Cannon Futures Weekly Letter Issue # 1202

- Important Notices – Trillion $ Earnings, FOMC, NFP

Futures 101 – Projecting Possible Targets

Hot Market of the Week – September Crude Oil

Broker’s Trading System of the Week – Mini Nasdaq Swing Trading System - Trading Levels for Next Week

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

-

Trillion Dollar Corporations , Fed Rate Decision, Non-Farm Payrolls, within a very active Data week.

Heavy Earnings (2,497 companies) Week:

Tues, pre-open Merck, Pfizer, After the close AMD, MSFT

Wed, Meta, Qualcomm after the close

Thur. Apple, Intel, Amazon all after the close

Fri. Pre-open, ExxonMobile, ChevronFed Rate Decision Wednesday. 1:00PM Central with Q and A to follow @ 1:30 PM Central.

Big Economic Data week:

Mon. Dallas Fed Manufacturing index

Tues. Case-Shiller Home prices, CB Consumer Confidence

Wed. ADP, Chicago PMI, Pending Home Sales

Thur. Global PMI, ISM

Fri. Non Farm PayrollsCheck the calendar for dates and times!

-

Futures 101: Trading Psychology Course

Trading Resource of the Week – Projecting Possible Price targets

By Ilan Levy-Mayer, VP

Watch the video below to get an idea on how to use Fibonacci extensions along with candle sticks to project possible price targets.

Try a FREE demo of the platform used to show the charts in this educational article. The platform is FREE and has charts, news, DOM, T&S, Alerts, advanced order entry, options and MUCH MORE!

-

Hot Market of the Week – September Crude Oil

Broker’s Trading System of the Week

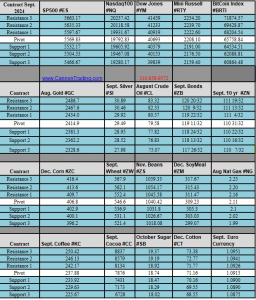

Daily Levels for July 29th 2024

Trading Reports for Next Week

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.