Trade live 5 year treasury note futures with expert insights & advanced tools. Stay ahead with real-time data & market analysis. Call today (800) 454-9572

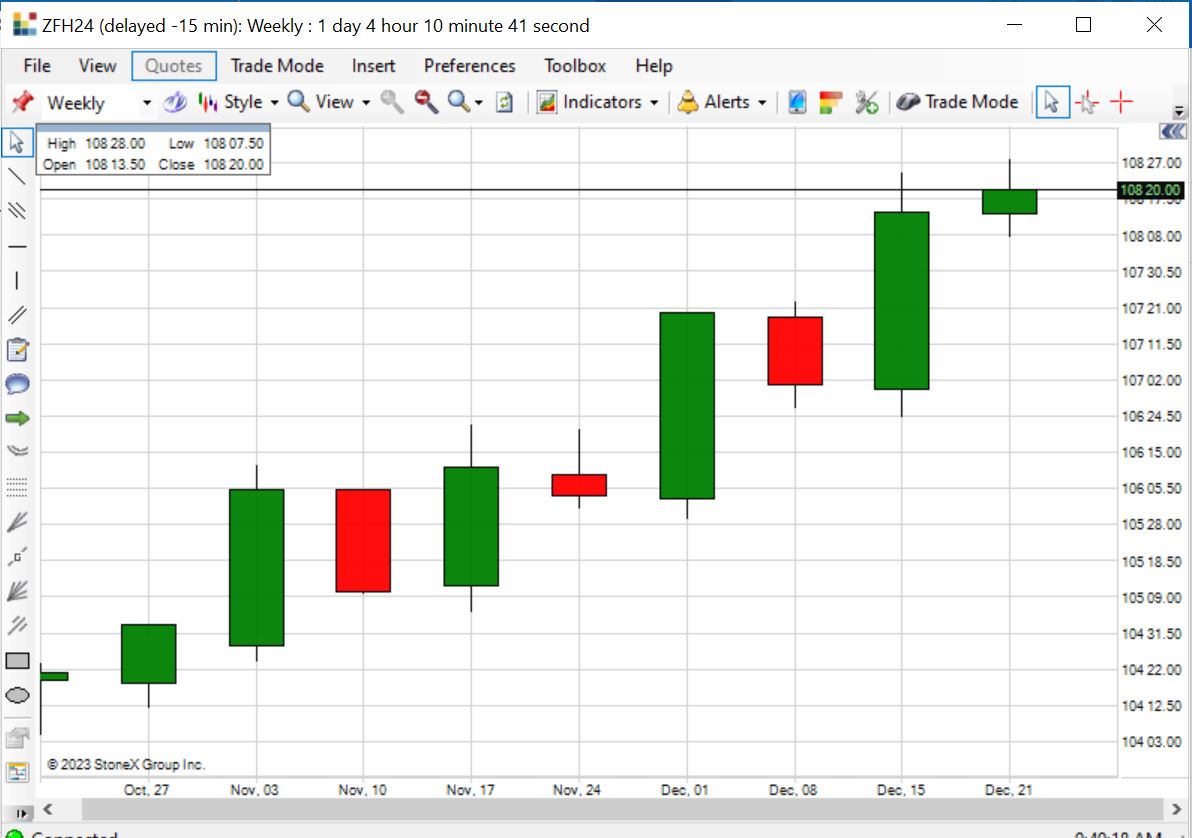

Chart of 5-Year Treasury Note Futures futures updated December 29th, 2023. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

![]()

| Contract Specification | 5-Year Treasury Note Futures |

| Product Symbol | ZF |

| Contract Size | The unit of trading shall be U.S. Treasury Bonds having a face value at maturity of one hundred thousand dollars ($100,000) or multiples thereof |

| Price Quotation | Points ($1,000) and quarters of 1/32 of a point. For example, 119-16 represents 119 16/32, 119-162 represents 119 16.25/32, 119-165 represents 119 16.5/32, and 119-167 represents 119 16.75/32. Par is on the basis of 100 points. |

| Venue | CME Globex, Open Outcry (New York) |

| CME Globex Hours (EST) | SUN - FRI: 5:30 p.m. - 4:00 p.m. |

| Open Outcry Hours (EST) | MON - FRI: 7:20 a.m. - 2:00 p.m. |

| Minimum Fluctuation | Par shall be on the basis of 100 points, with each point equal to $1,000 per contract. The minimum price fluctuation shall be one-quarter of one thirty-second of one point (equal to $7.8125 per contract), including intermonth spreads. Contracts shall not be made on any other price basis. |

