Today I wanted to share a few tidbits/ pointers that were going through my mind as the trading day progressed:

- Learn to forgive yourself….stop beating yourself up for mistakes and “could have, should have, would have”….it will only create frustration and frustration = erratic trading.

- Trading is not a perfect science, at times you can do everything right and still lose.

- Learn to relax, physically and mentally while trading. I think a relaxed trader is 2 s better than a stressed trader.

- It’s ok to reduce trading size if it helps making you a more relaxed trader.

- The sooner in the day you recognize what type of trading day is unfolding, better chances you will have to use the appropriate strategies. Example, trending days require different trading methods than choppy days. Take a look at today’s trading session versus Friday for example.

- If you are a short term trader, learn to look at range bar and volume charts RATHER than only TIME charts. Range bars and volume charts will do 2 things to help you in my opinion: when the market moves fast, you will get your clues faster ( think about how many big moves you have seen/ missed waiting for a 15 minutes bar to complete….) and when the market moves slow, you will not just get a “signal” simply because 15 minutes bar closed and study outputs have changes. More on that in this video.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

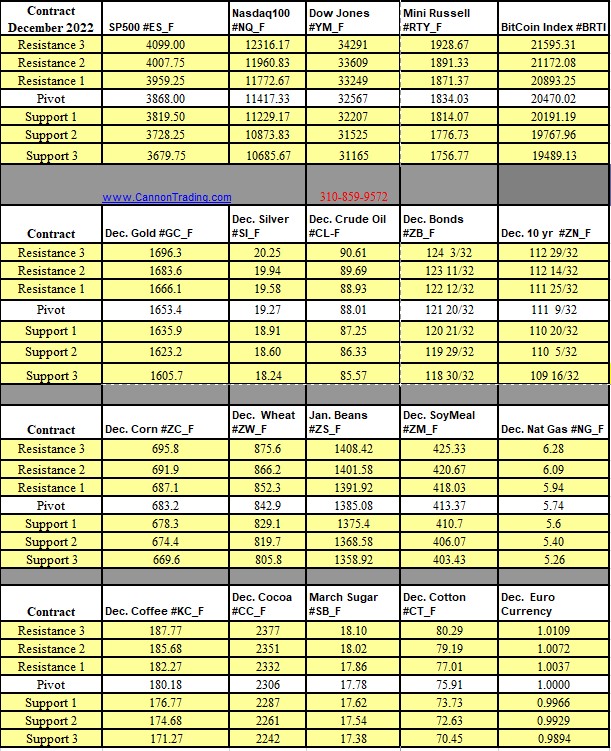

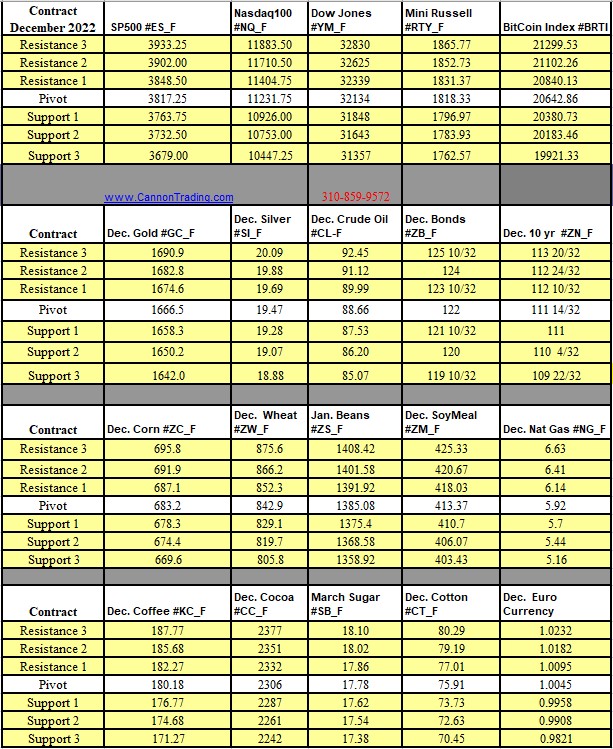

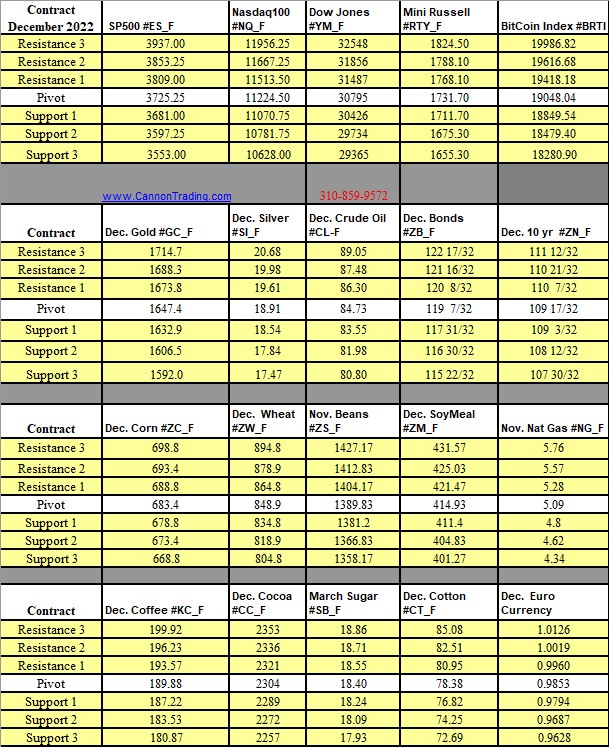

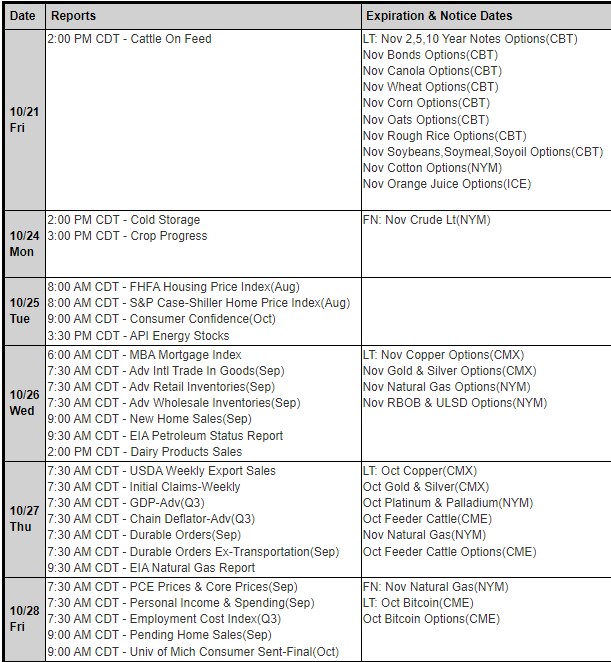

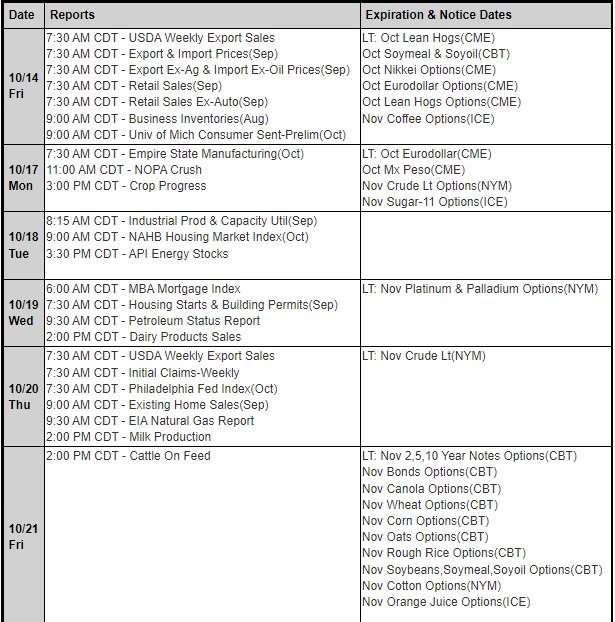

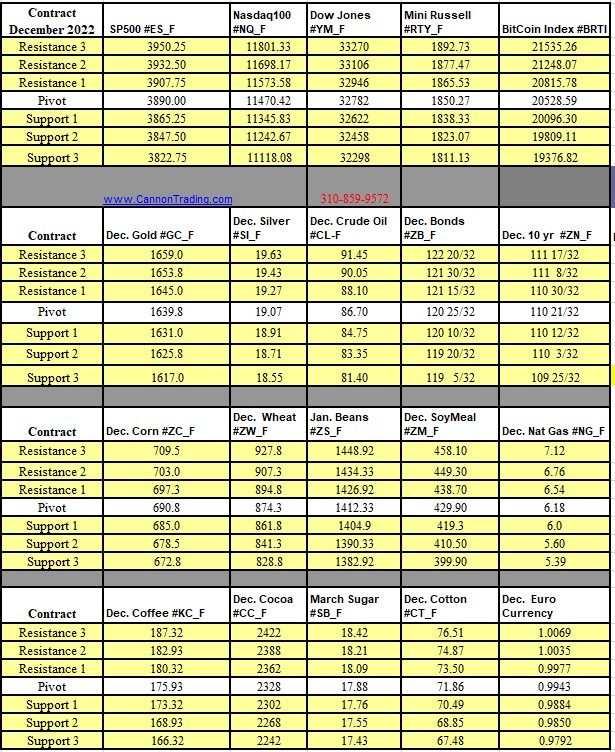

Futures Trading Levels

for 11-01-2022

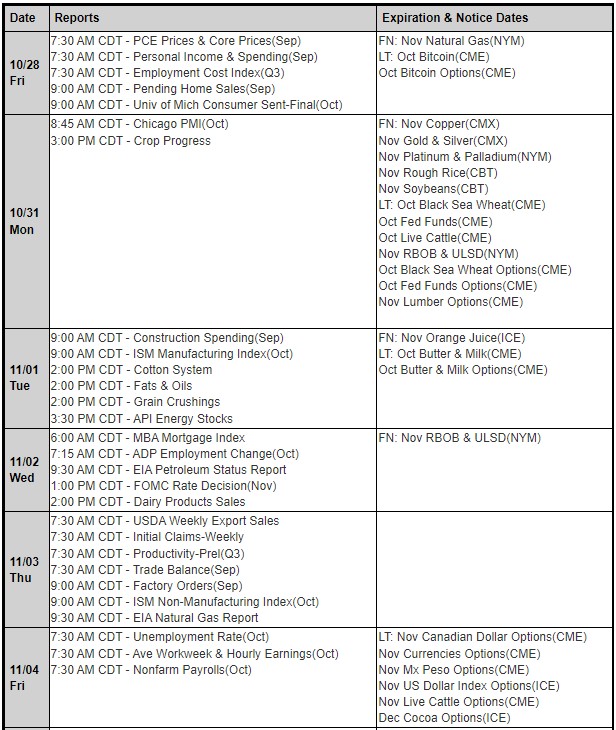

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.