Cannon Trading / E-Futures.com

There is a good article available at the Cannon Trading Company Weekly Newsletter. Continue reading “Futures Trading Levels, Unemployment Claims and Natural Gas Storage Reports Tomorrow”

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

Cannon Trading / E-Futures.com

There is a good article available at the Cannon Trading Company Weekly Newsletter. Continue reading “Futures Trading Levels, Unemployment Claims and Natural Gas Storage Reports Tomorrow”

Cannon Trading / E-Futures.com

I mentioned yesterday that 1266 can act as pivot level. Turns out it did, market was oversold and we got a buy signal after the close yesterday which hit the first target very quickly ( today….). Next target on the way up is 1300. Support below will be 1266 , , 1259.50 followed by 1235.

Daily chart of the mini SP500 along with potential levels below and above for you review below.

If you like to have a FREE TRIAL to my DIAMOND ALGORITHM using sierra charts, please send me an email with name, tel number and markets you trade.

This ALGO tries to identify turning points in the market and can be applied to variety of markets and time frames. Continue reading “Futures Trading Levels, Diamond Algorithm by Ilan Levy-Mayer”

Cannon Trading / E-Futures.com

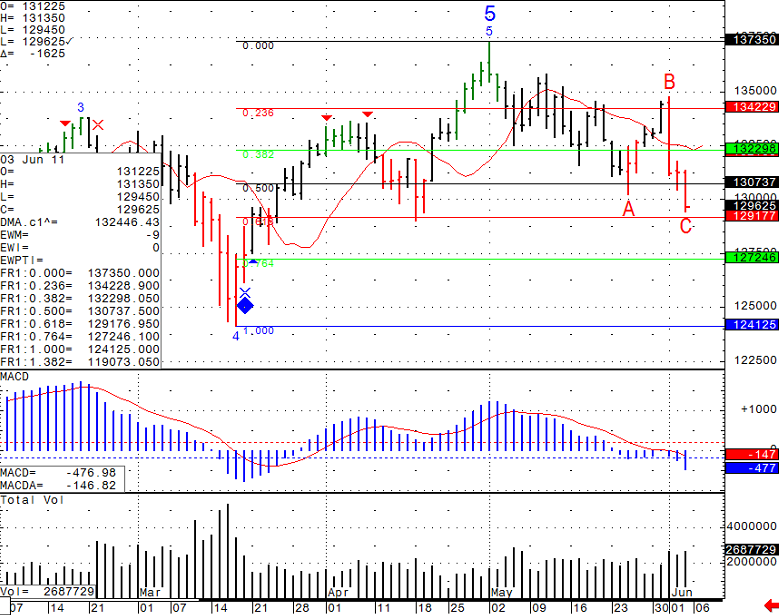

Daily chart of the mini SP500 along with potential levels below and above for you review below.

I think the current level we are at, 1267 is a pivot level. It is a 76.4% Fibonacci level between the lows made back on March 17th 2011 and the highs made on May 2nd 2011. If we can trade above it and start moving higher, we may see a bounce to 1286, if we can pick up steam below, we may see retest of 1235.75 Continue reading “Futures Trading Levels, Fibonacci Used in Context”

Cannon Trading / E-Futures.com

Please note that we are now trading September indices as well as September currencies.

Make sure you DO NOT HOLD ANY JUNE CURRENCIES in your account.

Should you have any further questions please contact your futures broker.

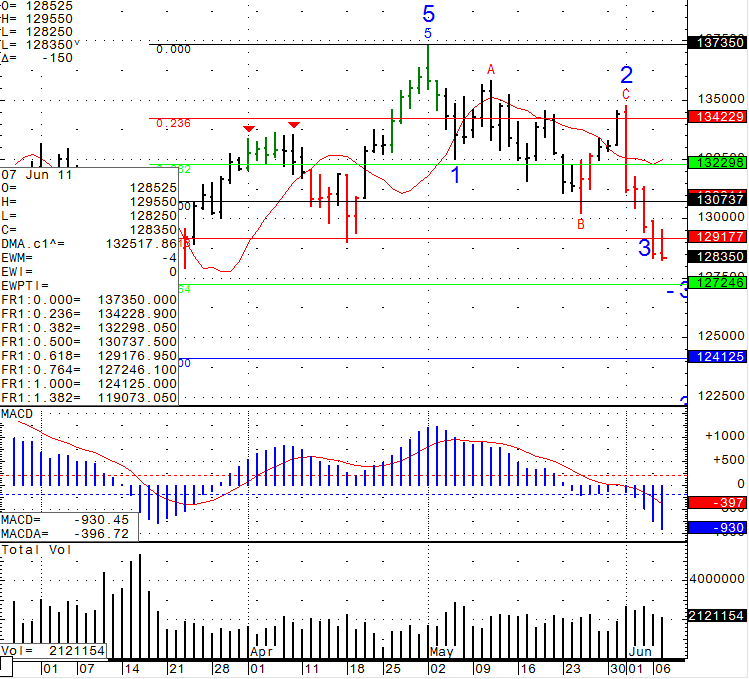

Daily chart of the DOW JONES CASH INDEX for your review below.