| Position Limits and Position Accountability | In accordance with Rule 559., no person shall own or control positions in excess of 45,000 contracts in an expiring contract during the contract’s last 10 trading days (Rule 20102.F.). No hedge exemptions will be permitted with respect to this position limit. Position accountability, as defined in Rule 560., will apply to trading of Medium-Term U.S. Treasury Note futures. |

| Termination of Trading | The last day of trading in an expiring contract shall be the last business day of the contract’s month of expiration. Any contracts remaining open after the last day of trading must be either: (a) settled by physical delivery no later than the third business day following the last business day of the contract’s named month of expiration (Rule 20103.); or (b) liquidated by means of a bona fide Exchange of Futures for Related Position (Rule 538.) no later than 12:00 noon on the business day immediately following the last business day of the contract’s named month of expiration. |

| Listed Contracts | The first five consecutive contracts in the March, June, September, and December quarterly cycle. |

| Physical Delivery | Each individual contract lot that is delivered must be composed of one and only one contract grade Treasury note issue. The amount at which the short Clearing Member making delivery shall invoice the long Clearing Member taking delivery of said notes (Rule 20105.A.) shall be determined as: Invoice Amount = ($1000 x P x c) + Accrued Interest where P is the contract daily settlement price on the day that the short Clearing Member gives the Clearing House notice of intention to deliver (Rule 20104.A.). P shall be expressed in points and fractions of points with par on the basis of 100 points (Rule 20102.C.); and c is a conversion factor equal to the price at which a note with the same time to maturity as said note, and with the same coupon rate as said note, and with par on the basis of one (1) point, will yield 6I per annum according to conversion factor tables prepared and published by the Exchange. For each individual contract lot that is delivered, the product expression ($1000 x P x c) shall be rounded to the nearest cent, with half-cents rounded up to the nearest cent. Example: Assume that P is 100 and 25.5/32nds. Assume that c is 0.9633. The product expression ($1000 x P x c) is found to be $97,097.6296875. The rounded amount that enters into determination of the Invoice Amount is $97,097.63. In the determination of the Invoice Amount for each individual contract lot being delivered, Accrued Interest shall be charged to the long Clearing Member taking delivery by the short Clearing Member making delivery, in accordance with 31 CFR Part 306--General Regulations Governing U.S. Securities, Subpart E--Interest. See also Rule 20102.B. |

| Expiring Futures Contracts Delivery |

Deliveries against expiring contracts shall be by book-entry transfer between accounts of Clearing Members at qualified banks (Rule 20109.) in accordance with 31 CFR Part 306-- General Regulations Governing U.S. Securities, Subpart O--Book-Entry Procedure, and 31 CFR Part 357--Regulations Governing Book-Entry of U.S. Treasury Bonds, Notes and Bills Held in Legacy Treasury Direct®. Deliveries against an expiring contract can be made no earlier than the first business day of the contract’s named month of expiration, and no later than the third business day following the last business day of the contract’s named month of expiration (Rule 20103.). All deliveries must be assigned by the Clearing House |

| Delivery Period | Delivery of contract grade U.S. Treasury notes may be made by a short Clearing Member upon any business day of the contract delivery month that the short Clearing Member may select. The contract delivery month shall be defined so as to commence on, and to include, the first business day of the contract’s named month of expiration, and to extend to, and to include, the third business day following the last business day of the contract’s named month of expiration. |

| Grade and Quality Specifications | The contract grade for delivery on futures made under these Rules shall be U.S. Treasury fixed-principal notes which have fixed semi-annual coupon payments, and which have: (a) an original term to maturity (i.e., term to maturity at issue) of not more than 5 years 3 months; and (b) a remaining term to maturity of not less than 4 years 2 months. For the purpose of determining a U.S. Treasury note’s eligibility for contract grade, its remaining term to maturity shall be calculated from the first day of the contract’s named month of expiration, and shall be rounded down to the nearest one-month increment (e.g., 4 years 5 months 14 days shall be taken to be 4 years 5 months). New issues of U.S. Treasury notes that satisfy the standards in this Rule shall be added to the contract grade as they are issued. If the U.S. Treasury Department auctions and issues a Treasury security that meets these standards, such that said security is a re-opening of an extant Treasury issue that had not previously met these standards, then the extant Treasury issue shall be deemed to be a Treasury note meeting these standards and shall be added to the contract grade as of the issue date of said newly auctioned Treasury security. Notwithstanding the foregoing, the Exchange shall have the right to exclude any new issue from the contract grade or to further limit outstanding issues from the contract grade. |

| Rulebook Chapter | 20 |

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOT. |

![]()