Stock Index Futures Fall Sharply -Again!

Stocks tried recovering after yesterday’s sell off and for a bit it seemed like they were but completely reversed and posted a bearish close!

Both silver and gold sold off sharply as well!

Crude oil managed to hold first level of support.

Side note if you are a day-trader in stock indices:

Volatility is quite high. This requires one to evaluate their stops? targets? Trading size?

With the micros Trading such good volume across the board a trader now has the option of trading one 3, 6 micros for example rather than trading one Single mini SP or mini Nasdaq This is especially true on volatility as as high as we see today And may help certain traders adapt to the volatility.

If you like feedback, discuss ideas – let us know and we will do our best to assist.

NQ daily chart for your review below with possible support levels.

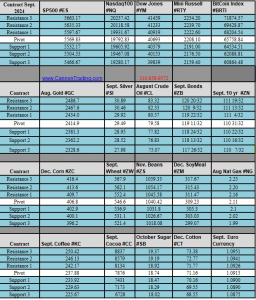

Daily Levels for July 26th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.