Futures brokers, also known as broker futures or broker future professionals, play a vital role in the futures trading industry. They act as intermediaries between traders and the futures exchanges, providing crucial services to facilitate the buying and selling of contracts. The responsibilities of futures brokers are vast and multi-faceted, encompassing both professional and personal aspects that are essential for successful trading. This article examines the responsibilities of futures brokers, the importance of selecting a reputable and ethical broker, and the ways they can assist in loss mitigation. By understanding these aspects, a full-time futures trader can make more informed decisions when choosing and working with a futures broker.

Responsibilities of Futures Brokers

Futures brokers have a range of responsibilities, from executing trades on behalf of clients to offering expert advice. A responsible broker futures professional ensures that clients receive accurate information, fair pricing, and a transparent trading experience. Here are some of the main responsibilities of a future broker:

Executing Trades Promptly and Efficiently – One of the primary responsibilities of a futures broker is to execute trades efficiently. In the fast-paced world of futures trading, where price movements can be rapid, any delay in trade execution could lead to significant losses. A reliable broker futures trading professional must understand this urgency and execute orders promptly. This duty requires technical skills and familiarity with the trading platform, as well as the ability to manage multiple orders from various clients without errors.

Providing Market Insights and Research – A good futures broker goes beyond basic execution to provide clients with valuable insights into the markets. Many futures brokers offer research reports, analyses, and trading recommendations to help clients make informed decisions. By providing access to comprehensive market research, brokers assist traders in navigating market volatility and identifying trading opportunities. This guidance is particularly important for new traders, who may lack experience in analyzing complex market data.

Ensuring Compliance and Ethical Trading Practices – Futures brokers are also responsible for upholding ethical standards and complying with regulations. This responsibility is essential for maintaining trust within the industry. Broker futures professionals are often regulated by authorities such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). They must follow strict guidelines regarding trading practices, client funds management, and transparency. By ensuring compliance, futures brokers protect their clients from fraud and mitigate the risk of unethical practices.

Offering Risk Management Support – Risk management is an integral part of futures trading, and a responsible broker future professional should provide risk management support to clients. This support may include offering advice on stop-loss orders, margin requirements, and other tools to control exposure to adverse price movements. Since futures trading is inherently risky, the guidance provided by a futures broker can help clients limit potential losses and protect their capital.

Providing Educational Resources – In addition to executing trades, a reliable futures broker offers educational resources to enhance the trading skills of clients. These resources can include webinars, tutorials, articles, and one-on-one coaching sessions. By educating clients on futures trading strategies and market trends, brokers empower them to make informed trading decisions and develop a deeper understanding of the markets.

Importance of a Reputable and Reliable Futures Broker

Having a reputable, reliable, and ethical futures broker is essential for a full-time futures trader for several reasons. A good broker not only facilitates trading but also contributes to a trader’s overall success and financial security. Here’s why choosing the right future broker is crucial:

Trust and Transparency – A reputable broker futures professional operates with transparency, ensuring that clients fully understand the costs and terms associated with their trades. Trustworthy brokers provide clear information on fees, commissions, and trading conditions. For a full-time trader, knowing the costs and having confidence in the broker’s integrity is critical to maintaining a consistent trading strategy. Brokers that disclose hidden fees or execute trades in ways that benefit themselves over the client are damaging to the trader’s success and can lead to unexpected costs.

Reliability and Responsiveness – Reliability is one of the most sought-after qualities in futures brokers. A reliable broker future professional is available when the market is open, responds quickly to client inquiries, and addresses any technical issues promptly. Full-time futures traders depend on these brokers for seamless trade execution, especially during high-volatility periods when the slightest delay could result in significant losses.

Ethical Conduct and Client Interests – Ethical futures brokers prioritize their clients’ best interests and avoid practices that could compromise their clients’ financial stability. Ethical conduct includes refraining from high-pressure sales tactics or encouraging excessive trading for the purpose of generating commissions. A broker futures trading professional with a strong ethical foundation aims to foster a long-term relationship with clients, built on trust and mutual respect.

