Get Real Time updates and more on our private FB group!

I read the following by Gary Norden and

www.nordenmethod.com ** the other day in the introductory part and I thought to myself – “How true!” and got permission to share:

Before any trader starts to trade a contract he/she should learn as much as possible about it. In order to construct a good watchlist you will need to know how your market correlates with other markets; what connections it has with the world around it. Some correlations work on many days while others just pop up as important from time to time (e.g. oil for bonds).

Know about the Participants…

Who trades the market? What is the average proportion of small retail traders vs. larger pros?

Take a moment for example, to think about whether the ES has a higher or lower proportion of retail traders than 10-year Treasuries?

Know about your Sessions…

Don’t just consider the main session, we should also think about out-of-hours trading. We have many clients who trade the ES, for example, during European hours.

Trading correlations can be a greater help also during out-of-hours, but we need to be more watchful of liquidity and two-way flow (discussed later).

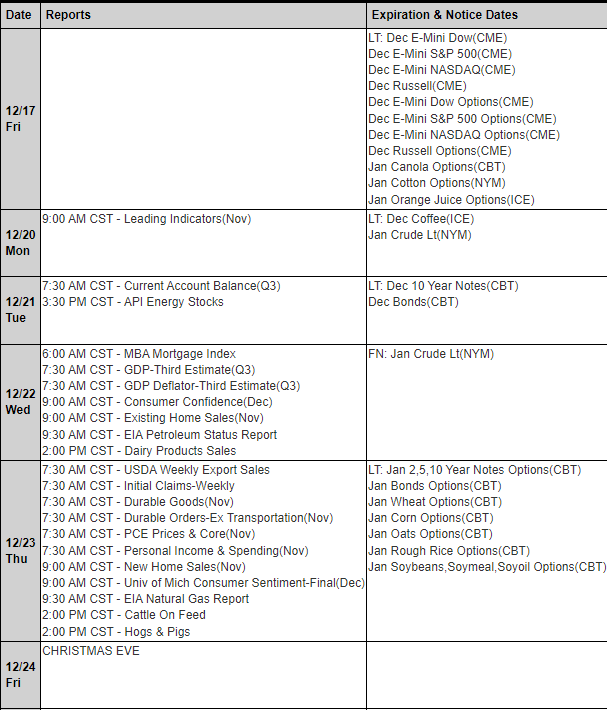

Know about your Expirations…

Understand the dynamics of your contract around its expiry.

We should stop trading as soon as we see rollover activity until completed, and then move onto the next contract.

Cash settled contracts tend to rollover later than physically settled ones, but you need to learn when your market does this.

Know the News drivers…

Understand what news events drive your market and when they come out.

We usually don’t want to trade over scheduled news and data announcements.

