Jump to a section in this post:

1. Market Commentary

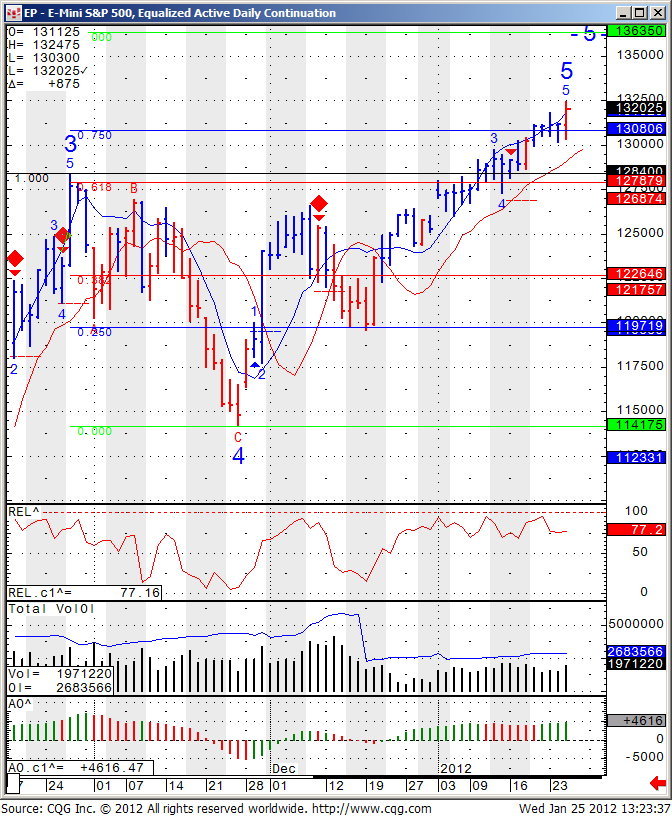

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for February 2, 2012

1. Market Commentary

Many clients new and veteran have asked me in the past for different resources as far as day-trading education so I wanted to share a few pointers from my colleagues at Naturus.com about day-trading in general and day-trading futures in specific.

This ain’t rocket science. But it ain’t easy either.

Day-trading is just the process of buying and selling a futures contract within the same session.

It sounds pretty simple. If you buy and the price goes up you make money. Buy low, sell high (or sell high and buy low) and go fishing.

But knowing how it is done is not remotely close to knowing how to do it.

Learning to trade is a bit like learning to play the piano. You can’t learn by reading about it, or by watching somebody else do it, any more than you can lose weight by watching work-out videos.

You have to do it yourself, which means spending time – lots of time – in front of the screen, trading and analyzing. Experience isn’t just the best teacher; it is the only teacher.

The problem is that you can get hurt while you are learning. When you risk your money in the market, the guys taking the other side of your trade are much more experienced and much more skillful. They are pros, and there is no minor league where you can learn without getting hurt. Continue reading “Day Trading Education | Support and Resistance Levels”