Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for January 26, 2012

1. Market Commentary

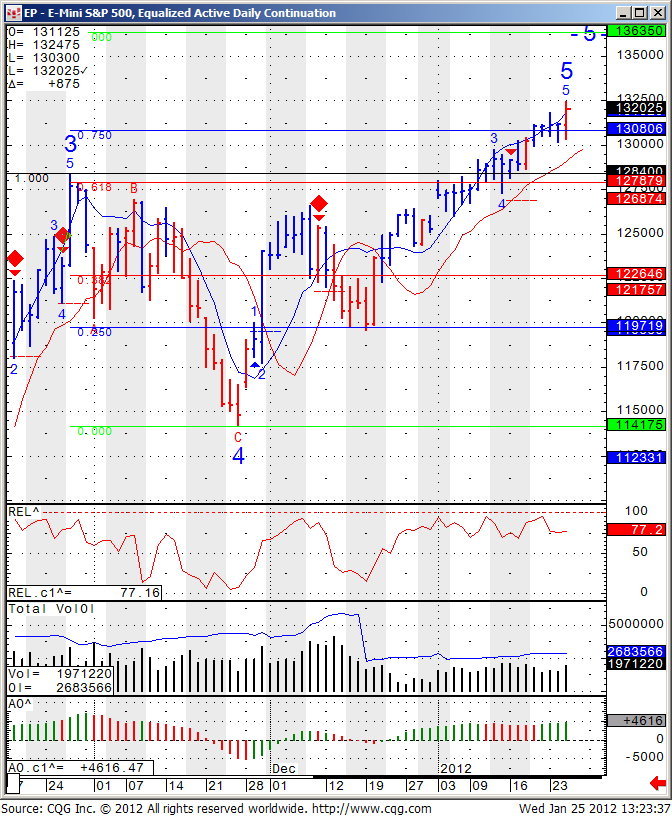

FOMC is behind us and below you will find some commentary from WSJ online as well as my daily chart of the Mini SP 500, which like always have at least two scenarios…upside possible targets as well as reversal zones if the market losses momentum..While I think this market may be overbought, I would not look to fight this momentum unless I see signs of buying exhaustion and reversal.

************************************************************

WSJ BLOG/MarketBeat: Today Looks a Lot Like a QE Trade

01/25/12 14:32

(This story has been posted on The Wall Street Journal Online’s Market Beat blog at http://blogs.wsj.com/marketbeat.)

By Min Zeng

US stocks and gold are bouncing, the ten-year Treasury yield is tumbling below 2% again (at least briefly) and the dollar is getting hit — sounds like the typical picture of a QE trade rippling through the financial markets.

Indeed, some market participants are taking today’s dovish FOMC statement as QE-lite.

The key boost for risky assets lies in the Fed’s further extension of its promise to keep its ultra-low target rate into late 2014. That means investors can be assured that the first rate hike won’t come until then or even later.

A bond trader says that the statement signals the Fed is more worried about deflation, which suggests more policy easing to co! me.

“They won’t use the D word but that is what they are thinking,” he says. “Expect QE3 to come.”

The dollar wilts on the dovish Fed, with the euro up 0.4% at $1.309.

Gold, another QE beneficiary, bounced from less than $1660 an ounce before the Fed’s statement to more than $1710 at last check.

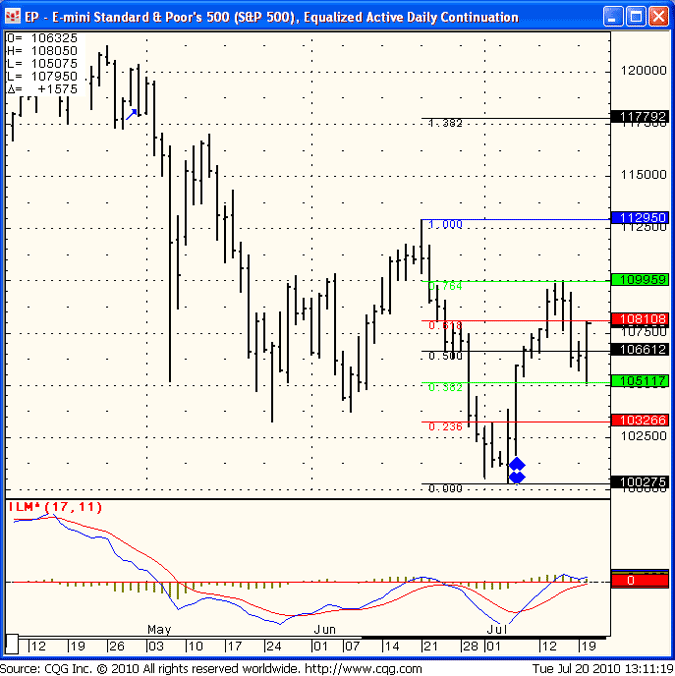

EP – E- mini S&P 500, Equalized Active Daily Continuation