Safety of Funds – A reputable broker futures professional ensures that client funds are secure. They adhere to strict regulatory standards, which often include keeping client funds in segregated accounts. Segregation of funds means that a trader’s funds are kept separate from the broker’s own operational accounts, providing a layer of security against broker insolvency. This protection is particularly valuable for full-time futures traders, whose livelihood depends on the accessibility and safety of their trading capital.

Access to Resources and Expertise – A good future trading broker provides access to proprietary research, advanced trading tools, and knowledgeable experts. These resources support full-time traders in making sound decisions, adjusting strategies, and staying updated on market developments. Traders who work with experienced and resourceful brokers gain a competitive edge, as they benefit from specialized insights and professional advice tailored to their trading style.

How Futures Brokers Help Mitigate Losses?

While futures trading inherently involves risk, futures brokers play an important role in helping clients mitigate potential losses. Here are some strategies through which a broker futures professional can assist clients in managing risk:

Implementing Stop-Loss Orders – A common risk management tool offered by futures brokers is the stop-loss order, which allows traders to set a predetermined price at which their position will be automatically closed if the market moves against them. For example, a trader might buy oil futures at $50 per barrel and set a stop-loss order at $48. If the market price falls to $48, the stop-loss order would automatically sell the position, limiting the trader’s loss to $2 per barrel. By advising clients on appropriate stop-loss levels, a future broker helps protect them from unexpected price fluctuations.

Advising on Leverage and Margin – Leverage allows traders to control large positions with a relatively small amount of capital. While leverage can amplify profits, it also increases potential losses. A responsible future trading broker educates clients on the risks of using excessive leverage and guides them on appropriate margin levels. For instance, if a trader has a $10,000 account, a broker futures trading professional may recommend not to use more than 5x leverage, thereby limiting the exposure to risk. This guidance helps traders avoid the common pitfall of overleveraging, which can result in margin calls and significant losses.

Diversification Strategies – Future brokers can advise clients on diversification strategies to reduce risk. By diversifying across multiple asset classes (e.g., commodities, financial futures, and indices), traders can protect their portfolios from volatility in any one market. A broker future expert might suggest that a trader balance their portfolio with both equity futures and commodity futures, thus spreading the risk. For example, if oil prices plummet, gains in other assets, such as equity futures, might offset losses in oil.

