March 6th, 2020 - Issue #1002

In This Issue

1. Trading 102: Learn to Lose

2. Hot Market Report: Stock Index Futures - What's ahead?

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 102: Learn to Lose

Important NOTE: With the recent volatility across markets, we have seen margins increase in some markets as well as wild swings and extreme volatility in many markets. For some, it can cost the full account value but doesn’t need to. These volatile times require MAJOR adjustments in how you approach trading and risk management. I hope this article helps and I encourage you to utilize our brokers and the knowledge they have to assist you.. contact us

Many different factors go into trading. Too many to discuss efficiently in one blog post. Some relate to trading techniques, other to money management, mental aspect, risk capital and much more.

I am not sure how a trader can embed this into their trading mind, BUT in my opinion if you train your brain to expect losses, understand losses and that losing days will happen, you will increase your chances of surviving in this business, which in return will actually give you a chance to succeed....

Losses are part of trading and as long as your losses are part of the plan and are quantified in advance and you can adhere to your rules, then you have a chance. I think it's easy when traders are winning...making money etc. Much harder when you lose or down. your brain starts playing tricks on you...it tells you to double down, maybe reverse even though your analysis does not say so....all of a sudden you start pulling trades out of instinct, fear rather than a calculated plan that has solid risk/ reward. If a trader learns how to lose, to accept losses, to have realistic expectations, then he/ she can avoid having one of those terrible days when traders can lose almost of all their account.

I went into this subject and detailed day-trading money mgmt in an article I wrote a few years back for SFO magazine. You can read the full article by filling out the form below

Learn to Lose

Read Survivor Day Trader

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Stock Index Futures and Stock Market - Whats next.....

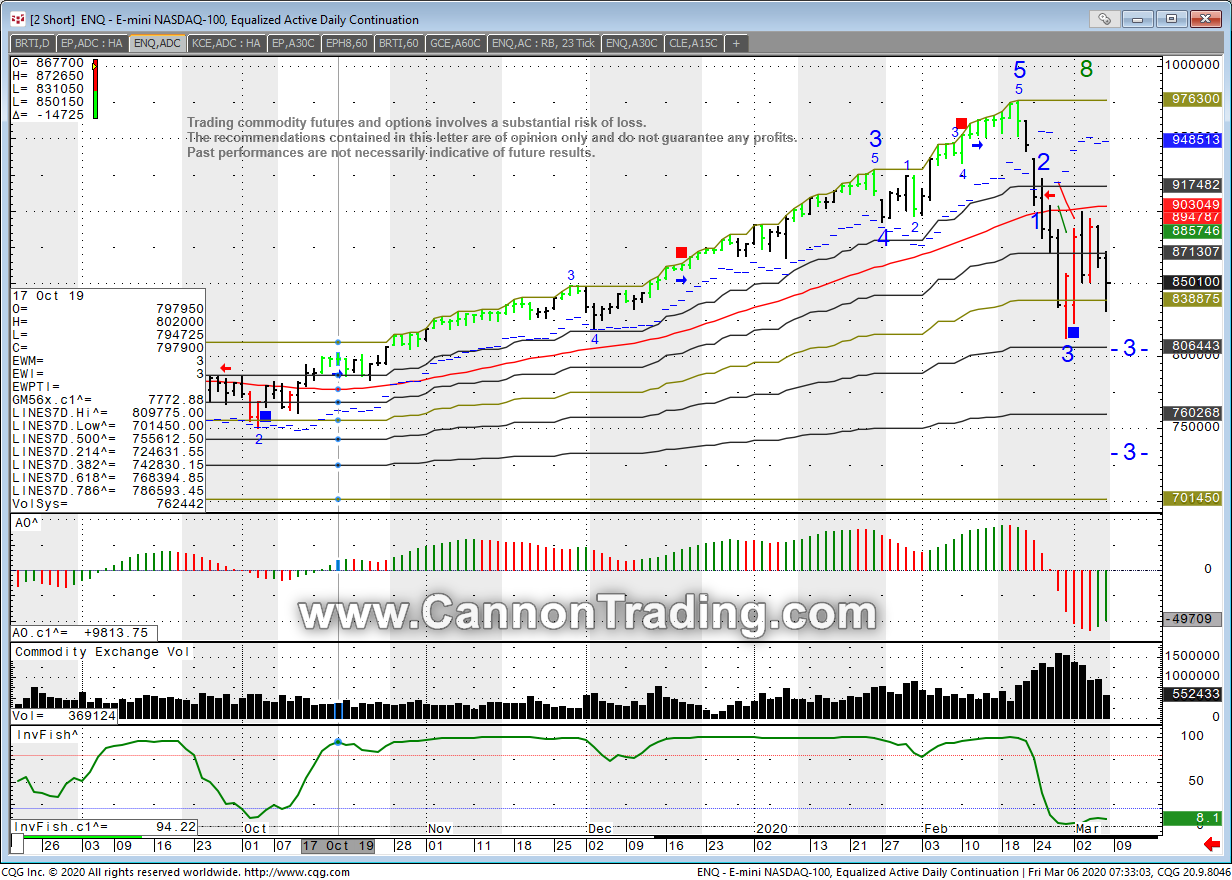

By Ilan Levy-Mayer, VPClick on image below to enlarge

Mini NASDAQ 100 futures are part of the stock index family that includes mini SP 500, mini Russell, mini Dow, Mid cap, Nikkei and a few more. Most traded on the CME/CBOT/GLOBEX exchanges.

