Movers & Shakers

By John Thorpe, Senior Broker

Todays Headlines

**US June NAR Existing Homes Sales: -5.4%; expected -4.0%

**US June NAR Existing Homes Sales: 3.89 mln unit annualized rate; expected 3.95 mln

**US June NAR Existing Homes Median Home Price: $426,900 ; +4.1% vs yr ago month

**US June NAR Existing Homes Inventory of Unsold Homes: 4.1 Months

**Richmond Fed July Manufacturing New Orders: -23.0 ; prior -17.0

Updated: July 23, 2024 10:19 am

President Biden’s administration senior climate policy advisor, Podesta, said they will seek to curb nitrous oxide emissions . The administration claims nitrous oxide and methane cause the other half of climate change. Nitrous oxide emissions come from a variety of sources including some fertilizers and synthetic materials production. It’s unclear what the costs will be to cut the emissions.

Russia’s Deputy PM Novak Tuesday said the Kremlin will restart gasoline export ban starting August 1st, and then consider extensions in September and October

Traders Tuesday afternoon estimated commodity funds added a net 7,500 Chicago corn futures, but shed a net 1,500 Chicago wheat. Traders estimate funds bought a net 5,500 Soybean, 2,000 soymeal and 1,500 soyoil contracts on Tuesday.

Tomorrows Movers and Shakers

S&P Global group will release their US prelim July manufacturing and service sector purchasing managers indexes (PMI) at 8:45 am CT Wednesday morning. Analysts expect the manufacturing index at 51.5 compared to the 51.6 in the final June report. The service index for early July is expected at 55.0 compared to the 55.3 in the final June report.

US new home sales data for June will be updated Wednesday morning at 9:00 am CT. Analysts expect new home sales month-to-month at a 0.640 mln unit annualized pace, up +3.4%. The prior month’s sales were -11.3% at 0.619 mln unit annual rate.

EIA Weekly Petroleum Stocks Estimates for Wednesday, July 24 at 9:30 AM CT

in million barrels per day (mln bpd)

IBM reports after the close

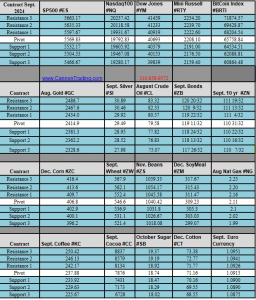

Daily Levels for July 24th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.