaps exposure or any other exposure not involving the production, merchandising or processing of the underlying cash commodity are not allowed to exceed the Spot Month limit. 2. Spread or arbitrage positions between Single Months of a futures or options contract, on a Net Equivalent Futures Position basis, outside of the Spot Month, in the same crop year (for KCBT wheat, a crop year begins with the contract month of July and ends with the contract month of May); provided however, that such spread or arbitrage positions, when combined with any other net positions in the Single Month, do not exceed the All Months limit set forth in Section (b) of this Rule. 3. Positions carried for eligible entities as set forth in Commodity Futures Trading Commission Regulation 150.3(a)(4). 4. Enumerated Hedging Transactions as defined by CFTC Regulation 1.3(z)(2). Any person who wishes to avail himself of the provisions of CFTC Regulation 1.3(z)(2)(i)(B) or (ii)(C) to make sales or purchases for future delivery in any commodity in excess of trading and position limits then in effect pursuant to section 4a of the Act for the purposes of bona fide hedging shall file statement with the Exchange in conformity with the requirements of CFTC Regulation 1.48. 5. Non-enumerated Hedging Transactions as defined by CFTC Regulation 1.3(z)(3). Any person who wishes to avail himself of the provisions of CFTC Regulation 1.3(z)(3) and to make purchases or sales of any commodity for future delivery in any commodity in excess of trading and position limits then in effect pursuant to section 4a of the Act shall file statement with the Exchange in conformity with the requirements of CFTC Regulation 1.47. |

| Grade Specifications | No. 1 Hard Red Winter Wheat with eleven percent (11%) protein level or higher deliverable at 1-1/2 cents per bushel over contract price No. 2 Hard Red Winter Wheat with eleven percent (11%) protein level or higher deliverable at contract price All above grades are deliverable at protein levels equal to or greater than 10.5% but less than 11% at a ten cent (10¢) per bushel discount to contract price. Protein levels of less than 10.5% are not deliverable on the contract. |

| Listed Contracts | March, May, July, September, December |

| Settlement Type | Physical |

| Delivery Payment | Delivery Payment is to be made in same day funds 1) by a check drawn on and certified by a Chicago bank or 2) by a Cashier’s check issued by a Chicago bank. The long clearing member may effect Delivery Payment by wire transfer only if this method of Delivery Payment is acceptable to the short clearing member. Buyers obligated to accept delivery must take delivery and make Delivery Payment and sellers obligated to make delivery must make delivery before 1:00 p.m. of the day of delivery, or by such other time designated by the Clearing House, except on banking holidays when delivery must be taken or made and Delivery Payment made before 9:30 a.m. the next banking business day, or by such other time designated by the Clearing House. Adjustments for differences between contract prices and delivery prices established by the Clearing House shall be made with the Clearing House in accordance with its rules, policies and procedures. |

| Storage Charges | Storage charges on rough rice shall not exceed such charges as have been filed with the Exchange in accordance with Rule 17109.A. (which shall be designed to cover costs of storage, insurance and taxes). No rough rice warehouse receipts shall be valid for delivery on futures contracts unless the storage charges shall have been paid up to and including the 18th day of the preceding month and such payment endorsed on the rough rice warehouse receipt. Unpaid accumulated storage charges at the posted tariff applicable to the warehouse where the rough rice is stored shall be allowed and credited to the buyer by the seller to and including the date of delivery. If storage charges up to and including the 18 calendar day preceding the delivery months of March, July and September and are not paid by the first calendar day of any such delivery month, a late charge will apply. The late charge will be an amount equal to the total unpaid accumulated storage charges multiplied by the “prime interest rate” in effect on the day that the accrued storage charges are paid, all multiplied by the number of calendar days that storage is overdue divided by 360 days. The term “prime interest rate” shall mean the lowest of the rates announced by each of the following four banks at Chicago, Illinois, as its “prime rate”: Bank of America-Illinois, JP Morgan Chase & Co., Harris Trust & Savings Bank and the Northern Trust Company. Storage on rough rice shall not exceed 34/100 of a cent per hundredweight per day. Regular Rough Rice warehousemen shall maintain in the immediate vicinity of the Exchange either an office, or a duly authorized representative or agent which is a registered clearing member of the Exchange, to whom Rough Rice storage charges must be paid. |

| Rulebook Chapter | 20 |

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of KCBT. |

![]()