Here’s a morning cup o’ joe for all you futures traders, our morning support and resistance levels. Good trading!

Support and Resistance Levels – S&P 500, Nasdaq 100, Dow Jones, Mini Russell 2000, 30-Year US Bond, 10-Year US Note

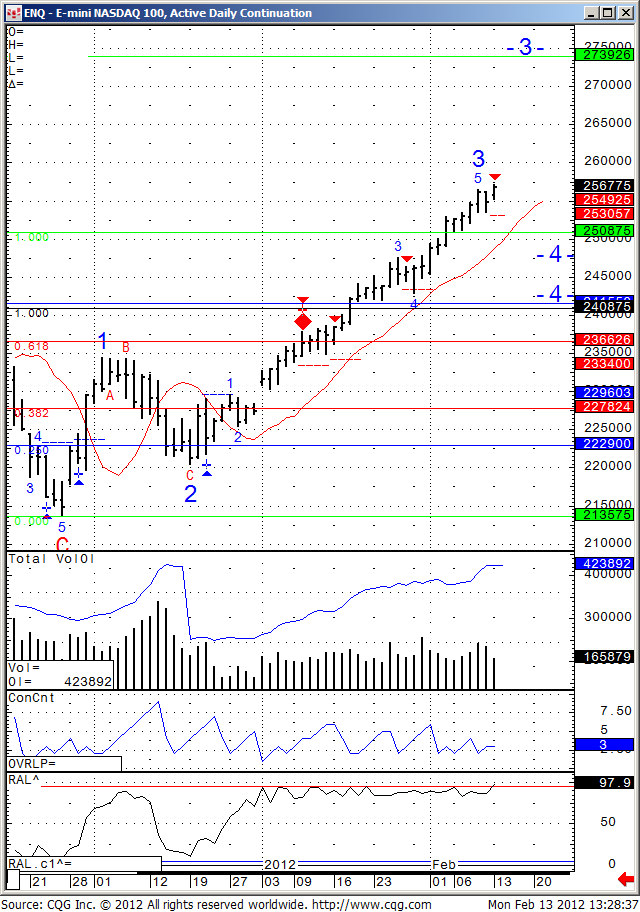

| Contract (Mar. 2012) | Mini S&P 500 | Mini Nasdaq 100 | Dow Jones | Mini Russell 2000 | 30-Year US Bond | 10-Year US Note |

| Resistance Level 3—————————————— Resistance Level 2——————————————

Resistance Level 1 —————————————— Support Level 1 —————————————— Support Level 2 —————————————— Support Level 3 |

1381.51373.5

1369.5

1360.5

1356

1347.5 |

2622.52611

2600

2583

2572

2563 |

1315313101

13024

12944

12901

12864 |

848.50843.4

832

828.5

824.5

817.5 |

1422114211

14201

14114

14023

13924 |

1310413031

13025.5

13015

13007.5

12926 |

Continue reading “Tuesday Morning Support and Resistance Numbers”