We have been trading lower on good volume and for now the trend points lower. Wishing you a great weekend and good trading week to come. Continue reading “Futures Trading Levels, We Now Trade September Indeces and Currencies”

Cannon Trading / E-Futures.com

Please note that we are now trading September indices as well as September currencies.

Make sure you DO NOT HOLD ANY JUNE CURRENCIES in your account.

Should you have any further questions please contact your futures broker. Continue reading “Futures Trading Levels, Watch for the Federal Budget Balance Tomorrow”

Cannon Trading / E-Futures.com

Please note that Equity Indices products; TF, ES, NQ, EMD and YM roll on Thursday the 9th at 8:30 am Chicago time from the June 2011 contract to the September 2011 contract. The month code for September is ‘U’.

It is recommended that all new positions be placed in the September contract as of Thursday’s trade date.

Please close any open June Currencies positions by the close on Friday, June 10th.

Should you have any further questions please contact your futures broker. Continue reading “Futures Trading Levels, June to September Rollover is Tomorrow”

Cannon Trading / E-Futures.com

Daily chart of the Mini Sp 500 along with possible support and resistance levels for your review below.

My technical opinion is that we should visit 1272.50 soon.

OPEC MEETING TOMORROW

Continue reading “Futures Trading Levels, OPEC Meets Tomorrow”

Continue reading “Futures Trading Levels, OPEC Meets Tomorrow”

Cannon Trading / E-Futures.com

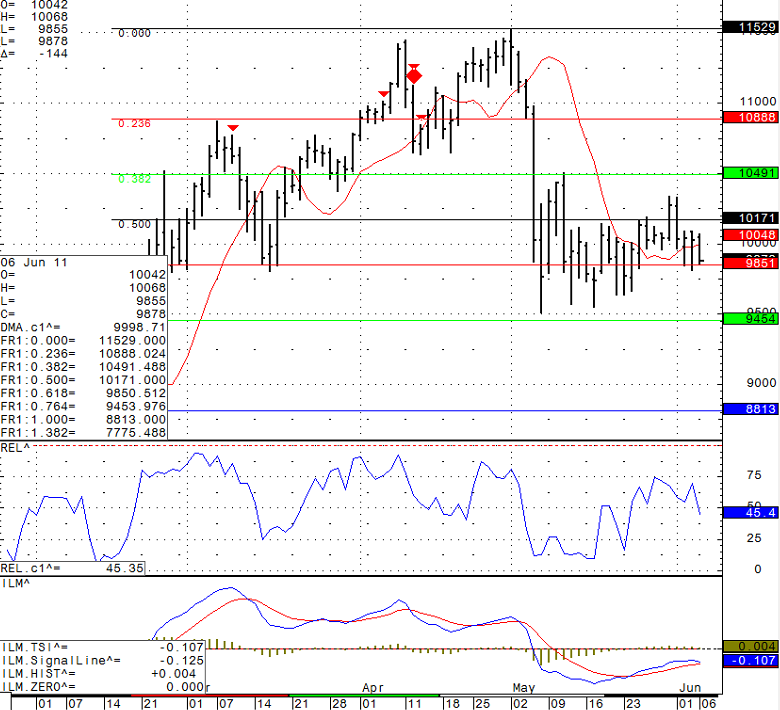

Crude Oil has been moving the rest of the commodities sector the last few months and has influence on all futures.

Thought I would share a daily chart for review, along with a screen shot of the crude oil set ups I share in my daily live day-trade signals service.

As far as longer term direction for crude, I will need to see which level we can break out first, 104.91 on the upside or 94.54 on the downside. In between, you have wide 410 trading range ( equal to $10,000 per one contract against you or in your favor….)