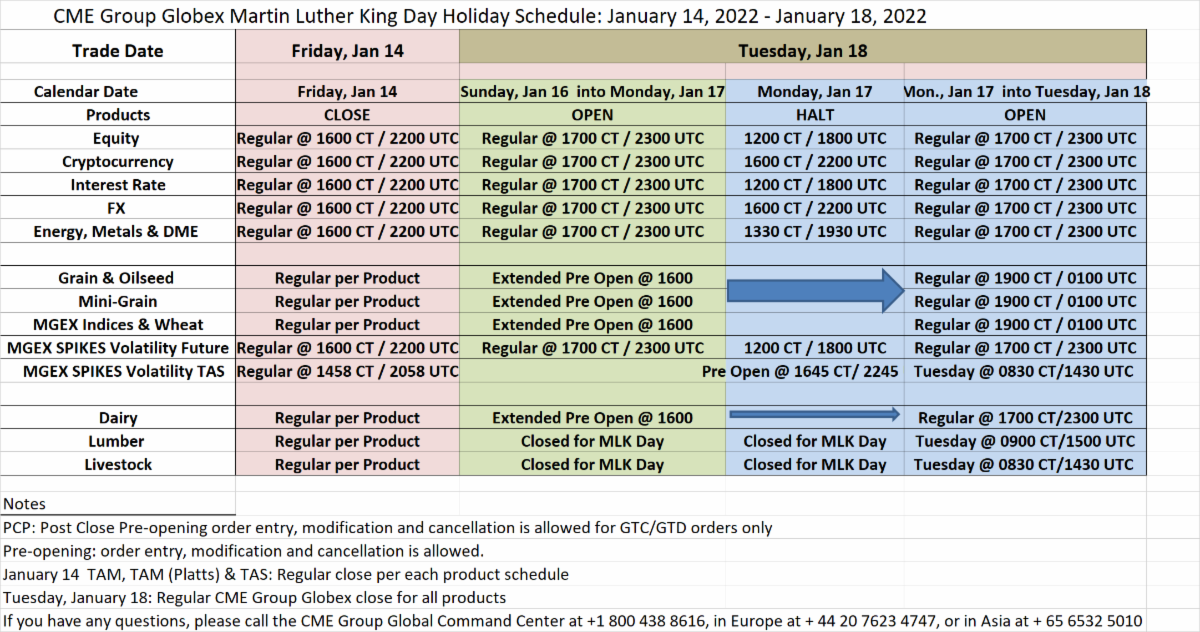

Know the Holidays…

Learn the effect of scheduled holidays on your market.

For example, if you are in the US and are trading the Dax, you need to be aware of German public holidays.

Know the Underlying Market…

You should be seeking information about your underlying market(s).

Remember, futures are a derivative. They derive their price from the underlying market.

Basically, learn as much as you can about your market; become an expert in it. You would be amazed at how many traders lose money on silly (and avoidable) things related to a lack of knowledge.

Important: Trading commodity futures and options involves a substantial risk of loss.

**You are about to leave the Cannon Trading website. No responsibility is assumed to any such statement or any expression of opinion herein. Readers are urged to exercise their own judgement

Past performances are not necessarily indicative of future results.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

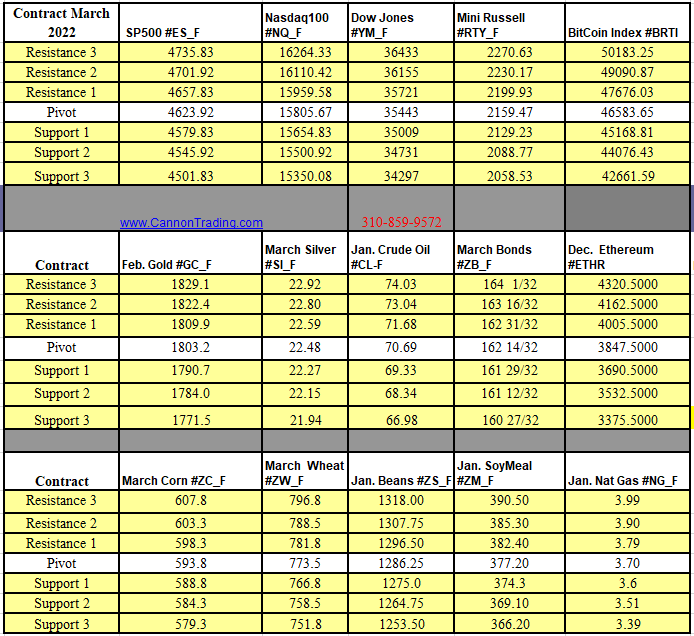

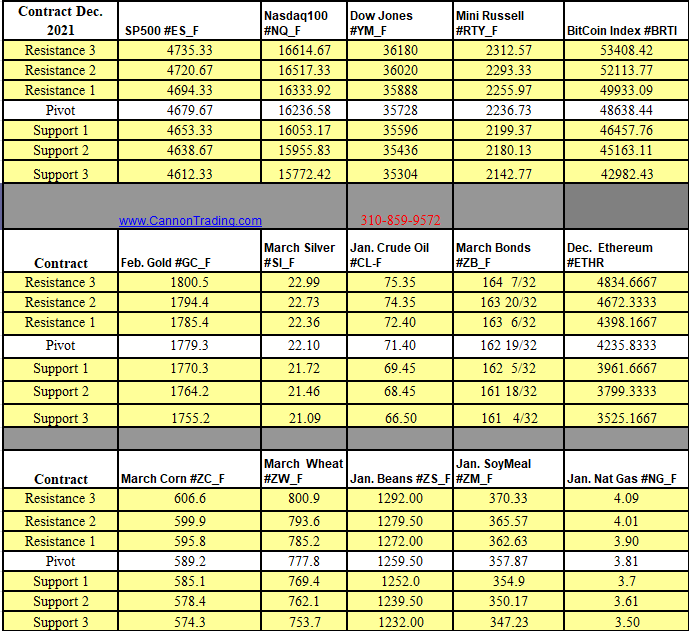

Futures Trading Levels

12-10-2021

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.