The NQ futures, mini nasdaq 100 have been the most volatile stock index instrument in my eyes. The moves in this market intraday, overnight and such have been historic. I suspect volatility will continue but slowly come down a bit... As far as direction of the market, and this is a pure personal opinion speculation, I think we will see a slight bounce over the next few days before the market attempts to test lows made last week.

Daily chart of NQ Futures for your review from this morning ( March 6th 2020). This chart was prepared using our CQG software, which you can demo for 28 days with real time data.

To access a free trial to the ALGOS shown in the chart ( "early trend identifier" included) along with other tools, visit and sign up for a free trial for 21 days with real time data.

With the historical volatility we are seeing, I would highly recommend looking at the MICRO contracts including the MICRO NQ which is 1/10th the size of the mini NASDAQ. The symbol is MNQ and you can read more about the MICROS here.

Mini NASDAQ 100 Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $9900 initial, $9000 Maint. ( as of the date of this newsletter)

Point Value: full point = $2000 ( Example: 7067.00 to 7167.00 ). Min fluctuation is 0.25 = $5 ( Example: 8530.00 to 8530.25) Settlement: Cash on the open of the third Friday of each month

Months: Quarterly cycle, June, Sep, Dec, March. M,U,Z,H

Weekly Options:YES

Micro NASDAQ 100 Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $990 initial, $900 Maint. ( as of the date of this newsletter)

Point Value: full point = $200 ( Example: 7067.00 to 7167.00 ). Min fluctuation is 0.25 = $0.5 ( Example: 8530.00 to 8530.25) Settlement: Cash on the open of the third Friday of each month

Months: Quarterly cycle, June, Sep, Dec, March. M,U,Z,H

Mini NASDAQ 100 is one of my favorite markets for Day Trading because of the intraday range and movements. Be careful, these factors can work against you or in your favor.

Some of the basic fundamentals to keep in mind when you are considering trading the NQ or other indices for this matter:

1. Longer term view of current market prices

2. Dates and times of important reports. CPI, Housing, employment, FOMC are just some of the reports you need to watch for

3. Earning reports

4. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the MINI NASDAQ market, other indices, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 03/06 Fri |

7:30 AM CST - Nonfarm Payrolls(Feb)

7:30 AM CST - Ave Workweek & Hourly Earnings(Feb) 7:30 AM CST - Unemployment Rate(Feb) 7:30 AM CST - Trade Balance(Jan) 9:00 AM CST - Wholesale Inventories(Jan) 2:00 AM CST - Consumer Credit(Jan) |

LT: Mar Canadian Dollar Options(CME)

Mar Currencies Options(CME) Mar Mx Peso Options(CME) Mar US Dollar Index Options(ICE) Mar Live Cattle Options(CME) Apr Cocoa Options(ICE) |

| 03/09 Mon |

|

LT: Mar Cotton(NYM)

|

| 03/10 Tue |

11:00 AM CDT - WASDE Report & Crop Production

3:30 PM CDT - API Energy Stocks |

|

| 03/11 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Core CPI & CPI(Feb) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

LT: Mar Orange Juice(ICE)

|

| 03/12 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Core PPI & PPI(Feb) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

LT: Mar Nikkei(CME)

Mar Nikkei Options(CME) |

| 03/13 Fri |

7:30 AM CDT - Import(ex-oil) & Export(ex-ag) Prices(Feb)

7:30 AM CDT - Import & Export Prices(Feb) 9:00 AM CDT - Univ of Michigan Consumer Sent-Prelim(Mar) |

LT: Mar Canola(CBT)

Mar Wheat(CBT) Mar Corn(CBT) Mar Oats(CBT) Mar Rough Rice(CBT) Mar Soybeans,Soymeal,Soyoil(CBT) Mar Lumber(CME) Apr Coffee Options(ICE) |

| 03/16 Mon |

7:30 AM CDT - Empire State Manufacturing(Mar)

11:00 AM CDT - NOPA Crush 2:00 PM CDT - Net Long-Term TIC Flows(Jan) |

FN: Mar Lumber(CME)

LT: Mar Currencies(CME) Mar Eurodollar(CME) Mar Mx Peso(CME) Mar US Dollar Index(ICE) Mar Cocoa(ICE) Mar Eurodollar Options(CME) Apr Sugar-11 Options(ICE) |

| 03/17 Tue |

7:30 AM CDT - Retail Sales(Feb)

7:30 AM CDT - Retail Sales Ex-Auto(Feb) 8:15 AM CDT - Industrial Prod & Capacity Util(Feb) 9:00 AM CDT - Business Inventories(Jan) 9:00 AM CDT - NAHB Housing Market Index(Mar) 3:30 PM CDT - API Energy Stocks |

LT: Mar Canadian Dollar(CME)

Apr Crude Lt Options(NYM) |

| 03/18 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Housing Starts & Building Permits(Feb) 9:30 AM CDT - EIA Petroleum Status Report 1:00 PM CDT - FOMC Rate Decision(Mar) 2:00 PM CDT - Hop Stocks 2:00 PM CDT - Dairy Products Sales |

LT: Apr Platinum & Palladium Options(NYM)

|

| 03/19 Thu |

7:30 AM CDT - USDA Weeky Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Current Account Balance(Q4) 7:30 AM CDT - Philadelphia Fed Index(Mar) 9:30 AM CDT - EIA Natural Gas Report 2:00 PM CDT - Honey 2:00 PM CDT - Milk Production 3:30 PM CDT - Money Supply |

LT: Mar Coffee(ICE)

Mar S&P 500(CME) Mar S&P 500 Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!