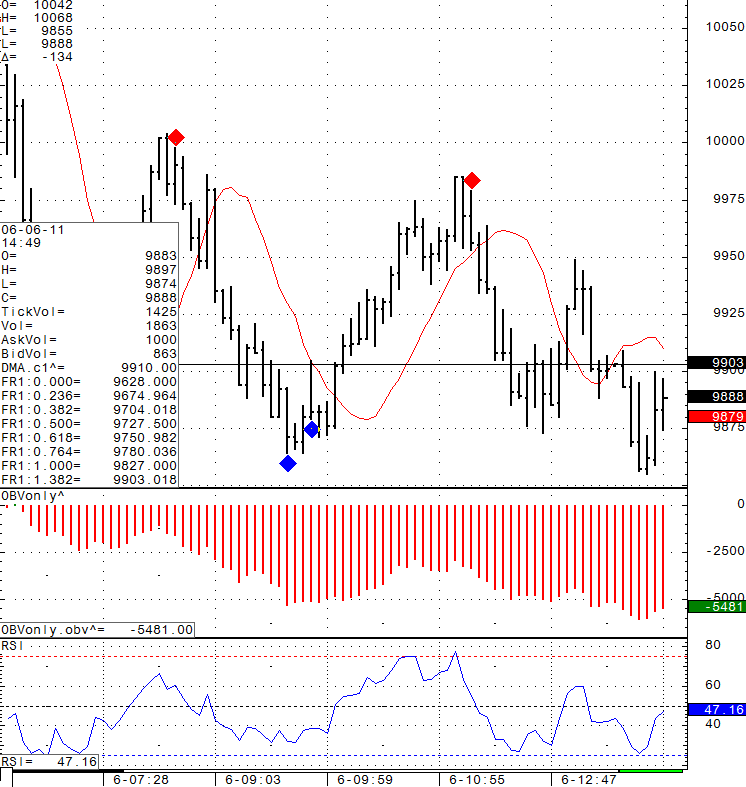

Intra-day chart: (blue diamond = potential buy, red diamond = potential sell)

Continue reading “Futures Trading Levels, Crude Oil as a Leader of Commodity Prices”

Continue reading “Futures Trading Levels, Crude Oil as a Leader of Commodity Prices”

Cannon Trading / E-Futures.com

Wishing everyone a nice weekend.

Below is a daily chart of the mini SP 500.

We had good volume over last few days and the key level to watch early next week is 1290- 1292.

If you like to view my INTRADAY charts live with my trading signals for mini SP 500, Euro Currency and Crude Oil, sign up at:

Cannon Trading Company Futures Trading Webinar.

Continue reading “Futures Trading Levels, Treasury Secretary Tim Geithner Speaks on Monday”

Continue reading “Futures Trading Levels, Treasury Secretary Tim Geithner Speaks on Monday”

Cannon Trading / E-Futures.com

Market will be waiting monthly un employment numbers , tomorrow morning before the open of cash market.

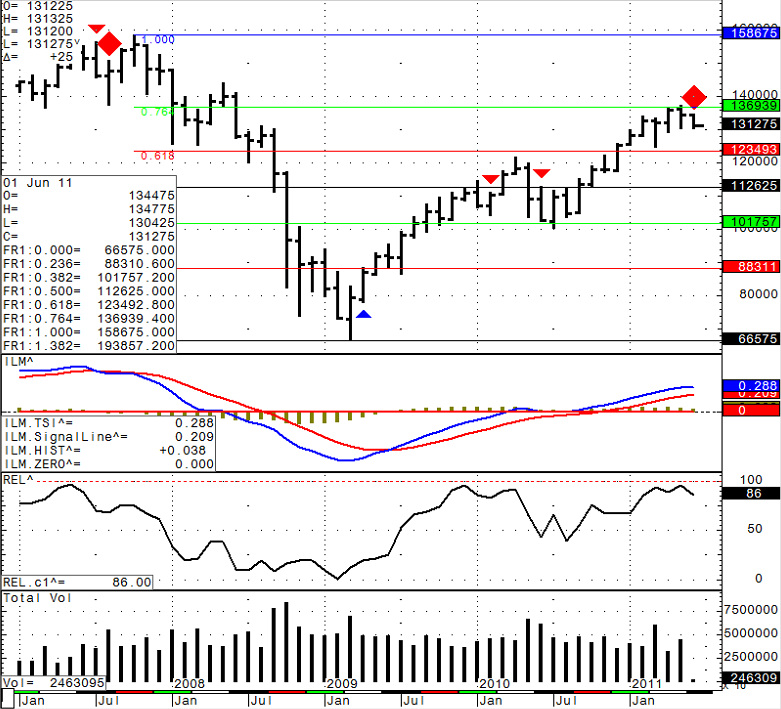

Since we started a new month, I figured I will share a monthly chart for your review.

From MY TECHNICAL perspective, if we can break below, we may see a deeper correction.

Continue reading “Futures Trading Levels, Non-Farm Employment Report”

Continue reading “Futures Trading Levels, Non-Farm Employment Report”