Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for January 24, 2012

1. Market Commentary

A week full of reports ahead with the “star” coming out this Wednesday, that being FOMC.

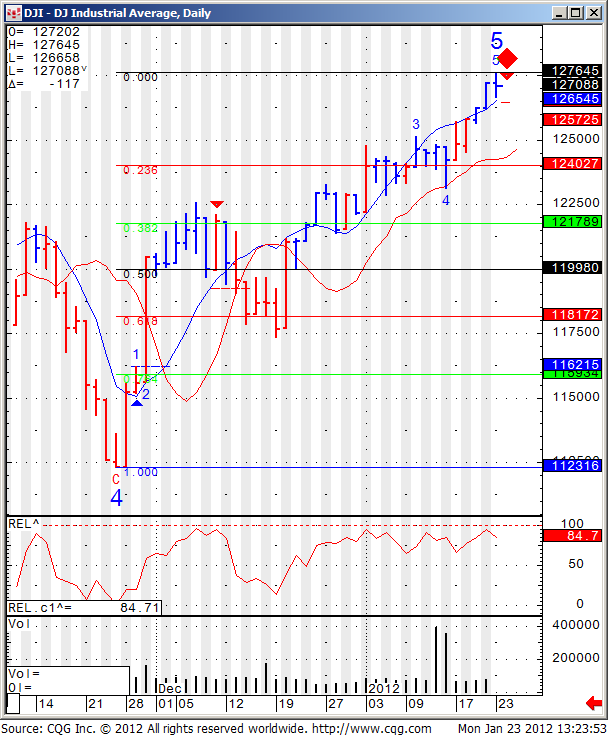

In between, you can view a chart of the Dow Jones Industrial chart with a possible small sell signal if the Dow Cash breaks below 12648.

Some of you may ask why am I showing the chart of the Dow Jones Cash Index? And my answer is that when it comes to stock indices, “Cash is King” and in this case the underlying asset for the Dow Jones futures ( and mini Dow Jones) is the Dow Jones Index, just like the SP500 cash index is the underlying for the mini SP500 futures.