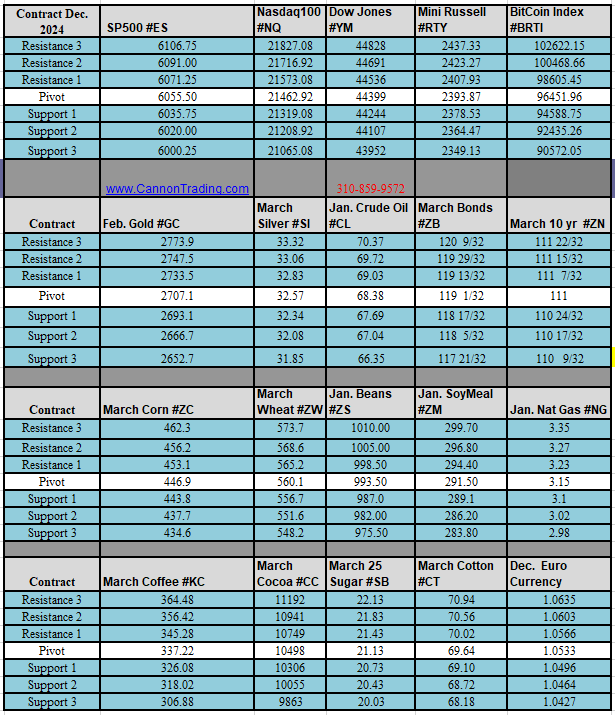

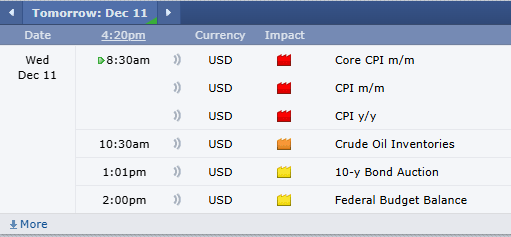

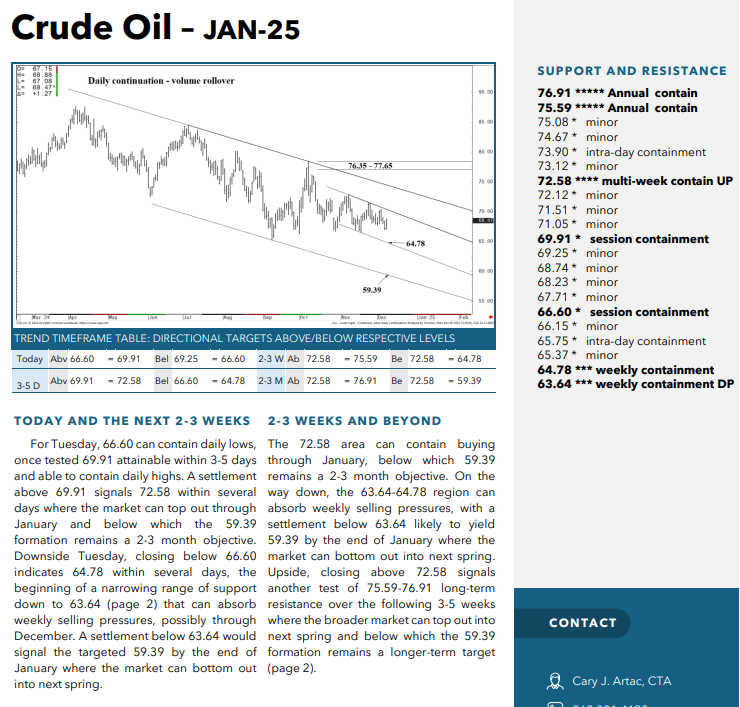

Providing Timely Market Updates – Future trading brokers often provide real-time market data and updates, which are crucial for making informed decisions. Suppose a broker futures trading expert notices a significant economic event that could impact the market. In that case, they may alert clients to adjust their positions accordingly. For example, if inflation data is about to be released, the broker might advise caution in trading currency futures due to anticipated volatility. By staying informed of these developments, traders can preemptively reduce exposure to unfavorable price movements.

Risk-Reducing Recommendations – A proactive broker future professional offers specific risk-reducing recommendations based on market conditions. For instance, if the market is highly volatile, a broker might recommend reducing position sizes or temporarily halting trading. Hypothetically, if a trader is holding a position in agricultural futures and a natural disaster threatens the supply chain, the broker could suggest closing the position early to avoid substantial losses.

Hypothetical Examples of How Futures Brokers Can Assist in Mitigating Losses

To better illustrate how futures brokers can assist clients, consider the following hypothetical scenarios:

- Commodity Market Volatility: A trader holds a long position in gold futures, expecting prices to rise due to economic uncertainty. However, the broker notices an unexpected policy change that could negatively impact gold prices. The broker advises the trader to set a tighter stop-loss order or reduce their position. When prices indeed drop, the stop-loss order limits the trader’s loss, preserving a portion of their capital.

- Leverage Control in Forex Futures: A trader with a $20,000 account plans to enter a forex futures trade with 10x leverage. Recognizing the risks, the futures broker suggests a more conservative approach with 5x leverage. When the market moves against the trader, the smaller leverage prevents a significant portion of their capital from being wiped out, highlighting the importance of cautious margin management.

- Agricultural Futures and Weather Forecasts: A futures broker monitors weather patterns and advises clients trading agricultural futures on potential supply chain disruptions. The broker might suggest hedging strategies or diversifying into non-agricultural assets. When adverse weather impacts the market, clients following the broker’s guidance experience mitigated losses.

Future brokers, or broker futures professionals, serve as indispensable allies for full-time futures traders. Their responsibilities go beyond executing trades to include providing market insights, ensuring compliance, offering risk management support, and educating clients. Choosing a reputable, reliable, and ethical futures broker is crucial, as they contribute to a trader’s long-term success and protect against unethical practices.

A skilled futures broker also aids in loss mitigation through various strategies, including stop-loss orders, leverage control, diversification, and timely market updates. By working with a reputable broker futures trading expert, traders can navigate the complexities of the futures market with greater confidence and minimize potential losses. As these examples and explanations show, a responsible future broker does more than just facilitate trades—they become a valuable partner in a trader’s journey toward achieving consistent profitability and financial stability.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading