Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for March 27, 2012

Hello Traders,

Thought I would share the following with you as good , quick reading refresh…..

Bob Farrell was a legend at Merrill Lynch & Co. for several decades. Farrell had a front-row seat to the go-go markets of the late 1960s, mid-1980s and late 1990s, the brutal bear market of 1973-74, and October 1987’s crash.

He retired as chief stock market analyst at the end of 1992, but continued to occasionally publish.

Marketwatch gathered some of Farrell’s more famous observations, and republished them as “10 Market Rules to Remember.”

1. Markets tend to return to the mean over time

When stocks go too far in one direction, they come back. Euphoria and pessimism can cloud people’s heads. It’s easy to get caught up in the heat of the moment and lose perspective.

2. Excesses in one direction will lead to an opposite excess in the other direction

Think of the market baseline as attached to a rubber string. Any action to far in one direction not only brings you back to the baseline, but leads to an overshoot in the opposite direction.

3. There are no new eras — excesses are never permanent

Whatever the latest hot sector is, it eventually overheats, mean reverts, and then overshoots. Look at how far the emerging markets and BRIC nations ran over the past 6 years, only to get cut in half.

As the fever builds, a chorus of “this time it’s different” will be heard, even if those exact words are never used. And of course, it — Human Nature — never is different.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

Regardless of how hot a sector is, don’t expect a plateau to work off the excesses. Profits are locked in by selling, and that invariably leads to a significant correction — eventually. comes. Continue reading “10 Market Rules to Remember | Support and Resistance Levels”

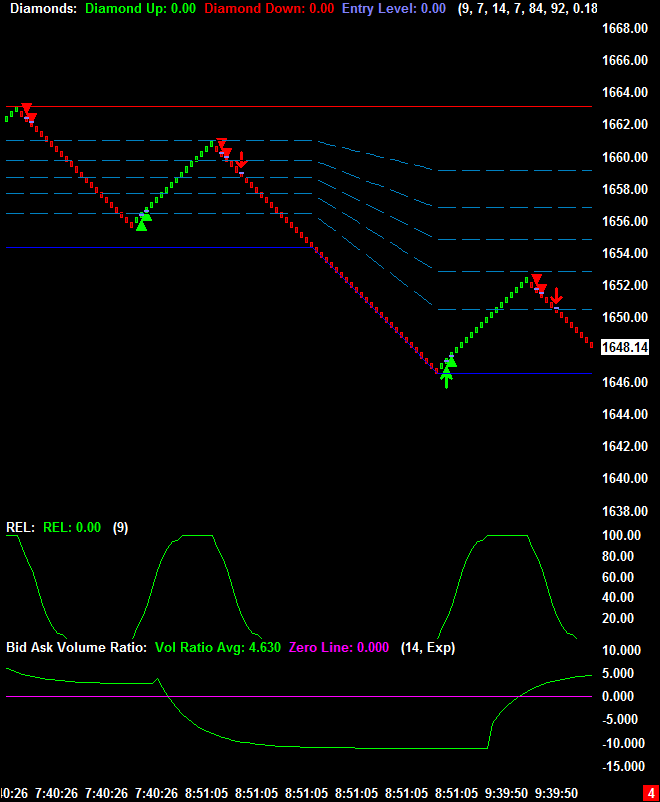

Continue reading “Intraday Chart | Support and Resistance Levels”

Continue reading “Intraday Chart | Support and Resistance Levels”